Causes behind fall in social financing

Updated: 2014-09-19 08:53

By Li Xiaotang(chinadaily.com.cn)

|

|||||||||||

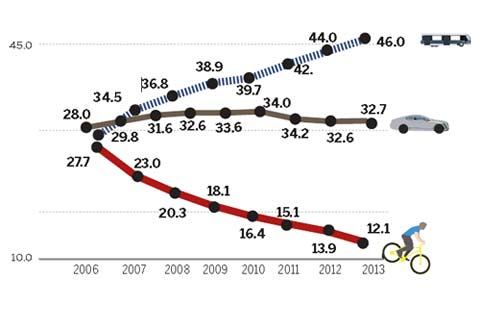

China extended 957.4 billion yuan ($155.9 billion) worth of total social financing (TSF) in August, 683.7 billion yuan more than July, the latest central bank data shows.

However, the August TSF was 626.7 billion yuan less than a year ago, and the TSF growth further slowed in the month and the growth rate was 0.8 percentage point lower than the end of July.

New yuan loans increased by 317.3 billion yuan from July, to 702.5 billion yuan in August, but the new lending was still 10.3 billion yuan less than the same period of last year.

|

|

| Slowdown curbs Q1 lending activity |

|

|

| Nation's social financing expands, says PBOC |

The TSF refers to the total amount of money the real economy obtains from the financial system in a certain period of time, say a month, a quarter or a year. It mainly comprises yuan loans from banks, foreign currency loans, entrusted loans, trust loans, bank acceptance bills, corporate bonds, non-financial institutions' equity sales, compensations made by insurance companies, investment properties and financing by other financial tools.

The year-on-year fall in the August STF can be attributable to:

The depression of off-balance-sheet financing. Since the end of last year, regulators have rolled out a series of measures to enhance regulation over shadow banking and interbank business, which has dealt a blow on entrusted loans as well as trust loans;

The drop in financing demand, as a result of the adjustment of the property market and China's effort to resolve overcapacity;

The increasing exposure of problems in capital and guarantee chains. Enterprises were facing mounting pressures in their operations and thus financial institutions became more cautious in granting funds to them.

While the Chinese economy is operating within a reasonable range, it is inevitable that short-term fluctuations may occur in economic and financial data.

In view of such factors as the country's rapid growth of financial innovations and the ongoing economic restructuring, the connection between the actual TSF and its target will become more complicated and harder to predict than before, and we should not obsess about the short-term change in quantitative indicators.

Good news is that the decrease in off-balance-sheet financing will be conducive to financial risk prevention, making the financial system capable of serving the real economy in a sustainable way.

The author is a certified financial planner and independent commentator. The views do not necessarily reflect those of China Daily.

Today's Top News

'Yes' in Scotland could be 'maybe' for Chinese firms

Cooperation helps extradite fugitives

Xi, Modi set friendly tone for visit

Collector has 'proof' of atrocities

Naked newborn survives typhoon

How Alibaba IPO learnt from Facebook's mistake

Russia to beef up troops in Crimea

10 problems of Chinese society

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|