Shadow banking can have good ending

Updated: 2014-02-17 07:23

By Wu Jiangang (China Daily)

|

|||||||||||

It is hard to calculate how much commercial banks have used the inter-bank market to meet cash demand, but the liquidity crises in June and December last year vividly reflect the scale on which banks use inter-bank repurchase agreements in the money market to repay short-term debt.

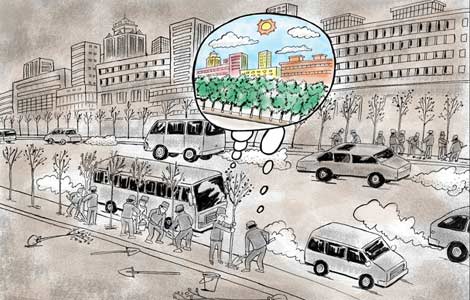

Shadow banking in China can be regarded as the banks' shadows, since a major segment of shadow banking is the off-balance sheet business of commercial banks.

Two other main forms of shadow banking are monetary funds and private finance, which are expanding rapidly because of the Internet. .

Because shadow banking grows, it is outside of the purview of regulators and creates systemic risks.

As the main part of shadow banking is by regulated, systemically important banks, the risk is clear.

We don't really know where these off-balance sheet loans have gone, but from the fact that private enterprises have found it especially difficult to secure credit in recent years, we can surmise that these loans have flown to local government financing vehicles and real estate projects.

There is some evidence to back up this assumption. One is that the latest audit of local government debt tallied shadow banking at 17.9 trillion yuan by the end of last June, up 67 percent from the 10.7 trillion yuan at the end of 2010. Another is that real estate prices may have more than doubled in many cities since 2008.

As the real estate bubble in China poses a danger and a plunge in housing prices can cause problems, there is not much left for the government to choose from.

First, the government should bring shadow banking under regulation.

Second, the government should cautiously manage the expectation of housing and land prices to avoid sharp rises or falls.

Finally, the government should break the financial monopoly by allowing private capital to open banks and giving up interest rate management. The government must cede control in other industries, especially service sectors, for private enterprises so that they can create investment opportunities and lending demand.

The author is a lecturer at the Management School of Shanghai University and a research fellow at the China Europe International Business School Lujiazui International Finance Research Center. The views do not necessarily reflect those of China Daily.

|

|

|

Related Stories

Tackling the shadow banking is huge task 2014-01-31 15:59

China dodges major shadow banking default 2014-01-28 09:46

Spotlight is set to shine on shadow banking 2014-01-22 09:50

Banking document could pose challenges 2014-01-09 20:41

Key shadow banking document released 2014-01-08 07:06

Call for closer scrutiny of shadow banking 2013-10-10 07:21

Today's Top News

EU halts education talks with Switzerland

Ukraine protesters leave city hall

Germany, France seek data security

No much progress in Syria peace talks

Lantern Festival fires kill 6 in China

China urges US to respect history

KMT leader to visit mainland

11 terrorists dead in Xinjiang

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|