Low inflation may suggest downward risks

Updated: 2014-02-15 09:15

By Chen Jia in Beijing and Yu Ran in Shanghai (China Daily)

|

|||||||||||

Flat inflationary pressure in the first month of 2014 may be suggestive of a weak economic outlook, experts said.

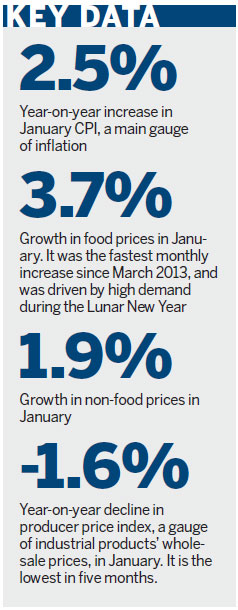

The consumer price index, a main gauge of inflation, rose 2.5 percent year-on-year in January, unchanged from December and slightly above the market consensus of 2.4 percent, according to the National Bureau of Statistics on Friday.

Food inflation in January rose 3.7 percent, the fastest monthly increase since March 2013, reflecting strong demand during the Chinese Lunar New Year.

Growth of non-food prices accelerated to 1.9 percent from 1.7 percent in December and 1.6 percent in November, the bureau said.

Lu Zhengwei, chief economist at the Industrial Bank, said that consumer inflation in 2014 may remain weak, despite rising consumption boosted by seasonal factors in the first two months.

"It is likely to see an obvious downward trend of CPI after February", as the government's broadened anti-graft campaign will continue to reduce gift giving and dining out among officials, said Lu.

The bureau also released the January producer price index on Friday, a gauge of industrial products' wholesale prices.

The PPI dropped for the 23rd consecutive month, at a rate of 1.6 percent year-on-year, the lowest rate in five months. It declined by 1.4 percent in December.

Yu Qiumei, an economist at the bureau, said that industrial output slowed during the holidays in January, which was the main reason behind the weak figure.

The fragile global economic recovery also depressed industrial production.

Yiwu Fangyuan Locks, a manufacturer and exporter of locks and pet chains, saw its gross profit margin drop to about 8 percent from 15 percent since the end of last year. The number of orders still kept declining.

The company cut 10 percent of its workforce and sent production of certain items to smaller workshops to reduce costs, said Yao Pin, the company's sales manager.

Zhang Wenhua, the owner of a company in Nanjing that exports mechanical products to Europe, said that the overseas economic climate seems to have improved as it has received more enquires. But its orders didn't increase as sharply as expected in the first month. He hopes they will grow in the next three months.

Zhang added that the company is now focused on expanding its domestic market share while waiting for overseas orders to recover gradually.

Liu Ligang, chief economist in China at ANZ Bank, said that the falling PPI reflects more sluggish market demand for manufacturing products. "Manufacturers may have a more cautious attitude in their economic outlook," he said.

"The weak inflation showed the Chinese economy may face downside risks," said Liu. "If the government decides to keep the 7.5 percent annual economic growth target in 2014, it may need to release a series of stimulus policies before June and the structural reform process may by delayed."

Economists expect that inflation is unlikely to become a priority policy concern in the near term. Industrial overcapacity remains a challenge for economic adjustment.

Chang Jian, chief economist in China at Barclays Capital, noticed that the central bank sounded less hawkish and has emphasized "stability" since the beginning of 2014.

"We think the policy bias has shifted to neutral, reflecting changes in economic conditions, as inflation is lower than expected and growth continues to moderate on the back of higher interest rates and slower money growth," Chang said.

Xinhua contributed to this story.

Today's Top News

Beijing urges Washington to respect history

KMT leader to visit mainland

11 terrorists dead in Xinjiang

Illegal detention reports probed

4 die in Austrian train-car crash

China spends billions on rural education

Plan drafted for $36b undersea tunnel

Rural reform needs science input

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|