Sino-US accountancy is at crucial level with SEC probe

Updated: 2014-02-13 00:41

By GAO CHANGXIN in Shanghai (China Daily)

|

|||||||||||

If the ban is upheld by the US Securities and Exchange Commission, more than 200 Chinese companies listed in the US will have to find new auditors. Multinationals with big Chinese operations will also have to make new arrangements.

The incident comes as Chinese companies' enthusiasm to list in the US recovers from a low in 2011, when the market froze following allegations by short-sellers including the notorious Muddy Waters LLC.

Eight Chinese companies went public in the US last year, up from three in 2012. Alibaba Group Holding Ltd, China's largest e-commerce company by sales, sees the US as an option in for its IPO location.

Lee, from the Institute of Chartered Accountants in England and Wales for China, wrote the issue needs to be resolved at three levels.

First, the SEC has to deal better with reverse takeover companies, which are outside the China Securities Regulatory Commission's jurisdiction.

Second, the SEC needs to collaborate with the China Securities Regulatory Commission in resolving disputes involving Chinese companies listed in the US through IPOs on a case-by-case basis.

Third — and most important — regulators must multilaterally agree on a common international framework for cross-border audit oversight, Lee wrote.

|

|

Related Stories

'Big Four' vow to appeal US suspension ruling 2014-01-24 07:33

'Big Four' China units to appeal SEC suspension ruling 2014-01-23 13:19

China-US auditing disputes near resolution 2014-02-08 00:45

SEC charges China-based firm with fraud 2013-06-21 05:21

Today's Top News

China's lunar rover comes back to life

No casualties reported in Xinjiang quake

Embassy in talks over arrest

Abe's view on history rapped

Prostitution crackdown expands in Guangdong

New visa policies a blessing for Chinese travelers

Chinese consume too much food from animals

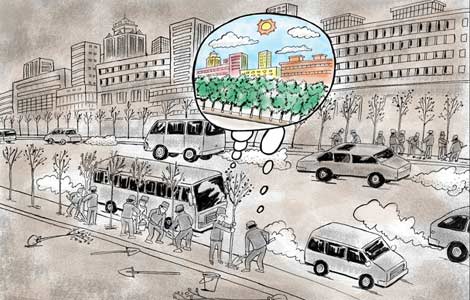

Beijing low on list of green cities

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|