Investors spooked by PBOC's latest money market inaction

Updated: 2013-12-27 09:28

By Gao Changxin in Shanghai (China Daily)

|

|||||||||||

|

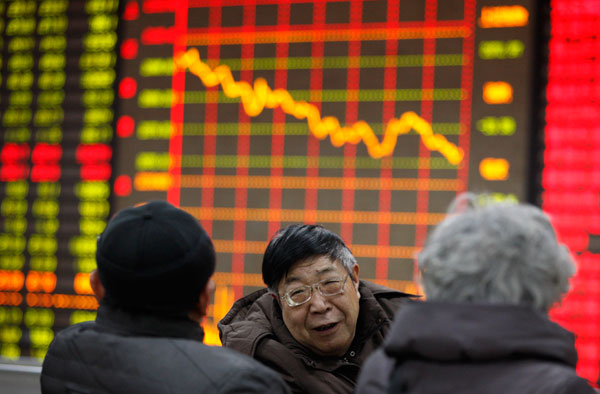

Investors follow the markets in Huaibei, Anhui province. The benchmark Shanghai Composite Index was down 1.58 percent to 2,073 on Thursday. The fact that the PBOC wasn't active in the money market had investors worrying that rates will go up again soon. Xie Zhengyi / for China Daily |

The A-share market prolonged its weakness during Christmas with a 1.58 percent drop on Thursday, as the central bank spooked investors by halting its scheduled Thursday money market operation.

The year-to-date gain was trimmed to 5.58 percent, down from around 10 percent 12 trading days ago on Dec 10.

The benchmark Shanghai Composite Index was down 1.58 percent, 33 points, to 2,073. The Shenzhen Component Index lost 2.46 percent to 7,897 points. The ChiNext Index reversed gains in the past two days and ended Thursday with a 1.46 percent loss.

A fear of tight liquidity is one of the reasons that caused the recent retreat in the stock market. Zhang Qi, a Shanghai-based stock analyst with Haitong Securities Co Ltd.

The People's Bank of China injected liquidity into the banking system on Tuesday by selling 29 billion yuan ($4.8 billion) of seven-day reverse repurchase agreements. The PBOC took the action after money market rates grew to a level reminiscent of the cash crunch in June, when some rates soared to an astronomical level of more than 30 percent.

The PBOC normally conducts open market operations on Tuesdays and Thursdays. But the cash injection was the first time since Dec 3 that it proceeded with the schedule. The injection brought down money market rates, with the benchmark seven-day repurchase agreement opening at 5.55 percent on Tuesday, down sharply from a closing level of 8.9 percent on Monday.

The rate was 5.33 percent upon the close on Thursday, still higher than the 4.5 percent earlier this month.

The fact that the PBOC didn't operate in the money market on Thursday had investors worrying rates will go up again soon, said Zhang.

The PBOC said in a statement on Dec 20 through its official micro-blog account that excess reserves in the banking system are at a historic high level of more than 1.5 trillion yuan. It urged lenders to strengthen liquidity management. The statement is widely interpreted by the market as a signal that the PBOC won't as a matter of course pour money into the banking system.

Investors are also worried that the scheduled initial public offering resumption in January will siphon funds away from existing shares and cause a retreat in the market. The China Securities Regulatory Commission has said at least 50 companies will go public in January after a 14-month hiatus.

China Investment Securities Co Ltd said in a report on Thursday that the Shanghai Composite Index will fluctuate between 2,000 to 2,600 points in 2014. It cited the central bank tightening as one of the key risk factors. It forecast a rally between February and March, before a retreat in the second quarter.

Related Stories

China's stock market heads for longest decline 2013-12-21 09:48

Disappointed investors push stock market to one-month low 2013-12-17 07:34

A step forward in reforming China’s stock market 2013-12-03 15:31

Learning from Malaysian stock market 2013-12-03 07:31

Stock market can't meet cash call 2013-09-30 08:07

Stock market needs effective regulation 2013-09-18 07:49

Today's Top News

Anger over Abe's World War II shrine visit

'An overall view' on Mao required

Factories halted to clear air in Beijing

China's urbanization rate to hit 60% by 2018

Foreign patients treated like natives

Couples who lose a child to receive higher subsidies

Arafat died of natural causes: Russia

Turk PM announces major cabinet reshuffle

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|