Firms heading home as benefits wane in China

Updated: 2013-11-01 00:54

By Matt Hodges (China Daily)

|

|||||||||||

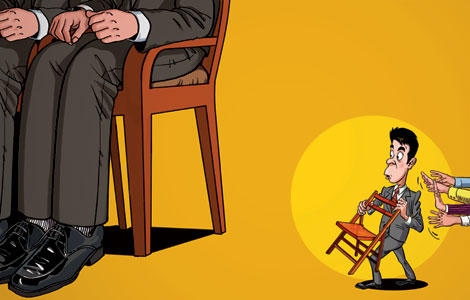

More companies from Europe and the United States that outsourced production to China are returning home as price gaps narrow, reports Matt Hodges

For Dutch engineering and electronics conglomerate Philips NV, improved automation and smarter robots meant it made more sense financially to build a new factory in Drachten last year than extend its operations in China.

Philips found the robots to be more productive than workers in Guangdong in southern China, where it, like many other foreign multinationals, faces rising labor and raw material costs and occasional staff shortages.

General Electric Co took arguably a bigger gamble by opting to reshore some production from China to its Appliance Park in Louisville, Kentucky, also in 2012.

There, GE was able to redesign one of its water heaters and slash the time it takes to get it to warehouses. Efficiency rose and material costs fell by more than 20 percent, enabling it to lower the US retail price of its GeoSpring heater from $1,599 to $1,299. GE also returned production of some washing machines and refrigerators.

Such cases have become more common over the past five years as more European and US companies find it attractive to return jobs and production home, a strategy known as reshoring.

These moves mostly involve companies that sell mainly to their domestic markets. And they indicate that China's competitiveness as a global low-cost production base is waning.

"Current research shows many (US) companies can reshore about 25 percent of what they have offshored and improve their profitability,"said Harry C. Moser, founder and president of the Reshoring Initiative, in an e-mail to China Daily.

Figures from the nonprofit organization show that from 2000 to 2008, the number of manufacturing jobs offshored from the US grew by 100,000 to 150,000 each year, while the number reshored was about 2,000 per year.

Moser wrote that the numbers now stand at "maybe 30,000 to 50,000 jobs/year offshoring, while reshoring is growing at about 30,000 jobs/year”.

"New offshoring is down 70 percent to 80 percent, and new reshoring is up about 1,500 percent.”

According to a report by the RI in July, most US companies returned production home because of higher wages in China and unfavorable currency value. Other reasons cited were quality problems, freight costs and other problems related to delivery, such as deadlines not being met.

Chinese factory workers' expectations are changing. According to the National Bureau of Statistics, the average annual urban income jumped to 41,799 yuan ($6,850) in 2011, from 24,721 yuan in 2007.

Rising costs and other issues have persuaded some companies to abandon their China manufacturing dreams. Sleek Audio LLC returned production to Florida after losing hundreds of thousands of dollars in scrap and more in lost sales due to poor quality control in China.

Scovill Fasteners Inc cited rising salaries and the experience of seeing one-quarter of its staff never return from their annual holidays in explaining its decision to go back to Georgia.

Other factors cited for reshoring include high oil prices that make international shipping more costly, friendlier investment climates in the US and parts of Europe and soaring wages in China. Labor costs have shot up by as much as 500 percent in China since the turn of the century, and they're still rising.

However, "salaries for technicians and designers in China are still much lower than in the US and Europe,"said Zhang Jun, director of the China Center for Economic Studies at Shanghai's Fudan University.

Though high-profile companies such as Caterpillar Inc, Google Inc and Ford Motor Co have followed the reshoring trend, finance professors and business consultancies in Shanghai warn against overplaying the situation.

"This reshoring trend is quite prominent, and it's going to continue in the near future. But its fate over the longer term really depends on how well and how quickly China can transform itself from a country driven by investment and imports to one driven by domestic consumption,"said Xu Bin, a professor of economics and finance at the China Europe International Business School, which has a main campus in Shanghai.

For every big-name company that's moved work back home, there are other producers staying put in China.

French Industry Minister Arnaud Montebourg said recently that "only a few"French companies have decided to reshore or given it serious thought. And in July, the Financial Times described the reshoring trend among United Kingdom companies as "modest”.

"Europe is behind the US, but it's starting to push hard,"said Moser. "It is spreading in the Netherlands and France, and there is interest in the UK, Switzerland, Italy and Belgium."

The number of reported cases is limited — perhaps 100 in the US, likely even fewer in Europe — but it hints at the changing dynamics of the global playing field. The US now has highly competitive energy prices, and its workers are among the most highly skilled and efficient in the world.

Incentives cut back

China, meanwhile, is slowly reducing incentives to attract foreign direct investment. Changes in the value of the yuan, dollar and other currencies are having an impact as well.

"In the past, the Chinese government used many favorable policies to attract FDI, but as Chinese companies close the technological gap, it is winding these down.

"This is going to continue, and foreign multinationals find it quite frustrating,"said Xu. "They're also not receiving the kind of policy incentives that local companies are getting.”

Small companies are part of the offshoring trend, too.

In April, the president of Quality Float Works Inc, a Chicago company that makes hollow float metal balls, told ABC Radio Australia that his experiment with outsourcing to China had proven to be a mistake due to faulty materials, delivery delays and the changing economic landscape.

"It started out being a very positive experience. We were able to save a lot of money, but unfortunately it went downhill,"Jason Speer said. "It became a nightmare. It ended up costing us money overall, because all the time and money that we wasted in trying to check everything ... (we) ended up just having to buy it again.”

Boston Consulting Group, which has published papers on reshoring in recent years, predicts that ongoing trends could "virtually close the price gap"for most products sold in the US by 2015.

"Within five years, the total cost of production for many products will be only about 10 to 15 percent less in Chinese coastal cities than in some parts of the US where factories are likely to be built,"BCG wrote in 2011.

"Factor in shipping, inventory costs, and other considerations, and — for many goods destined for the North American market — the cost gap between sourcing in China and manufacturing in the US will be minimal.”

The firm advised companies to "rigorously assess their global supply networks"when deciding where to base production, rather than just looking at factory prices.

It said that China remains the best choice for products that require a large workforce or that are destined for Asian markets. But it added that companies that choose to keep production in China need dramatic efficiency improvement to prosper.

One German businessman whose company makes automobile components in North China said that it's the country's winning supply chain that keeps his company anchored. But he expects more foreign companies will leave in the next five years as tax and land incentives weaken.

Contact the writer at matthewhodges@chinadaily.com.cn.

Related Stories

SW China to build aero-engine outsourcing base 2013-10-08 10:53

China's service outsourcing up 43.6% in Q1 2013-05-18 23:29

Labor-intensive enterprises should move to Africa 2013-09-09 10:01

Turning point for labor 2013-07-22 08:19

Today's Top News

China securitization plan to include foreign banks

China's PMI growth hits 18-month high

Firms heading home as benefits wane in China

German lawmaker meets Snowden in Moscow

Russian coal mines seek new outlets in China

US urged to explain phone taps

Disclosure of WTO report rebuked

Vaccine gets nod for global use

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|