Two firms to debut in US at higher prices

Updated: 2013-11-01 00:44

By GAO YUAN (China Daily)

|

|||||||||||

|

|

|

Qunar Cayman Islands Ltd, China's top travel-booking website, expects share prices to rise to $14. Provided to China Daily |

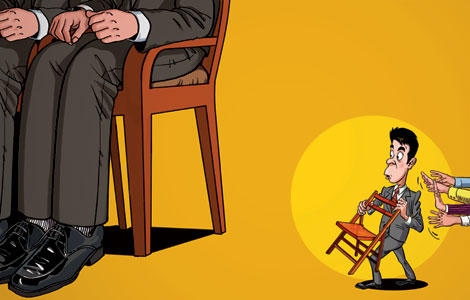

Two Chinese Internet companies lifted their initial public offering price range on Thursday, hours ahead of their debut on the United States stock market.

Analysts said the US capital market is recovering for Chinese companies this year and more China IPOs will be posted in 2014.

Beijing-based 58.com, an online marketplace active in about 380 Chinese cities, boosted the ceiling of its price range by a dollar, to $16 a share. The company was listed on the New York Stock Exchange on Thursday local time.

Qunar Cayman Islands Ltd, China's top travel-booking website controlled by local search engine Baidu Inc, also increased its expected IPO price range because of positive market forecasts.

It expected share prices to rise to $14. Two weeks ago, the estimation was $9.5 to $11.5 for an American Depositary Share. Qunar is looking to raise as much as $156 million, 22 percent more than the high end of its initial range, according to Bloomberg News.

Qunar is scheduled to go public on Friday in New York.

Baidu invested $306 million in Qunar in 2011. The Chinese version of Google Inc is Qunar's biggest shareholder.

Paul Lau, a partner of KPMG China, said the IPOs of 58.com and Qunar are likely to open a new window for Chinese dot-coms going to the US stock markets.

"The US capital market is steadily recovering and we are expecting two to three more China IPOs by the end of this year," said Lau.

"I do not see any reason why the number wouldn't go up."

Tech firms are the most favorable candidates among US investors. China's Web fever has helped boost evaluations of Internet companies.

The nation had more than 590 million Internet users as of June, accounting for nearly half of the total population, according to China Internet Network Information Center.

The number of China IPOs slumped dramatically after a series of Chinese companies' financial scandals disrupted Wall Street's confidence in 2011.

Chinese companies have raised about $171 million on Wall Street this year. The amount was above $4 billion in 2010, data from financial service platform Dealogic showed.

The small number of Chinese companies listed after 2011 were "doing well", according to Lau. The companies saw their values surge by up to 10 times after an IPO because their initial evaluation was only 60 percent of the actual value.

A passive economic outlook and negative attitude toward Chinese companies created low evaluations.

In addition, Lau said the e-commerce giant Alibaba Group Holding Ltd's potential US IPO will also give momentum to other local companies that are eyeing a US listing.

However, Chinese companies have to survive attacks from short-selling firms after their IPOs, analysts warned.

Last week, the market cap of New York-listed NQ Mobile Inc, a Beijing-based smartphone security company, almost halved after a US short-selling company said NQ was marking up its market share.

Related Stories

Online travel giants Ctrip, Qunar move toward cooperation 2013-08-06 06:47

Today's Top News

Firms heading home as benefits wane in China

US urged to explain phone taps

Disclosure of WTO report rebuked

Vaccine gets nod for global use

Freer RMB 'can answer US claims'

'Dangerous provocation' condemned

Promoting baby formula prohibited in hospitals

Police told to protect medical workers

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|