Ministry clarifies media brand critique

Updated: 2013-11-01 00:39

By Li JIABAO (China Daily)

|

|||||||||||

|

|

A Starbucks shop in Wangfujing, a busy shopping area in downtown Beijing. China Central Television reported that the Seattle-based company sells its coffee at higher prices in Beijing than in London, Chicago, or Mumbai, India. Zhang Zhenxiang / For China Daily |

Chinese media's recent criticism of foreign brands in China is not specially targeted at foreign enterprises, and the country remains a top destination for global investors, a commerce official said on Thursday.

"Recently, China's media reported and criticized the product quality, pricing and after-sales services of some foreign enterprises such as Samsung Electronics Co Ltd and Apple Inc. The reports and criticism showcase the social responsibility of the media outlets and was not purposely targeted at foreign investors," Shen Danyang, a spokesman of the Ministry of Commerce, said during a news conference.

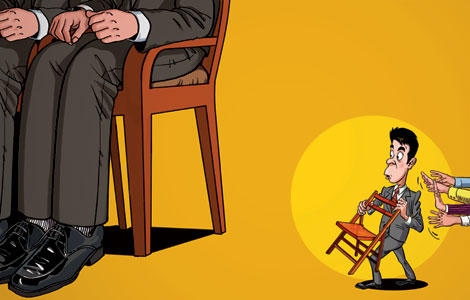

The China Central Television pointed a finger at Samsung (China) Investment Co Ltd in a program earlier this month and said that seven smartphone models under the Galaxy Note II and Galaxy S3 series constantly crashed or malfunctioned. Furthermore, there were high repair fees for Chinese buyers. CCTV also criticized Starbucks for pricing coffee and mugs more expensively in China than in London, Chicago and Mumbai.

This year, the government launched a series of antitrust and anti-corruption investigations ranging from solar panels and infant formula to pharmaceutical products and investigated the Chinese business operations of foreign brands including GlaxoSmithKline, Mead Johnson, Dumex, and Fonterra.

Shen urged enterprises involved in the reports and criticism to take buyers' complaints and media supervision seriously and said businesses should be more than merely lawful to better establish brand image.

A survey by the American Chamber of Commerce in China reported in late October that only 28 percent of surveyed companies said China's investment environment had improved in the last 12 months. The chamber urged China to shorten the "restricted" and "prohibited" categories under the Guiding Catalogue on Foreign Investment in Industry while streamlining the investment approval procedures.

The European Union Chamber of Commerce in China also called on the Chinese government in September to reduce restrictions on market access and open more sectors to private as well as foreign investors.

"On the whole, global investors are still retaining strong confidence on investment in China… and Chinese markets continue to lure international investors," Shen said while noting the report from the United Nations Conference on Trade and Development, which put China as the top investment destination during the 2012-2014 period, and the 2013 A.T. Kearney Foreign Direct Investment Confidence Index which ranked China in second position, just after the United States.

In the first nine months of this year, foreign direct investment in China maintained growth after reversing a decreasing trend in February. The FDI inflow rose 6.22 percent from a year earlier in the January-September period but the number of newly approved foreign-invested enterprises went down 9.29 percent year-on-year in the same period, suggesting slowing investment inflow by multinational companies in the future.

"The media criticisms and the authority's investigations, which are minor details for global investors in deciding investment destinations, will not affect foreign investors' confidence and future FDI inflow," said Zhuang Rui, deputy dean of the Institute of International Economy at the University of International Business and Economics in Beijing.

China's market size, industrial potential as well as its improving investment environment are the top magnets to global investors, Zhuang added.

Shen said that the new leadership has made great progress in optimizing the investment environment. Investment approvals were simplified and the newly established free trade zone in Shanghai are piloting innovations in FDI management and expanding the sectors for foreign investment.

Related Stories

Starbucks' pricing furor brings tempest in a coffee pot 2013-10-25 07:05

Starbucks responds to reports of over-pricing 2013-10-22 15:08

Samsung's apology not satisfying 2013-10-25 13:47

Samsung's response fails to satisfy users 2013-10-25 07:02

Today's Top News

Firms heading home as benefits wane in China

US urged to explain phone taps

Disclosure of WTO report rebuked

Vaccine gets nod for global use

Freer RMB 'can answer US claims'

'Dangerous provocation' condemned

Promoting baby formula prohibited in hospitals

Police told to protect medical workers

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|