Pilot FTZ to build open economy

Updated: 2013-09-27 07:07

By Chen Bo in Shanghai (China Daily)

|

|||||||||||

Editor's Note: As preparations for the China (Shanghai) Pilot Free Trade Zone are entering the final stage ahead of its unveiling ceremony on Sunday, China Daily invited a number of business leaders and experts to share their thoughts on how this ground-breaking project will shape their future plans that target the Chinese market. Their comments should serve as a useful reference point for those attempting to grasp the magnitude of the project and its far-reaching significance for the future development of the Chinese economy.

The zone should include all major industries to create competition

The decision to establish a pilot free trade zone in Shanghai stems from a number of internal and external problems that China now faces.

While slowing economic growth is forcing the country to seek out deeper reforms and new growth engines, external moves that could be billed as "foreign aggression" have had a bigger hand in prompting the creation of the FTZ.

|

The gate of the China (Shanghai) Pilot Free Trade Zone on Yanggao Road N. in Pudong. Zhao Yun / For China Daily |

The influence of the Trans-Pacific Partnership Agreement (TPP), initiated by Singapore in 2005, was greatly enhanced after the United States signed up in 2008. Ever since, the TPP has moved in tandem with American interests.

As part of its bid to build a unified market in the Pacific Rim by 2020, the TPP requires member countries to eliminate all tariffs and open up their agricultural and financial services sectors. As such, Japan and developing countries like China have found themselves in the crosshairs.

The US-influenced TPP did not receive a positive response from Asia-Pacific countries at first. But with the US forcing Japan and Vietnam to join the negotiations - it also signed an FTA with South Korea in October 2011 - China has had to reconsider its position. China knows it will pay a higher price if it is excluded from such a unified market.

China expressed interest in joining the TPP for the first time during a fresh round of Sino-US strategic economic dialogue in July. However, time is of the essence if it hopes to meet the TPP's requirements for full liberalization before the 2020 deadline.

Despite rumors about what reforms the FTZ may herald, its long-term policy objectives will generally remain consistent with the requirements of the TPP.

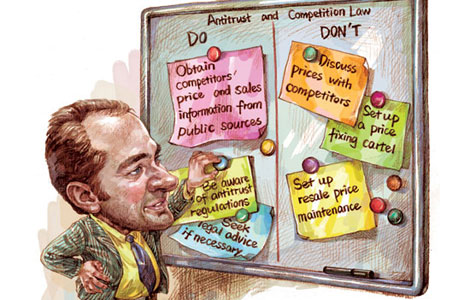

It has four main goals. The first is achieving zero tariffs on all merchandise traded, including agricultural products. The second involves protecting intellectual property rights, and making sure that labor, environmental and safety conditions meet international standards. The third centers on enhancing economic and regulatory fairness and transparency, and removing subsidies and preferential policy support for specific industries and State-owned enterprises. The fourth seeks to fully liberalize the financial services industry, and open up the capital account to facilitate the free convertibility of currency and free movement of capital.

In addition, the FTZ should include all major industries to create a fair sense of competition among State-owned, private and foreign businesses. It should also follow a negative-list management approach, which is to say, it needs to grant access to any businesses that are not prohibited. The traditional method of examining and approving tenants should also change to a registration-based system.

In short, the pilot FTZ scheme should serve as a perfect opportunity to build an open economy on a macroeconomic level by testing out innovative systems in a context of global competition. From this, China can learn about other economic management methods and assess the impact of full liberalization.

Many scholars have compared the Shanghai FTZ to the situation in Shenzhen in 1979, when China began experimenting with more liberal economic policies. Others have drawn analogies with the country joining the World Trade Organization in 2001.

Construction of the Shanghai FTZ is part of a series of reforms by Premier Li Keqiang. These are focused on de-leveraging debt, reducing financial support and upgrading industrial infrastructure in order to better allocate resources through a market mechanism.

(China Daily 09/27/2013 page17)

Today's Top News

Russia to guard Syria chemical weapon destruction

Interpol issues arrest notice for 'white widow'

Vice-Premier urges more cooperation in Eurasia

Foreign suppliers dominate

Early fish ancestor found

Joining talks on trade in services

Courier reaches for the sky with drone

New legal era for Shanghai FTZ

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|