Maturing market presents more challenges

Updated: 2013-05-03 07:10

By Zhu Jin (China Daily)

|

|||||||||||

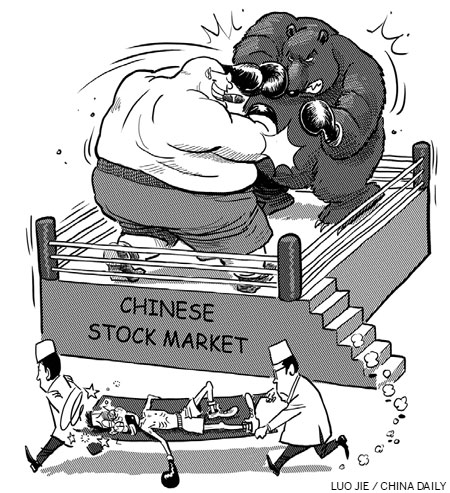

Many individual investors in Chinese stocks have called it a day after having lost faith in the market. Last year more than two-thirds of the active accounts of individual investors were sleeping accounts, because they had not registered any transaction. With increasing numbers of individual investors exiting, the stock market is now entering a new period in which institutional investors start to dominate the market. This seems inevitable as China's stock market matures.

Individual investors' passion for stocks was at its height five years ago when they accounted for more than 95 percent of all stock accounts. But after the stock index reached a peak of 6124 in October 2007, it took just one year for it to drop to 1664. Although the index rebounded to 3478 in September 2009, the activities of individual investors have been subdued since then.

Because individual investor's activities have more or less died down over the last five years, the capital inflow into the stock market has suffered. The serious losses they have incurred, along with the continued downward trend of the stocks, means individual investors have no intention of venturing further into the stock market. Thus large accounts have shrunk and even been closed.

This process can be seen quite clearly in the capital distribution of individual accounts. Although the number of small accounts with less than 100,000 yuan ($15,984) increased by 16.2 percent from 2009 to 2011, the number of large accounts, with capital of more than 10 million yuan, fell by 17.28 percent and the number of accounts with 5 million yuan to 10 million yuan declined by 21.9 percent. Also, in 2012 the number of smaller accounts dropped by 5 percent.

International experience shows that such a transition - when individual investors leave the market - is inevitable in a maturing stock market like China's. In a mature stock market, institutional investors account for about 80 percent of the total number of transactions, which is good for market stability. In the US stock market in 2008, for example, individual investors accounted for only 34 percent of the market's value, the lowest in its history. In contrast, the share of individual investors in 1950 was 94 percent and dropped to 63 percent in 1980.

The transition in China is happening more quickly. What took decades in the US to develop is taking just years in China to happen. That's why the exit of individual investors may be good for the development of the stock market, because the central government can stop safeguarding the profits of investors by taking non-market measures. With the government no longer required to play the role of savior, there will not be any need for unsuitable administrative intervention.

Such a transition - in which institutional investors begin to dominate the stock market - is inevitable in China because the current share of individual investors in total trade is still about 80 percent. The transition is irreversible, because China's maturing stock market will no longer be suitable for individual investors, especially small investors.

More professional institutional investors entered the market last year. In December, China Securities Regulatory Commission approved six more Qualified Foreign Institutional Investors. This means China now has 207 QFII investors. Guo Shuqing, former president of the commission, has said that the scale of QFII and yuan QFII in the future should be 10 times the current scale. That would raise the total to 7.66 trillion yuan, which will considerably strengthen the power of institutional investors in the market.

Many individual investors lack necessary financial knowledge needed to work the stock market successfully. Institutional investors, on the other hand, are able to make profit by applying long- and short-term equity strategies, and they can hedge their risks using securities' margin trading and stock index futures.

The higher the number of financial institutions the greater is the likelihood of a change in the structure of market valuation, because institutional investors are prone to focus on long-term value investment instead of pursuing short-term gains, which is quite different from most individual investors' goal.

Though more financial investors could ensure healthy and stable market growth, institutional investors have started dominating the stock market. Therefore, the CSRC should be prepared to deal with the inevitable transition. It should learn from the experiences of other countries - that institutional investors can escape supervision more easily than individual investors, which could trigger a subprime-like crisis that overshadowed the US in 2008.

China's financial market is still in its early stages and the CSRC is quite cautious about regulating the stock market. So in the short term, more professional financial institutions can help standardize and stabilize the market.

It is thus highly likely that, given the rapid growth of stock market and the need to compete in the international arena in the near future, China will introduce more innovative and complicated trading measures. That, however, will require more advanced and stronger regulations, especially the ability to hedge risks and prevent a crisis.

A maturing stock market will present more challenges to Chinese regulators, and the CSRC should be prepared to meet them.

The author is a reporter with China Daily.

Related Stories

China unveils guideline for RQFII investors 2013-05-03 09:51

Investors bearish on weak economic data: Analysts 2013-05-02 05:00

Investors find a home in overseas real estate 2013-04-25 02:37

Chinese investors should be welcomed in Germany 2013-04-23 11:15

Increased scrutiny as investors diversify 2013-04-15 10:04

Today's Top News

Detention of petitioners denounced

Lawyers get an advocate

Pentagon accusation on China's military rejected

Foster homes for homeless children

Public hearing to discuss taxi fare increase

21 Party officials, SOE managers disciplined

Clarity on tax evasion needed, lawmakers told

Visa policy to attract global tourists

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|