Firms chase overseas deals

Updated: 2013-01-08 13:06

By Du Juan (China Daily)

|

|||||||||||

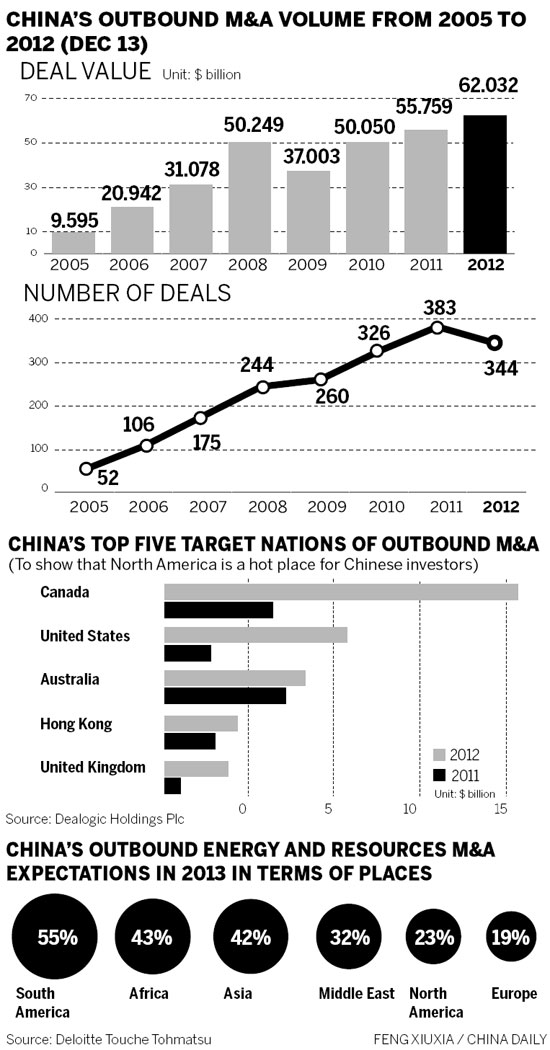

China's appetite for foreign energy and resources assets has remained strong over the period, accounting and consulting firm Deloitte Touche Tohmatsu said in a report.

In 2005, just 10 China outbound energy and resources deals were announced. In 2008, the number had grown to 34, and over the first nine months of 2012, 39 such transactions had come to market, it said.

China has spent $44.8 billion on purchasing Canada's assets since 2005, while $42.8 billion was spent buying Canadian energy and resources targets, Deloitte said.

|

|

In addition to the CNOOC-Nexen deal, Asia's biggest oil producer PetroChina Co Ltd, said it would purchase a 49.9 percent stake in Encana's Duvernay shale gas field in Canada last month. Sinopec Group had acquired a 49 percent stake in the United Kingdom subsidiary of the Canada-based Talisman Energy Inc for $1.5 billion.

The United States was listed as the second-biggest target nation of China's outbound M&As in 2012, with more than $10 billion in deal volume, nearly triple what it was in 2011.

Analysts said North America might become a new hot spot for Chinese energy investors.

"A key reason for the success of the CNOOC-Nexen deal is that the international energy scale has changed because the US is becoming increasingly independent in energy supply thanks to its unconventional natural-gas development," Lin said. "Thus, the US' dependence on Canadian energy resources is declining, which has created opportunities for closer China-Canada cooperation in the energy sector."

Read more in

Related Stories

China's M&A market reached 6-yr record in 2012 2013-01-07 15:04

Chinese M&As surge 37% in 2012 2013-01-06 17:21

Nexen deal to benefit all sides: CNOOC 2012-12-10 15:45

Timeline of CNOOC's bid for Nexen 2012-12-08 10:16

Chinese companies' cross-border M&A rising 2012-12-24 10:07

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|