Firms chase overseas deals

Updated: 2013-01-08 13:06

By Du Juan (China Daily)

|

|||||||||||

Global economic woes have boosted outbound mergers and acquisitions by Chinese companies to a new high in 2012, reports Du Juan.

China's outbound mergers and acquisitions reached a record high in 2012 as companies and investors continued to seek opportunities abroad, especially in the energy and resources sectors.

The country's total outbound M&A volume was $59.7 billion from January to Dec 13, up 23 percent from the previous year, and accounted for 7 percent of the global cross-border M&A volume in 2012, according to statistics from Dealogic Holdings PLC, an international financial-data provider.

|

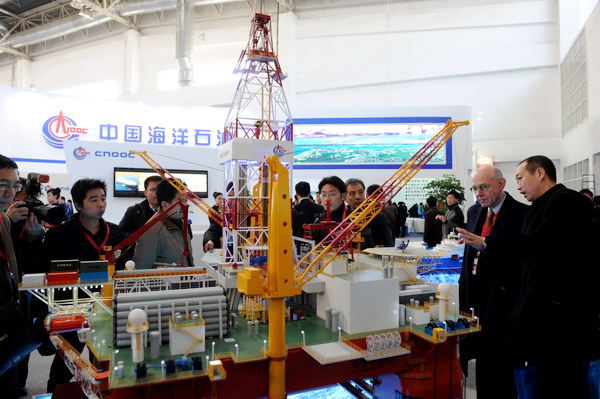

A drilling platform developed by CNOOC Ltd, China's largest offshore oil producer. The Canadian government earlier approved the Chinese company's acquiring Canadian energy counterpart Nexen Inc. The volume of China's outbound M&As in the oil and gas industry reached $34.5 billion with 35 deals by Dec 13, 2012. [Photo / China Daily] |

In contrast, China-targeted M&A volume fell 7 percent year-on-year to $167.1 billion this year.

"The weak global economy has provided Chinese companies a good chance to purchase foreign assets in order to expand their overseas businesses," said Lin Boqiang, director of the Xiamen-based China Center for Energy Economic Research. "The timing is good for overseas acquisitions, especially in the high-capital energy industry."

The bulk of China's overseas investments continued to be within the energy and resources industries, reflecting its growing appetite for raw materials.

The volume of China's outbound M&As in the oil and gas industry reached $34.5 billion with 35 deals by Dec 13. That was 55.5 percent of the overall deal volume, up 20.6 points compared with the previous year, according to data from Dealogic.

|

|

After the oil and gas industry, finance, mining, leisure and utilities were the top five target sectors for Chinese companies.

They spent up to $20.7 billion in M&A deals in Canada, which made it the largest target nation of China's outbound M&As for the first time in 2012, boosted by CNOOC Ltd's $18.2 billion acquisition of Nexen Inc.

"It is a trend for Chinese oil companies to buy more overseas assets," said Liao Na, information director at energy consultancy ICIS C1 Energy.

"The CNOOC-Nexen deal will help China get into the North Sea area, which will lead to gradually increasing participation in the international oil-pricing market."

More news on CNOOC Ltd

CNOOC oil fields in operation in South China Sea

Nexen CEO: CNOOC deal not yet done

China welcomes approval of CNOOC-Nexen deal

Timeline of CNOOC's bid for Nexen

Related Stories

China's M&A market reached 6-yr record in 2012 2013-01-07 15:04

Chinese M&As surge 37% in 2012 2013-01-06 17:21

Nexen deal to benefit all sides: CNOOC 2012-12-10 15:45

Timeline of CNOOC's bid for Nexen 2012-12-08 10:16

Chinese companies' cross-border M&A rising 2012-12-24 10:07

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|