Aluminum producers steeled for losses

Updated: 2012-06-18 09:20

By Du Juan (China Daily)

|

|||||||||||

Transition period

Overcapacity and shrinking demand have accelerated the cut-throat competition in the electrolytic aluminum industry.

Xiong Weiping, general manager of Aluminum Corporation of China, the largest primary aluminum producer in the country, said the industry will experience three to five years of downturn but the company could still remain strongly competitive if a whole production chain of coal, electricity and aluminum can be formed.

The Chinese government obviously has made efforts to keep a lid on the problem.

In 2005, the National Development and Reform Commission announced that the government will restrict new production capacity of electrolytic aluminum.

In 2009, the commission said it will not approve any new projects for the production of electrolytic aluminum in the following three years.

In April last year, it, together with other related departments, made a statement saying that the increasing aluminum investment in western China was in disorder and canceled preferential policies. In July, the construction of 23 electrolytic aluminum projects was stopped.

However, it seems nothing can stop the companies' continued enthusiasm to go west. The consequences will eventually emerge in such areas as a high dependence on bauxite imports.

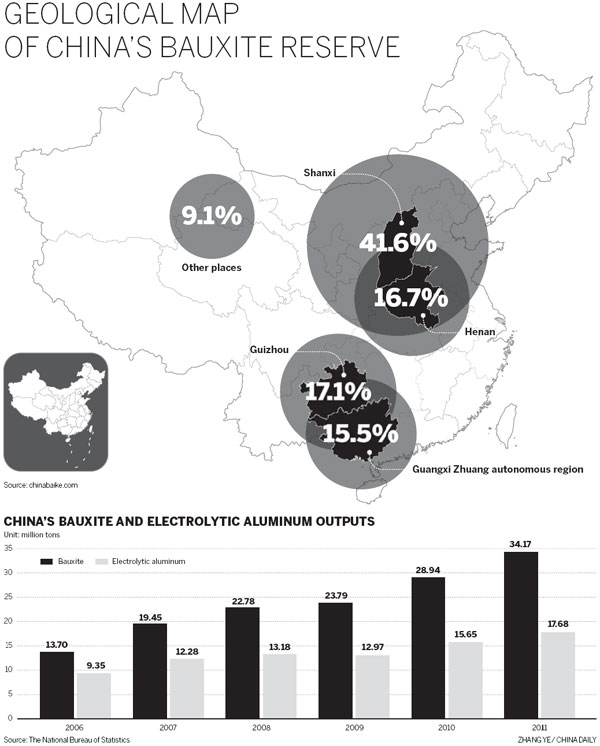

In 2011, China imported 44.85 million tons of bauxite, a 50 percent growth year-on-year. The imports are mainly from Indonesia, Australia and India, among which Indonesia is the biggest supplier, accounting for 80 percent of the total.

The Indonesian government announced recently that the country will stop exporting bauxite from 2014, which will affect China's aluminum production and the stability of the whole industrial production chain.

McLane said the Chinese aluminum industry is going through a transition period in the up-stream business because of this high dependence on raw material imports, as well as rising electricity costs and emissions.

According to data from the China Nonferrous Metal Industry Association, China's dependency on foreign bauxite was 47 percent in 2011. The total output of bauxite in China last year was 34.17 million tons. The country's proved reserve of bauxite could only last another nine years of production based on the current production scale if all the bauxite were supplied domestically.

At present, Chinese companies' bauxite resources abroad are still at the exploration stage and therefore not yet able to guarantee a secure supply.

Alcoa strategy

In such a difficult time for the aluminum industry, Alcoa achieved a good performance in the first quarter this year when most Chinese aluminum companies were losing money.

The company reported income from continuing operations in the first quarter was $94 million, or 9 cents a share, compared with a profit of $309 million, or 27 cents a share, in the same quarter last year. The revenue rose slightly to $6 billion. Before the company released its financial report, analysts were expecting a loss of 4 cents per share and revenue of $5.77 billion, according to Reuters.

McLane said a cash sustainability program that includes cost control and asset management in the upstream businesses of the company, combined with high value-added products and innovation in the midstream and downstream businesses, helped in cutting costs and led to good performance.

However, he said the market started to become very challenging this year.

"We cut costs in the upstream business, which is our strategy, creating growing revenues in the mid-stream and down-stream," he said. "We got hurt as well on the commodity side like many companies that don't have mid-stream or downstream businesses."

In the company's midstream businesses in China, he predicted the beverage can sector will grow the fastest, and products used in automobiles will increase too.

Alcoa doesn't have up-stream businesses in China, which prevents it from being affected by oversupply in the electrolytic aluminum market.

The company declined to release its revenue or profits by region but McLane said he sees aluminum demand growth in China this year of 11 percent. He said that compared with the 15 percent growth in 2011, it is a little bit of a slowdown, but still a pretty significant figure.

"The Chinese government is doing a good job at balancing the real estate, inflation and trade balances, which helps to move the economy along. The related policies will not affect the downstream aluminum businesses in China," he said. "In 2010, we estimated the world aluminum demand is going to double by 2020 and we are still on pace to see that."

The company, which makes aluminum for aircraft, cars and beverage cans, raised its 2012 global growth forecast for the aerospace market by 3 percentage points to 13 to 14 percent and said it expects global growth in the auto industry of 3 to 7 percent.

Alcoa and its Chinese partner, China Power Investment Corporation, one of the five giant power groups in the country, finalized an agreement in February to form a joint venture for producing high-end fabricated aluminum products for the Chinese market.

The new company, named Alcoa CPI (China) Aluminum Investment Co, will be based in Shanghai. Alcoa is expected to hold a major portion of the company's share, according to public reports.

McLane said Alcoa is evaluating with its partner some of the upstream projects outside China. But, for the activities inside China, they will focus on fabricated aluminum for aerospace, commercial transportation, packaging, automotive and consumer electronic industries.

Having seen the growing development of China's aerospace market, Alcoa will bring more products in this sector to the country. Currently it is supplying Commercial Aircraft Corp of China Ltd with both domestic products and imports.

"We have plans to bring some other businesses to China," he said.

dujuan@chinadaily.com.cn

Related Stories

Farmland inundated after aluminum sludge leak 2012-05-29 12:33

Aluminum manufacturer wins land bid 2012-03-09 16:15

Aluminum stockpiles surge 30% as growth decelerates 2011-10-21 10:05

Outlook for aluminum production 2011-07-07 10:39

Govt may stop 70b yuan electrolytic aluminum projects 2011-04-11 17:08

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|