Aluminum producers steeled for losses

Updated: 2012-06-18 09:20

By Du Juan (China Daily)

|

|||||||||||

Oversupply, falling rate of demand and high energy costs hit smelters

"The aluminum can in my hand will be back in the refrigerator in 60 days in the form of another aluminum can after I drink its contents and put it into a recycling bin," said Charles McLane, holding a canned drink while conducting an exclusive interview with China Daily.

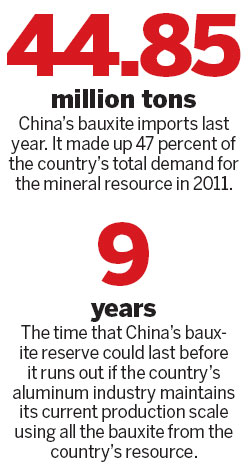

The words of McLane, executive vice-president and chief financial officer of Alcoa Inc, the world's largest miner of bauxite and refiner of alumina, describe how sparingly the metal has been used in an industry that has attracted huge investment enthusiasm in China, especially in western areas.

Faced with a gloomy global economy, many giant aluminum businesses decided to curtail their production capacity and close down some facilities to deal with shrinking demand in the downstream market and falling prices.

Rio Tinto, the world's third largest miner by market capitalization, started to consider curtailing its electrolytic aluminum businesses in late 2011 to deal with the sector's low profitability and, in some cases, losses.

Alcoa announced early this year that the company will curtail its electrolytic aluminum production capacity of around 531,000 tons and reduce the output of electrolytic aluminum by 12 percent. Meanwhile, the company shut down three smelters in the United States, according to public reports.

While foreign companies in the industry are changing their strategy to survive difficult times in the market, China's aluminum companies are substantially increasing production capacity and annual output.

The Chinese aluminum companies are faced with an extremely oversupplied market and rising energy costs, which has made competition even more fierce during their rapid expansion in West China.

As a senior leader of the biggest foreign investor in the aluminum industry, McLane's comment on Chinese electrolytic aluminum producers' go-west campaign appears right on target.

"If you look at the energy efficiency goals and the carbon emission reduction goals that China's 12th Five-Year Plan (2011-15) has set up and then you look at what is going on in the aluminum industry, I think it shows the aluminum industry has some significant challenges in order to be aligned with the plan's goal," he said.

According to statistics from the China Nonferrous Metals Industry Association, up to 90 percent of the new electrolytic aluminum production capacity has been from western China since the year 2009.

Last year, China's 3.4 million tons of new production capacity of electrolytic aluminum were mainly in the Xinjiang Uygur autonomous region and Qinghai province in Northwest China.

The total investment of new aluminum projects in Xinjiang alone reached 85.4 billion yuan ($13.6 billion), focusing on the smelting businesses. The overall production capacity of electrolytic aluminum including existing, under-construction and planned projects in the region is more than 13 million tons.

Compared with the rapidly increasing production capacity in the west of the country, sites in the east that used to be the main centers of the industry now have problems with rising energy costs and shortages of raw materials.

Some industrial insiders believe electrolytic aluminum producers in eastern China should quit the market even though it may affect the local governments' gross domestic product performances and add to the difficulties of attracting foreign investment. However, it sounds like the only solution to the oversupply situation.

China has had a severe oversupply of electrolytic aluminum on a monthly base for a long time and factory inventories keep increasing.

Related Stories

Farmland inundated after aluminum sludge leak 2012-05-29 12:33

Aluminum manufacturer wins land bid 2012-03-09 16:15

Aluminum stockpiles surge 30% as growth decelerates 2011-10-21 10:05

Outlook for aluminum production 2011-07-07 10:39

Govt may stop 70b yuan electrolytic aluminum projects 2011-04-11 17:08

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|