Seat at the table for furniture firms

Updated: 2012-04-30 10:33

By Liu Jie (China Daily)

|

|||||||||||

|

|

|

Visitors test a bed at a furniture show in Dongguan, Guangdong province. Furniture spending in China has increased rapidly since 2002, with sales hitting 262.4 billion yuan ($41.6 billion) in 2010. [Photo / China Daily] |

China has become the largest exporter, but industry experts say producers must focus more on own designs and quality

Fu Haijun led a team to the Milan Design Week Show, one of the world's leading design festivals, which ran from April 16 to 22 this year.

He went to show his company's concept product, which is the first of its kind in China's furniture industry.

Fu, the founder and general manager of Camerich Furniture, said instead of a product display, the main purpose of the show is sharing Camerich's exploration of new design trends and ideas with famous international designers and businesses.

"We are expanding our international vision and image. We hope the world gets a chance to know Camerich, and the Milan Design Week Show can act as a bridge," he said.

Camerich, a brand owned by Beijing Triumph Furniture Co Ltd, is among the Chinese furniture makers that are testing the waters of the international market with their own brands instead of sticking to the original equipment manufacturing business.

International vision

China has become the largest furniture exporter in the world, accounting for about one-fourth of global furniture exports for several years. Furniture exports amounted to $38.88 billion last year, a year-on-year growth of 15.31 percent, compared with a 29.95-percent gain in 2010, according to the China National Light Industry Information Center.

"The growth rate is declining, due to the global economic slowdown," said Zhu Changling, director-general of the China National Furniture Association.

"So far, the majority of China's furniture exporters are OEMs and the nation lacks internationally recognized brands, which means a large part of China's exports are low value-added and many exporters have to make their living on orders from foreign-branded companies."

Things are evolving, as some leading Chinese companies, such as Camerich and Markor, have started going abroad with their own names.

Thanks to a decade of efforts, Camerich has registered in nearly 60 nations and regions and owns 29 specialty stores in 20 cities, such as London, Sydney and Seoul.

"Given fast sales growth in the overseas market, we are planning to open more specialty outlets in the coming years. The number is expected to reach 200 by 2016," said Fu.

"In the past years, we focused on expansion in North America and Europe. At present, we are paying more attention to exploring the Southeast Asian market, such as Singapore."

|

|

The Milan Design Week Show, where Camerich Furniture shared its new design trends and ideas with famous international designers and businesses.[Photo / China Daily] |

The concept show is a tool that Camerich uses to present its design ability and promote its brand. At this year's Milan Design Week show, its product - Village Mountains - had the look of a tall, white, unadorned honeycomb structure.

This design implies the desire to live in seclusion in remote mountains. It represents traditional Chinese culture using both futuristic and realistic methods.

It also expresses people's hopes to build a new balance between continuous urban expansion and protecting farmland, and a return to the harmony between humans and the natural environment, the company said.

In September, the furniture maker launched a global concept show at the 17th China International Furniture Expo in Shanghai.

Camerich Brand Marketing Director Shirley Wang said: "Each of our concept designs not only features a certain kind of product, but also pursues a lifestyle.

"Only by great design can Chinese brands be brought onto the world stage. Good design can imbue a product with soul and a unique style," said Fu, adding that Chinese manufacturers, once regarded as only good at mass production, had been at the lowest part of the industry value chain and seen a consistent profit decline.

"If we want to change, the first thing we should do is to create our design, our own brand," he said.

Markor Furnishings Co Ltd, a Xinjiang Uygur autonomous region-based company, transformed itself from an OEM to a self-branded furniture producer in 2001. It set up cooperative arrangements with US-based furniture designer, maker and retailer Ethan Allen Group Inc in 2002 to promote Markor's furniture around the world.

In January 2009, the company's parent - Shanghai-listed Markor International Furniture Co Ltd - bought US upholstery and timber importer Schnadig Corp for $8.94 million. The deal helped Markor Furnishings expand its overseas business through Schnadig's marketing channels in the Americas, the Middle East and Asia.

According to Liu Chunjie, brand and public relations director of Markor Furnishings, the company will further accelerate its globalization process and seek more merger and acquisition opportunities overseas.

In addition to making full use of foreigners' mature networks to promote its overseas sales, Markor is introducing international brands' designs to China.

In April, it introduced five signature lifestyle designs from Ethan Allen, with themes known as elegance, modern, vintage, romance and explorer.

Domestic expansion

According to Christine Alba, design manager of Ethan Allen North and East US, the designs were simultaneously launched in China and the US. She said she believes Chinese consumers, especially high-end consumers, now have more internationalized tastes and American-style design - a combination of various cultures and inspirations - is expected to suit them.

Markor has more than 70 specialty stores in 30 cities around the nation. "The number of stores will hit 100 by 2013," said Zhao Ge, general manager of the company's stores nationwide.

|

|

|

Workers inspect mahogany furniture at a plant in Dongyang, Zhejiang province. China has at least 50,000 furniture companies, most of which are small enterprises. [Photo / China Daily] |

According to the furniture manufacturer's financial results, sales reached 1.36 billion yuan ($216 million) in 2011, a year-on-year gain of 26.16 percent. Domestic buyers contributed 54 percent of sales.

With annual sales growth at about 30 percent during the past seven years, Camerich said domestic sales had continued rising, despite the government curbs on the property market.

"Along with higher incomes and property curbs, people are now paying more attention to the quality of furniture and designs, which offers opportunities for our branded products," said Fu.

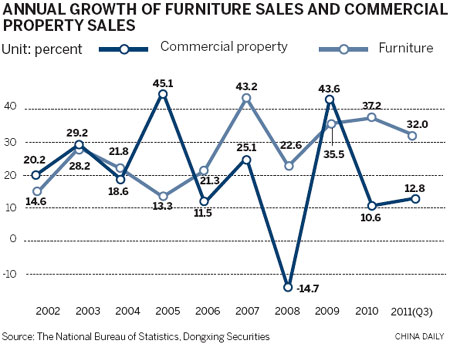

Furniture consumption in China has increased rapidly since 2002. Domestic sales hit 262.4 billion yuan in 2010 from 37.6 billion yuan in 2002, with a compound average annual growth rate of 27.5 percent.

Furniture spending per capita jumped to 196 yuan from 44 yuan, according to the National Bureau of Statistics.

Wang Mingde, an analyst at domestic brokerage Dongxing Securities Co Ltd, forecast that sales this year would increase 18 to 20 percent, lower than in previous years.

"Furniture companies are facing a series of challenges - property curbs, an export growth decline due to the global economic slowdown and a credibility crisis caused by counterfeit scandals," said Wang.

"The only way out is self-branding. To the international market, branding is the key to profit, while in the domestic market, brands can attract people with stronger consumption power, resulting in relatively high profit margins for makers."

He added that furniture is a kind of consumer durable. People in key cities prefer to buy products with brands - a guarantee of quality and after-sales services.

Due to limits on new house purchases, some people have turned to second-hand housing or improvement of their existing homes, which created demand for furniture.

"Consumers, especially those with high incomes, also need tailored or premium designs, which create opportunities for branded manufacturers with specialty outlets," he said.

Zhu of the CNFA stressed that branded furniture companies must always value their brands and be honest with consumers.

Chinese furniture seller Da Vinci Furniture's country-of-origin controversy, which took place last July, caused a credibility crisis in the industry. Da Vinci said its products were all made in Italy, while some Chinese media claimed they were made in Dongguan, Guangdong province, a hub of Chinese furniture OEMs.

The controversy made many Chinese consumers doubt the credibility of many furniture brands.

"We always state that we are a Chinese brand, and our products are designed in China and made in China. That's the value of our brand," said Fu.

Analyst Wang said that Chinese consumers are becoming mature and sophisticated, and they don't blindly trust foreign brands now. "What they care about most are quality, service and design," he added.

China has at least 50,000 furniture companies, most of which are small enterprises, according to the CNFA.

Consolidation of the industry is necessary, and mergers and acquisitions among large and branded companies should be encouraged, said Zhu.

"With consolidation, many large Chinese furniture makers will become strong and have the capacity in terms of finance, design, production and marketing to build their own brands domestically and abroad."

Camerich's Fu said that the great challenge for Chinese furniture manufacturers is a shortage of talent, especially designers, when building brands.

"Furniture design in China is still at an early stage and needs time to develop. Design is a combination of industry knowledge, culture and gifts," he added.

liujie@chinadaily.com.cn

Related Stories

Ikea, TCL product line to combine smart TVs, sound, furniture 2012-04-18 13:40

Furniture pioneer cuts out the middlemen 2012-04-09 08:06

Furniture fair lures guests with comfort 2012-03-22 13:33

Chinese furniture designers showcase in Milan 2012-03-16 11:10

Housing policy hits furniture market 2012-02-16 07:57

Da Vinci to sue over fake furniture claims 2011-12-29 15:46

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|