Aging nation creates nursing home boom

Updated: 2011-12-05 09:09

By Tania Lee (China Daily)

|

|||||||||

Until recently, the central government's focus had predominantly been on the lower socio-economic group in rural areas, an argument that explains why there hasn't been much professional development in the sector.

"The reason why we have not done more work in China is because there was little provision in the middle-income groups and very little in the high-income area," said David Lane of ThomsonAdsett & Partners Pty Ltd, an Australian consulting company that has worked in the sector in Asia since the 1990s.

"Most of them (developers and operators) can only really support the employment of local architects with very limited international assistance," he said.

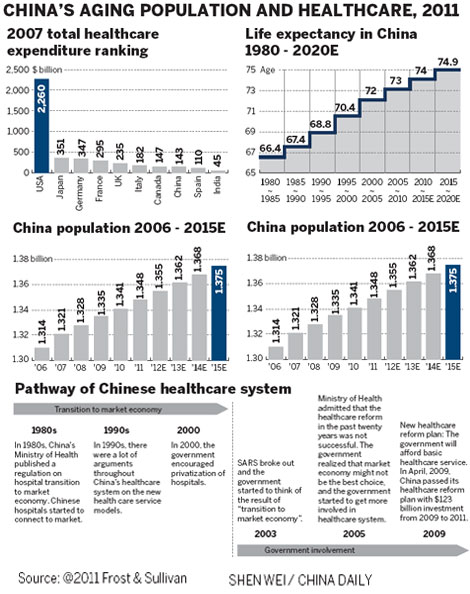

Now, with China facing an aging population, the government has welcomed private and foreign investors to help cover the shortfall in facilities for care of the elderly. Private companies dominate the nursing home sector in most major cities.

Although it is hard to determine exactly what percentage of the elderly rely almost exclusively on the family for support, a study earlier this year by US gerontologists and Chinese academics, published in the Journal of the American Geriatrics Society, indicates that the number of elderly people moving into nursing homes in Chinese cities is soaring.

The study, led by Zhanlian Feng, assistant professor of Health Services, Policy and Practice with the Center for Gerontology and Health Care Research at Brown University in the US, surveyed seven Chinese cities and discovered a growing number of care homes for senior citizens.

The ancient capital of Nanjing, in Jiangsu province, for example, had 27 homes in 1990 and 52 a decade later. By 2009, the number had risen to 148. Beijing and Tianjin showed similar growth, while Shanghai had 552 facilities by the same year.

Despite this sudden growth, many industry leaders believe that the market is still immature and has the potential for enormous growth.

ThomsonAdsett is currently working on numerous projects in Beijing and two in Shanghai, while bidding for further work in Foshan in Guangdong province, Dalian in Liaoning province, Wuxi in Jiangsu province, Wuhan in Hubei province and the municipality of Chong-qing.

"I expect the level of inquiry (from investors and developers) will continue to increase rapidly over the next five years," said Lane.

Official records also show that the number of available beds in nursing homes can only cater for 1.8 percent of China's elderly population, whereas the standard in many Western countries is between 5 and 7 percent.

"We'll need to increase the number by 3.4 million beds to accommodate 3 percent over the next five years," said Li Jianguo, vice-chairman and general-secretary of the Standing Committee of the National People's Congress, in March.

Over the 12th Five-Year Plan period, the government intends to increase pension coverage, expand home-care services and build more nursing homes. But despite their push for more outside input and more favorable policies on land, water, power and taxation in the elderly care sector, businesses are aware of the loopholes and the financial risks - particularly because of the great degree of apprehension about how the general public views care for the elderly and retirement facilities.

The setbacks

Filial piety, a Confucian ideal that used to be held above all others, is still widely accepted and applied. It's also enshrined in the Constitution of the People's Republic of China: Article 49 states that "parents have the duty to rear and educate their minor children, and children who have come of age have the duty to support and assist their parents".

ThomsonAdsett said that in dealing with potential investors, Chinese people feel lazy or selfish if they have to put their relatives in a nursing home because they are unable to look after them. "This is a comment that has been repeated to me in our marketing surveys and personal interviews," said Lane.

There is also the issue of the affordability of nursing homes. "Because fee-for-service and out-of-pocket payments are the norm, it's conceivable that access to nursing-home care may be beyond the means of many middle- to low-income elderly people in China," said Feng.

With a poorer and aging population,there will be a pragmatic limit to the amount the government can spend on older people, hence what it can afford to spend on elderly care services. "And that's why I think rational, middle-aged Chinese citizens continue to save a large proportion of their incomes because they believe they're going to have to look after themselves," said Orr.

Addressing this problem by increasing pensions while dealing with an aging population has been at the heart of parliamentary discussions. Last year a total of 1.3 trillion yuan was collected in pension premiums and about 1 trillion was handed out.

"The government is doing far more to be proactive in policy development on issues related to aging than many of the other Asian economies. For example, Hong Kong has in my opinion become quite sluggish and reactive in its policy development in this area," said Lane.

Foreign investors

"In urban China, it's fairly safe to say that the private sector makes up the majority of all facilities in most major cities, and that the private sector has dominated the rapid growth in the last decade," said Feng.

"To my knowledge, there are very few privately run facilities in rural areas," he added.

Many interested parties have come from Europe and the US, but the predominant investment focus has come from Hong Kong, Taiwan, Singapore and Japan.

"Some Western companies have been seeking entry to China's growing market for care for the elderly since the early 1990s but few, if any, have been successful to date," said Feng.

Lane said a lack of government funding and, until recently, minimal government oversight because of the absence of a formalized regulatory structure, have discouraged many would-be investors and professionals from seeking his company's advice. This is another reason why the sector is still in its infancy, according to Lane.

However, now ThomsonAdsett is able to utilize the preferential policies for the sector and has been working on a number of large and responsible government and commercial interests in China who are genuinely seeking to provide quality facilities.

Continuing to boom

The phenomenon of China's aging population is now becoming widely recognized and the growth of the problem is being mapped. According to Feng, the statistics concerning China's aging population reinforce the urgency for the implementation of proper policy responses to address the challenges in care for the aged. Ideally, quantity (growing adequate long-term care services over time) and quality (ensuring quality of care and regulatory oversight) should go hand in hand, he said.

K.K. Fung, managing director of the global real estate services provider Jones Lang LaSalle Greater China, holds a similar view, but says the focus should be more about providing quality of life. "Reform should be based on how people can earn more," he said.

Government oversight of this sector is minimal because of the absence of a formalized regulatory structure. But there are many in the industry that believe the sector will continue to boom in years to come as Chinese families become more stretched in their ability to take care of the elderly.