Economy

Inflation hits 37-month high, at 6.5%

Updated: 2011-08-09 16:59

(Agencies)

China's annual inflation quickened to a higher-than-expected 6.5 percent in July, putting the central bank in a bind as it tries to keep prices in check without dragging down an economy facing increasing threats from abroad.

The unexpected pick-up kept inflation at its highest mark since June 2008, when global oil prices were soaring toward a record high. Economists had expected inflation to dip to 6.3 percent, after June's reading of 6.4 percent.

Inflation is slated to exceed the official annual target of 4 percent this year. But with debt crises raging in the United States and Europe, the People's Bank of China (PBoC)is widely expected to hold interest rates steady.

"This is the type of data that should have prompted the PBoC to hike interest rates, but given the current turmoil in financial markets, we expect them to delay it," said Wei Yao, an economist with Societe Generale in Hong Kong.

Related: Analysts play up fear of new tightening measures

Asia's stock markets plunged at the opening on Tuesday, following deep losses on Wall Street, as investors weighed the risk of another US recession and a worsening sovereign debt crisis in Europe. The markets managed to recover most of the losses when they closed.

Some market watchers had hoped for a cooling in Chinese price pressures to offer relief from the global rout.

The US Federal Reserve holds its policy-setting meeting later on Tuesday. With interest rates already near zero, its easing options are limited. Economists see little chance that the Fed will announce another round of bond purchases this time.

The Chinese economy held up relatively well, as shown by the investment, industrial output and retail figures released later on Tuesday, even as troubles deepened in two of its biggest export markets, the United States and Europe.

The fixed asset investment rose 25.4 percent in the first seven months, while the industrial output growth decelerated to 14 percent in July from 15.1 percent in the previous month, according to the National Bureau of Statistics.

Retail sales, another key driver of the world's second largest economy, grew 17.2 percent year-on-year and 1.26 percent month-on-month, suggesting that China's efforts to spur domestic consumption is taking effect.

Some economists are expecting China to take the measures to boost the global economy as fears are growing that the US might slip into another round of recession and the European debt crisis will turn worse.

But given China's high inflation, it may not be in a position to reprise its 2008 role of lifting the global economy. Back then, when the Lehman Brothers bankruptcy triggered a worldwide slump, China quickly ramped up a big stimulus package, helping to buffer its own economy and buoy the world.

Related: China stocks dive amid US woes

Since October, China has raised interest rates five times and cash reserve requirements for banks nine times to combat quickening inflation. But those measures have not been enough to cap price pressures.

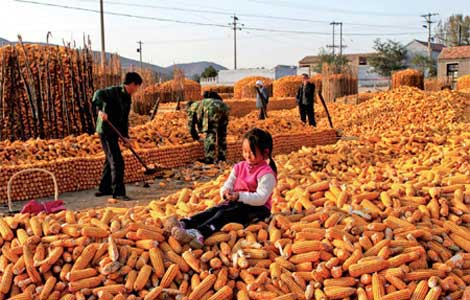

Economists had hoped that June might have marked the inflation peak. Although oil prices have dropped sharply since early May, food costs keep climbing.

Tuesday's data showed food inflation at 14.8 percent from a year earlier, up from 14.4 percent in June. Non-food price pressures actually eased to 2.9 percent from 3.0 percent a month earlier.

Pork prices, which were the primary culprit behind June's hot inflation figures, soared again in July despite a slight cooldown in the second-half of the month. They jumped about 57 percent in the year to July, lifting the consumer price index by a hefty 1.5 percentage points.

Overall, the month-on-month rise in the consumer price index was 0.5 percent, ahead of forecasts for a 0.3 percent rise.

The producer price index was up 7.5 percent year on year, faster than the 7.3 percent increase that economists had predicted and well ahead of June's 7.1 percent rise.

That suggests there is still some inflation pressure building in the pipeline. But if demand drops from the United States and Europe, China's next policy move may be towards easing, not tightening.

"It's time for the Chinese government to relax its policies. It's time for Beijing to announce to the whole world that it will try to stimulate domestic demand again," said Tang Yunfei, an analyst at Founder Securities in Beijing.

E-paper

My Chinese Valentine

Local businesses are cashing in on a traditional love story involving a cow herder and a goddess

Outdoor success

Lifting the veil

Allure of mystery

Specials

Star journalist leaves legacy

Li Xing, China Daily's assistant editor-in-chief and veteran columnist, died of a cerebral hemorrhage on Aug 7 in Washington DC, US.

Sowing the seeds of doubt

The presence in China of multinationals such as Monsanto and Pioneer is sparking controversy

Lifting the veil

Beijing's Palace Museum, also known as the Forbidden City, is steeped in history, dreams and tears, which are perfectly reflected in design.