Companies

Hutchison Whampoa's H1 profit misses estimates

Updated: 2011-08-05 13:21

By Mark Lee (China Daily)

|

|

|

Shoppers walk past a mobile-phone store of "3", a unit of Hutchison Telecommunications Hong Kong Holdings Ltd, on July 30. [Photo / Bloomberg] |

HONG KONG - Hutchison Whampoa Ltd, billionaire Li Ka-shing's biggest company, posted first-half profit that missed analysts' estimates after its Australian mobile-phone unit posted a loss, eroding higher earnings from utilities and energy investments.

Net income increased to HK$46.3 billion ($5.9 billion), or HK$10.86 a share, from HK$6.3 billion, or HK$1.48, a year earlier, the Hong Kong-based company said in a statement on Thursday. This missed the HK$51 billion median of five analysts' estimates in a Bloomberg News survey.

The setback in Australia renewed concerns about earnings at 3 Group, Hutchison's mobile-phone division that posted its first annual profit in 2010 after incurring $20 billion of losses over the previous seven years. Returns from Li's $9.5 billion acquisition of power networks in southeast England and higher oil prices lifted earnings.

"There was weakness in Australia," Adrian Lowe, an analyst at Mirae Asset Securities in Hong Kong, said before the announcement. Hutchison's strongest operations in the first half were infrastructure and energy, he said.

Hutchison shares fell 0.9 percent to HK$90.35 in Hong Kong trading on Thursday before the announcement. The stock has gained 13 percent this year, compared with the 5 percent decline in the Hong Kong benchmark Hang Seng Index.

The company plans to continue to invest and expand its business, Li said in the statement. Li said he's "confident" of the company's outlook in the second half.

Australian loss

3 Group, which operates 3G, or third-generation, mobile-phone services in seven markets in Europe and Australia, earned HK$767 million before interest and tax in the first half, compared with a loss of HK$998 million a year earlier.

Hutchison Telecommunications (Australia) Ltd had a loss of A$78.2 million ($83 million) in the first half, the Sydney-based unit reported this week, citing increased competition.

3 Group posted its first annual profit in 2010, seven years after starting services.

Cheung Kong Infrastructure Holdings Ltd (CKI), the roads and utilities arm of Hutchison, said last week that first-half profit almost doubled to HK$3.98 billion, after completing the 5.8 billion pound ($9.5 billion) purchase of the UK power networks of Electricite de France SA in October. This week, CKI said it plans to buy Northumbrian Water Group PLC for 2.4 billion pounds.

Husky Energy Inc, the oil producer part-owned by Hutchison, last week reported second-quarter net earnings more than tripled on higher margins.

Hutchison, with investments in ports, telecommunications, retail, property and energy in more than 50 countries, increased revenue to HK$112.3 billion from HK$97.8 billion, it said.

Bloomberg News

E-paper

My Chinese Valentine

Local businesses are cashing in on a traditional love story involving a cow herder and a goddess

Outdoor success

Lifting the veil

Allure of mystery

Specials

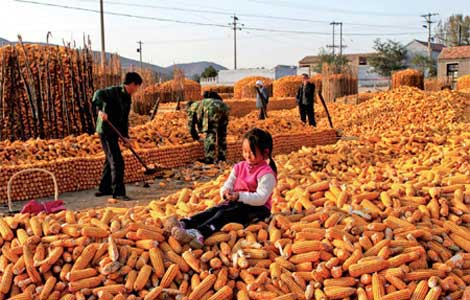

Sowing the seeds of doubt

The presence in China of multinationals such as Monsanto and Pioneer is sparking controversy

Lifting the veil

Beijing's Palace Museum, also known as the Forbidden City, is steeped in history, dreams and tears, which are perfectly reflected in design.

Beer we go

Early numbers not so robust for Beijing's first international beer festival