Rich Chinese buying up houses in Europe

Updated: 2011-01-21 10:39

By Andrew Moody and Yan Yiqi (China Daily European Weekly)

Kevin Green from Alamo International says he has a complete mix of clients from China, from the very wealthy to ordinary middle-class professionals. Feng Yongbin / China Daily |

"We already have one customer, a businessman, and he is in the process of making a decision on a castle, which costs 6 million euros," he says.

He believes it is a big potential market since there are no fewer than 40,000 castles in France, which can fetch anything from as low as 600,000 euros to 40 million euros.

"I think they will appeal to the Chinese because they have a very old culture just like France and the castles are part of that old culture.

"I don't think they are that expensive compared to a Beijing villa. People think they are expensive to maintain but that is not always the case."

London might have had gloomy gray January skies but James Moss was in an optimistic mood in his new Ives Street offices in fashionable Chelsea.

The managing director of Curzon Investment Property, which acts for a number of Chinese and Asian clients wanting to buy property in the city, believes soaring property prices in Shanghai, Beijing and also Hong Kong are driving the Chinese to invest in European property.

"I think a lot of Asian property is beginning to look very expensive. Just look at Hong Kong, where you have had 50 percent capital growth recently. You look at places like Vancouver also were Chinese have traditionally bought property. That has been a nightmare recently."

Moss, who also helps set up offshore financial vehicles through which clients can make their transactions, says Chinese and other Asian investors are not just buying very expensive properties.

"A lot of Chinese buyers are buying two or three smaller properties and then tucking them away. They are letting them out and the properties are paying their own way and they are regarding it as a long-term investment."

Moss insists there is a tendency for agents to go out to China to market property they can't sell in the UK and some unwary Chinese purchasers are falling for it.

"I think in a sense they are being ripped off. They are buying property they think is in a good location but is actually in a relatively deprived area like Lewisham in southeast London," he says.

|

Peter Illovsky markets luxury properties in locations such as Cannes and St Tropez. |

At the property showcase at the Ritz-Carlton Hotel in Beijing, Kevin Green managed to find a Chinese buyer for a 360,000-pound two-bedroom apartment near the Olympic village in east London for the 2012 London Games. He was selling the property for his agency Alomo International.

"The buyer was just back from London and he knows the value of the regeneration for the Olympics. He is in his 30s and worked in the City for a couple of years. As a result, he feels very comfortable with the rental opportunities. He is going to be getting a mortgage. It is not a cash purchase," he says.

Green says he has a complete mix of clients in China from the very wealthy to ordinary middle-class professionals.

"The people who come to us are not necessarily super rich. We have one lady who runs several companies in Shanghai and will come to us in London in February. Not everyone is a billionaire. We have some people who have some spare money who are just looking for investment opportunities."

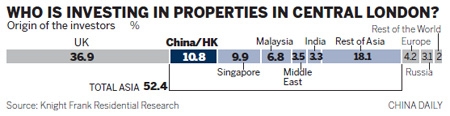

Warner at Knight Frank in London says his agency has sold 140 million pounds of new build property to Chinese and Southeast Asian buyers over the past year.

The agency, which has offices in Beijing, Shanghai and Guangzhou, is specifically targeting mainland investors and marketed a development in Croydon, just south of London, at an exhibition it held at the JW Marriott Hotel in Shanghai in October.

"We are planning to go to Beijing in the spring and we have many planned trips for Hong Kong," he says.

"China will be big for us in the future. There is a huge amount of money there and lots of people. If we can prize out another 10, 20 or 30 percent of sales on top of what we do already, it will be dramatic," he says.

Yang Yang contributed to this story.

Paper's Digest

Shaolin Kungfu

Shaolin Temple charts aggressive expansion plan to cash in on demand for kungfu.

Living 'IT' up

Father of pinyin

Touch and go

Specials

China Daily in Europe

China Daily launched its European weekly on December 3, 2010.

Hu visits the US

President Hu Jintao is on a state visit to the US from Jan 18 to 21.

Private Detective

Firms chart new strategies as tighter rules make information gathering tougher.