Rich Chinese buying up houses in Europe

Updated: 2011-01-21 10:39

By Andrew Moody and Yan Yiqi (China Daily European Weekly)

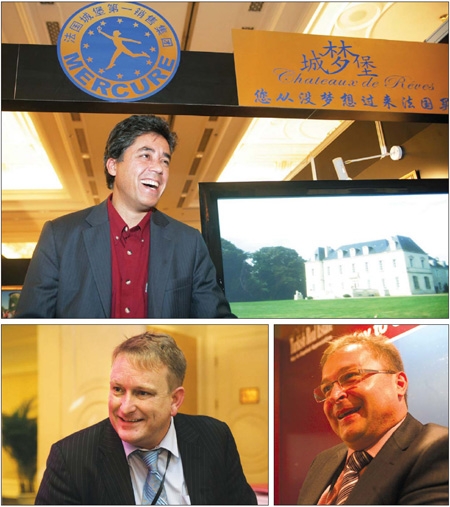

Top: Kim Truong, China president for Agency Mercure. Above left: Darren Lilley, managing director of Alamo International. Above right: Adnan M. Ozcolak, director of Turkish Real Estate. Feng Yongbin / China Daily |

Warner, who was speaking in Knight Frank's headquarters in Baker Street in central London close to where a lot of the Chinese property buying has been taking place, says it was the speed at which the Chinese made transactions that was often astounding.

"Generally with people from the UK, it can take weeks for them to make their mind up. People from the mainland take about a day. Those from Hong Kong are even quicker, usually about an hour."

For many Chinese investors the attraction of London as opposed to other parts of Europe is that they can buy property and live in the UK up to 90 days a year without being taxed on their worldwide income, taking advantage of the UK's non-domiciled tax rules.

Even though these rules have been tightened recently with a flat annual tax charge of 30,000 pounds (35,976 euros) a year being imposed on wealthy non-doms (people with an affiliation with another country), the tax status is still attractive to Chinese multi-millionaires.

According to agents, many of the buyers are looking to buy residences for their children at university in the London, often apartments worth 1 million pounds or more, which the parents can also make use of when they visit.

Some, however, are looking for trophy homes in some of the most luxurious developments, where penthouses and apartments can fetch more than 10 million pounds.

Daniel Knight, 35, a property developer in London, sold a two-bedroom garden apartment in St John's Wood on the northern edge of central London to a Chinese businessman for 995,000 pounds in November.

The property was viewed by his daughter, an art student in London, on a Saturday and her father came along on the Monday and wanted to buy it there and then. Normal property transactions in the UK take at least two months.

"I had to arrange for my solicitor to travel down from Doncaster (in northern England, around 270 kilometers north of London) by train for which he charged 800 pounds. He met with the purchaser's solicitors in Marylebone and an attendant exchange of contracts was completed in three hours on the Tuesday afternoon," says Knight.

Knight adds the purchaser, who worked for a major advertising company in China, paid in cash with the funds coming from Kuala Lumpur.

"All the agents here like Chinese buyers. They tend to be very decisive in their purchasing decisions unlike buyers from some other countries and domestic buyers."

Knight, who mainly develops apartments in the St John's Wood area, says he often develops his properties with Chinese buyers in mind.

"With the flat I sold to the Chinese businessman, the art student's mother was keen the feng shui of the property was right. She didn't like the fact the foot of the bed was pointed toward the door, which is the way a dead body would be carried out of the property. She was going to bring in a feng shui master after the sale was completed," he adds.

In China, properties from other parts of Europe were being offered to high net worth individuals at the Luxury Properties Showcase at Beijing's Ritz-Carlton Hotel over three days last month.

Peter Illovsky, an associate of Burger Sotheby's International Realty, who is based in Saint Jean Cap Ferrat on the Cote d'Azur was marketing luxury properties in such locations as Cannes and St Tropez.

He says selling property in France means battling against the tax advantages that the UK offers to the Chinese and other foreigners.

"In France, if you are resident for more than a month in any one year, you could have to pay tax on your worldwide income in France," he says.

Nonetheless he says he had had two Chinese clients buying property from him, both from Hong Kong.

"We are optimistic of selling more French properties to Chinese clients. We have more of a Russian tradition, however, and that is where many of our buyers come from. Many of the Russian writers used to live in France in the winter as did Tchaikovsky," he says.

"China is a big question mark for us. We are not expecting anything much within the next two years. The market is still very young."

A French estate agency which specializes in selling castles is more confident of attracting Chinese interest for its properties which often come with vineyards attached.

Agency Mercure, based in Toulouse in southwest France and which was formed in 1932, has sold 3,500 castles over the past 25 years.

Kim Truong, China president for the agency, set up an office in Beijing in July and has already had interest from wealthy Chinese.

Paper's Digest

Shaolin Kungfu

Shaolin Temple charts aggressive expansion plan to cash in on demand for kungfu.

Living 'IT' up

Father of pinyin

Touch and go

Specials

China Daily in Europe

China Daily launched its European weekly on December 3, 2010.

Hu visits the US

President Hu Jintao is on a state visit to the US from Jan 18 to 21.

Private Detective

Firms chart new strategies as tighter rules make information gathering tougher.