China's malls can withstand e-commerce: report

Updated: 2015-10-20 11:28

By AMY HE in New York(China Daily USA)

|

|||||||||||

Developers are still optimistic about building new malls in China despite the growth of e-commerce, though a report says the malls will have to feature new technologies and smart design to stay relevant.

With more than 4,000 new malls opening by the end of 2015, consumption by Chinese consumers is still strong despite the economy's slowdown, according to Michael Cole, author of China Mall 2020, published by re Mingtiandi, an independent source for news and information on China's real estate market, and Taubman Asia, a subsidiary of US mall developer Taubman Centers, which sponsored the report.

"China is uniquely positioned to build a modern, connected, and relevant retail real estate sector by 2020," wrote Cole, also executive editor at Mingtiandi. "China's malls of the future will be those that embrace powerful new technological capacities made for digital marketing and incorporate smart design elements to meet increasing consumer and retailer needs - differentiating the retail experience."

Despite China's slowing economy, retail sales doubled to 26.2 trillion RMB ($4.1 trillion) in 2014 from 15.7 trillion RMB ($2.5 trillion) RMB in 2010. Growth in consumption has primarily been driven by China's middle class, which by 2022 will be 76 percent of China's urban population, according to the report.

"This growth in spending and consumption has naturally led to rapid development of an increasingly sophisticated retail industry in China, first in the country's largest cities, and gradually expanding into lower-tier cities," according to the report. International luxury brands responded quickly to this demand, opening modern retail spaces and expanding in shopping centers, the author wrote.

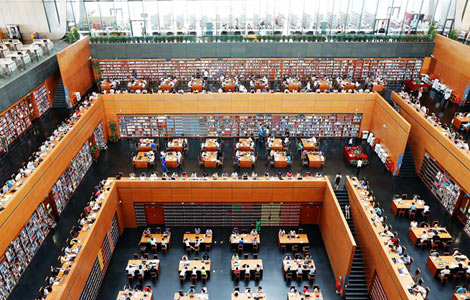

These demands for goods will lead to more retail spaces in China, which historically had a smaller number of stores per million Chinese (416) than compared to its counterparts in the US (3,620). In the last decade, the expansion of retailers has grown rapidly to appeal to an urban consumer class, but malls in China remain more "loosely organized and inefficient" than those in the US or Europe, the report found, but that can also mean more potential for improvement.

Despite China's booming e-commerce sector, consumers will have an ongoing need to interact with products and brands in the real world, the report said, and retailers are expected to expand their physical stores despite e-commerce. They need to design stores and spaces that incorporate digital technology, and allow customers, for example, to buy products online and pick them up in stores.

Taubman Asia has two projects in development in China: one in Xi'an is to open in spring 2016 and one in Zhengzhou twill open later next year, according to Taubman Asia president Rene Tremblay. "But we are always open to the right opportunities," he wrote in an e-mail.

Tremblay told Bloomberg News recently that Taubman Centers is aiming to open shopping malls in second-tier cities in China as opposed to cities like Beijing and Shanghai because potential returns are higher. Taubman Centers, founded in 1950 by the late real estate mogul Alfred Taubman, has the highest-selling collection of malls in the United States.

"Physical store presence is as important as ever. The increasing demand of social, entertainment and cultural experiences, as well as the improved spending power among consumers, are channeling the majority of sales for retailers through physical stores," Tremblay told China Daily.

"What is more, the increasing demand of social and cultural experiences is a good push for shopping malls to evolve from purely shopping destinations to a public space for the Chinese consumers," he added.

The Financial Times reported in June that according to a recent report by CBRE, the real estate consultancy, 44 per cent of all global shopping market completions last year were in China, home to nine out of the top 10 top cities for mall space under construction.

But Jones Lang LaSalle, the real estate services company, predicts that mall development could peak between now and 2017, because the expected return on investment has fallen, the newspaper reported.

"Developers...are not rushing to start projects like they used to," said Steven McCord, head of research for North China, he told the FT. "Returns...?have softened because sales growth rates have slowed. Malls are facing competition from three sources: online, overseas and outlets".

Still, good-quality shopping malls remain in high demand. "There are so many shopping malls but so few good ones", says Ke Chen, a Shanghai-based partner of retail consultancy Kurt Salmon.

amyhe@chinadailyusa.com

Today's Top News

Xi touches down in London

UK hailed for closer relations with China

Chinese president leaves for visit to Britain

UK visit to set course for ties, says Xi

Full text of Reuters' Q&A with Chinese President Xi

Students talk of hopes for Xi's visit

Royal family to gather in strength for Xi

Xi pledges stronger support to rid all Chinese poverty

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|