Experts discuss China economic future

Updated: 2015-02-04 16:37

By MAY ZHOU in Houston(China Daily USA)

|

|||||||||||

|

|

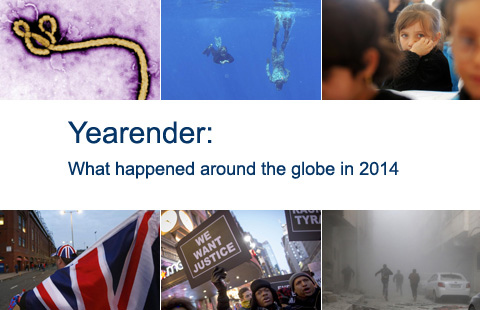

From left: Asia Society Texas Center Chairman Charles Foster introduces Martyn Goossen, president of JPMorgan Chase Bank-Houston Region; Nicolas Lardy, senior fellow at the Peterson Institute for International Economics;Barry Naughton, professor or Chinese economy and chairman of international affairs at the University of California-San Diego; andOral Dawe, founder, chairman and CEO of Dawe Holdings during an event at the Asia Society Texas Center in Houston on Monday. May Zhou / China Daily USA |

China has 18 percent of the world's population, so what happens in China doesn't stay in China anymore; it's a global matter, said a Houston banker.

Martyn Goossen, president of JPMorgan Chase Bank-Houston Region, made the remark as scholars and industry experts gathered at the Asia Society Texas Center in Houston on Monday to discuss China's economic trends, its deepening economic reforms and its position in the world economy.

"China has been negotiating the beginning of a long period of slowdown from previous miraculous growth to a more moderate growth pace, say 6 percent," said Barry Naughton, professor of Chinese economy and chairman of international affairs at the University of California-San Diego. "This is still a healthy growth rate, but history tells us the slowdown is a very difficult period."

Nicolas Lardy, a senior fellow at the Peterson Institute for International Economics, was more optimistic about China's economic prospects. China's private sectors are playing an ever more important role by contributing the most to economic growth, creating the most jobs, and providing more than half of exports, he said.

According to Lardy, there are 1.6 million private enterprises in China, and more than 13 million jobs were created in the private sector last year.

"Why is the private sector growing so fast?" Lardy asked.

"Simply because it's more efficient and has better ROI (return on investment)," he said. "Taking ROI into consideration, state-owned enterprises are actually a drag on growth. If the current reform works out as they talked about, I think the growth will be relatively strong for the next five years."

Naughton believes that China wants to redeem 200 years of national humiliation and become a superpower at least as strong as the US.

Lardy believes that China is mostly driven by domestic agendas.

"Improving the standard of living, providing more efficient public services such as healthcare and education will be what keeps the government in power, and that's their focus," he said.

Oral Dawe, founder, chairman and CEO of Dawe Holdings, which has business in China, echoed Lardy's view. "Globally, China wants a seat at the table, not to be pushed around, but it's driven rather by domestic not international issues," Dawe said.

China's financial structure, labor force, real estate, fiscal policy, anti-corruption drive and other topics also were discussed.

Goossen said over the last 30 plus years, China has gone through a transformation no other country has seen in that short period of time. "But it's not complete; there's still a lot of future to be seen,"Goossen said.

mayzhou@chinadailyusa.com

Related Stories

China economy to grow 7.3 pct in 2015: expert 2015-01-17 20:17

China economy still faces a long march 2014-09-30 10:16

China Economy by Numbers - December 2014-04-30 16:13

Today's Top News

China: Norway violates rights of Chinese scholar

Italy extradites suspect in theft

A great future for UK-China business relationship

Former IMF chief Strauss-Kahn on trial over pimping charges

Business leaders push for deeper China-EU economic ties

US taking 'fresh look' at weapons for Ukraine

New regional system set up

EU Parliament evacuated as police check suspicious car

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|