China's lonely fight against deflation risk

Updated: 2016-03-08 08:23

By ANDREW SHENG/XIAO GENG(China Daily)

|

|||||||||

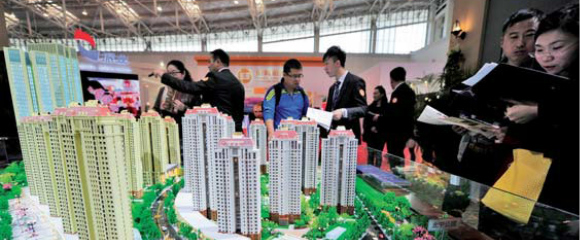

In the face of today's deflationary forces, however, real engineers in the world's major economies have been unwilling or unable to reflate. The United States, the world's largest economy, will not use fiscal tools to that end, owing to domestic political constraints. Europe's unwillingness to reflate reflects Germany's deep-seated fear of inflation (which underpins its enduring commitment to austerity). Japan cannot reflate because of its aging population and irresolute implementation of Prime Minister Shinzo Abe's economic plan, so-called Abenomics. And China is still paying for the excessive reflation caused by its 4 trillion-yuan ($586-billion) stimulus package in 2009, which added more than 80 trillion yuan to its own debt.

The consequences of financial engineering are intensifying. Zero and negative interest rates have not only encouraged short-term speculation in asset markets and harmed long-term investments; they have also destroyed the business model of banks, insurance companies, and fund managers. Why should savers pay banks or fund managers 1-2 percent intermediation costs when prospective returns on investments are zero? A system in which financial intermediaries can increase profits only by increasing leverage-sustainable only by increasing quantitative easing-is doomed to fail.

Indeed, in hindsight, it seems clear that financial engineers outperformed the real economy only with the support of super-financial engineers-that is, central banks. Initially, balance sheet expansion-by $5 trillion since 2009-provided banks with the cheap funding they needed to avoid failure. But bank deleveraging (brought about by stiffer regulatory requirements), together with negative interest rates, caused financial institutions' equity prices to fall, leading to further pro-cyclical destruction of value through price deflation, increasing illiquidity and crowded exits.

Experience has taught China's real engineers that the only way to escape deflation is through painful structural reforms-not easy money and competitive devaluation. The question is whether the US and other reserve-currency countries will share the burden of maintaining global currency stability, through an agreement resembling the 1985 Plaza Accord, in which five major economies agreed to depreciate the US dollar against the Japanese yen and the German Deutsche Mark. If not, why would Asia's net lenders, especially China, continue funding speculation against themselves?

The US dollar is a safe haven, but savers in need of liquidity still lack an impartial lender of last resort. Depositing in reserve currencies at near-zero interest rates makes sense only if the banker is not funding financial speculation against the depositor. But, as it stands, financial engineers have a lot of freedom; indeed, if they are big enough, they can't fail or, apparently, even go to jail.

China's G20 presidency this year offers an important opportunity to emphasize that the stability of the yuan is important not only for China, but also for the global financial system as a whole. If the US dollar enters into another round of revaluation, the only winners will be financial engineers.

Andrew Sheng is distinguished fellow of the Asia Global Institute at the University of Hong Kong and a member of the UNEP Advisory Council on Sustainable Finance, and Xiao Geng, director of the IFF Institute, is a professor at the University of Hong Kong and a fellow at its Asia Global Institute.

Project Syndicate

Related Stories

Deflation risks prompt more stimulus measures 2015-09-11 10:54

China sees consumer inflation, producer deflation in 2015 2016-01-09 17:42

Monetary policies helping to ease threat of deflation 2015-08-04 14:27

Inflation eases, but deflation risks rise 2015-06-10 07:17

Today's Top News

Inspectors to cover all of military

Britons embrace 'Super Thursday' elections

Campaign spreads Chinese cooking in the UK

Trump to aim all guns at Hillary Clinton

Labour set to take London after bitter campaign

Labour candidate favourite for London mayor

Fossil footprints bring dinosaurs to life

Buffett optimistic on China's economic transition

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|