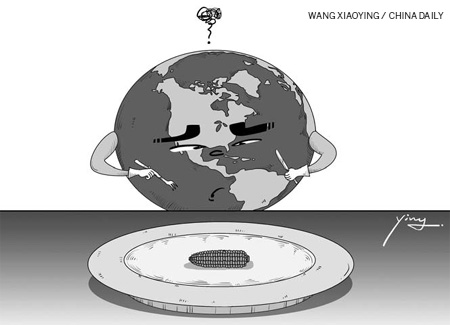

Food supply not keeping pace with demand

Updated: 2011-10-14 15:33

By Gerard Lyons (China Daily)

|

|||||||||

World Food Day is observed each year on Oct 16. This date commemorates the founding of the Food and Agriculture Organization of the United Nations in 1945. This year the theme of World Food Day is "Food Prices: from crisis to stability". Rarely could the subject have been more relevant for economies and people across the globe.

According to the UN, world food prices surged to an all-time high in February. Even though many items have fallen in price since then, food prices are still high and have doubled over the past five years. The trend for food prices is clearly up.

Demand is rising. Supply is not keeping pace. Several factors explain this worrying development. One positive is that as emerging economies grow, more people are moving out of poverty, finding jobs and are able to feed themselves or spend more on food.

As they do, families are changing their diets because they have access to a greater variety of foods. Rising demand for meat is just one example. Global food consumption per person has risen on average by one fifth since the 1960s.

The trouble is not everyone has been prepared for this. There are widespread concerns about dwindling crop yields and greater scarcity of fertile land. These concerns are not eased by infrastructure development and rapid urbanization.

There is still much that needs to happen to eradicate poverty, find jobs and see living standards rise. As this happens, food demand is likely to keep rising. The world's population is expected to rise from 7 billion to 9 billion by 2050. Food demand is likely to rise, in both quantity and quality.

What needs to happen to meet this challenge? Many things. There is likely to be a price, quantity and technology response. The price response has already been evident as food prices rise. This is a concern as the poorest spend a greater proportion of their income on food, and they are least able to cope with higher prices. In some rapidly growing economies, rising food prices can feed general inflation, explaining why many central banks have been tightening policy. World Food Day will have rising food prices at centre stage.

The World Bank recently highlighted high rates of malnutrition among young children in India and parts of Africa. But many countries have issues. For instance, Vietnam, the Philippines and China are among the countries in East Asia that are vulnerable to food price inflation.

Throughout this year, the Group of 20 major economies has been seeking ways to curb speculative activity from pushing commodity prices higher. This issue still needs to be addressed.

Perhaps the most interesting questions are whether supply can respond and how technological progress can help. There is cause for optimism.

It is only in recent years, as prices have risen and prospects for emerging economies have improved, that the need and the potential to boost supply has grown in prominence. Admittedly it is not just about food. Supply of energy and metals has also attracted attention. There is now a desire from the private sector to invest more in commodity producing countries. There are many winners in this. Just look at the increased interest and investment in sub-Saharan Africa in recent years.

No one should under estimate how much needs to be done. For instance, global cereal production may need to rise by 40 percent by 2050. That is a big increase, particularly as the use of biofuels has the potential of worsening the demand-supply balance. Excluding biofuels, much of the increase in cereals demand will be for animal feed to support the growing consumption of livestock products.

Finally, there is the importance of technology. The world needs a second "Green Revolution", similar to the one that led to the advances in crop production seen in the 1960s. There needs to be another leap in technology to boost crop yields and output.

The significance of this should not be overlooked. For example, in recent years, corn and rice yields have slowed sharply. In the future, perhaps as much as four-fifths of the increased output may come from intensification of cropping rather than from increases in arable land.

No one really knows how much needs to be invested, but it is huge. The UN believes $10 trillion will need to be invested in agricultural infrastructure, and research and development by 2050 to ensure sufficient food supplies. It may turn out to be much more than this, as there are so many complexities. One is the need to ensure more efficient use of water. Technology can certainly make progress here. Just take Australia's increased water efficiency for irrigation. Other economies with a water shortage are making progress. Singapore is just one example. Some water-deficient countries are seeking to import crops that need large amounts of water. The Middle East is one such region.

Agriculture consumes around 70 percent of all fresh water available globally, and 82 percent in low and middle-income countries. While water use has increased sharply, its efficiency has barely improved.

Across some countries, where subsistence some net food-importing countries, such as the Philippines, Burkina Faso and Senegal farmers hope to gain, there is concern about the future of genetically modified foods. Yet, across, GM crops are seen as an important part of reducing import needs and boosting crop yields. It is a complex area meriting further research and investment.

Overall, global demand for food will continue to rise. With World Food Day focusing attention on the need for stable food prices, this should turn attention to the need to invest in new supply and to search for technological advances.

The winners from the current shift in the balance of power affecting the world economy will be those countries that have the cash, the creativity or the commodities. Food producers should be at the forefront of the winners from commodity rich countries.

The author is chief economist at Standard Chartered Bank.