Italian yield rises after bond auction

Updated: 2011-11-15 07:55

(China Daily)

|

|||||||||

5-year, 10-year spreads with German bunds expand to near record highs

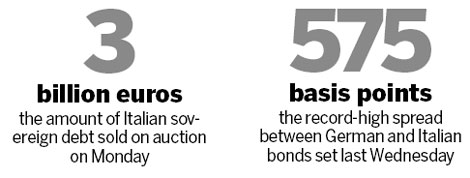

LONDON - Italian bonds fell for the first time in three days after the nation paid the highest yield since June 1997 at a 3-billion-euro ($4.1 billion) debt sale on Monday, highlighting the challenge facing the new government to win over investors.

Spanish government securities also slid as European Central Bank Governing Council member Jens Weidmann suggested the central bank should end its support of the region's most indebted nations.

Europe's banks need to sell more Italian bonds to avoid being sucked into the debt crisis, said Christian Clausen, president of the European Banking Federation. German bunds rose after eurozone industrial production fell the most in two-and-a-half years, spurring demand for safer investments.

"Despite the Italian auction's success, it seems the investor community is preparing for further setbacks," said David Schnautz, a fixed-income strategist at Commerzbank AG in London. "Seeing yields above 7 percent last week did a lot of damage and there will be a lot of pending desire to offload here. The demand for safe-haven assets is on the front foot."

The 10-year Italian yield rose 21 basis points, or 0.21 percentage point, to 6.66 percent at 12:38 am London time. The 4.75 percent security due September 2021 fell 1.32, or 13.20 euros for each 1,000-euro face amount, to 87.140.

Italy's Treasury sold 3 billion euros of notes due in September 2016 at a yield of 6.29 percent, the highest since June 1997 and up from 5.32 percent at the previous auction on Oct 13. Demand increased to 1.47 times the amount on offer, from 1.34 times last month.

Boost confidence

Former European Union Competition Commissioner Mario Monti accepted the opportunity to head a new government on Monday, aiming to boost confidence in the nation's ability to cut its debt levels.

The difference in yield between 10-year Italian and German bonds expanded by 30 basis points to 486 basis points. It reached a record 575 basis points last Wednesday.

Spain's 10-year yield climbed 13 basis points to 5.98 percent, widening the spread over German bunds by 23 basis points to 419 basis points.

"The co-option of monetary policy for fiscal needs must come to an end," Weidmann said on Monday in a speech at a conference in Frankfurt. The increasing pressure on the ECB to act "lessens the imperative" on leaders to implement the necessary measures, he said.

Italian bonds declined even as the European Central Bank was said to buy the securities on Monday, according to two people familiar with the transactions who declined to be identified because the deals are confidential.

Bunds gain

German bunds snapped a two-day decline after the European Union's statistics office said production in the 17-nation eurozone dropped 2 percent in September from August, when it increased 1.4 percent. The 10-year yield fell 10 basis points to 1.79 percent.

Bunds have returned 8.3 percent this year, compared with 8.8 percent for US Treasuries, according to indexes compiled by Bloomberg and the European Federation of Financial Analysts Societies. Italian bonds have lost 7.2 percent.

Slovakia accepted no bids from investors at a sale of five-year notes on Monday.

Bloomberg News