Japan cautious over euro rescue vehicle

Updated: 2011-11-01 07:36

(China Daily)

|

|||||||||

|

European Financial Stability Facility (EFSF) Chief Executive Klaus Regling at a news conference in Beijing on Friday. His trip to secure pledges of money for the fund comes ahead of a G20 leaders' summit this week in France. [Nelson Ching / Bloomberg] |

TOKYO - Japan told the head of Europe's bailout fund on Monday that it would continue to buy its bonds, but, like fellow potential investor China, did not commit to putting cash into a mooted special purpose vehicle to enhance the rescue fund's firepower.

Other potential buyers, such as Brazil and Russia, have indicated they are willing to support the eurozone either through the International Monetary Fund (IMF) or bilateral talks with individual member countries.

European Financial Stability Facility (EFSF) Chief Executive Klaus Regling was in Tokyo after courting China over the weekend.

His trip comes ahead of a G20 leaders' summit in France on Thursday and Friday that policymakers hope will secure pledges of more money to help resolve the bloc's debt crisis.

Europe is looking to countries with big foreign exchange reserves, such as China, Japan and major emerging economies, to provide the extra financial firepower to strengthen the fund by four to five times, to about 1 trillion euros ($1.4 trillion).

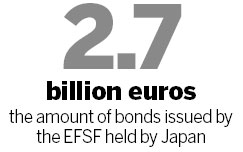

Japan is already the biggest holder of EFSF bonds outside of the eurozone bloc and Tokyo has in the past indicated it would be willing to buy more, but first it wanted to see Europe taking decisive steps to contain its sovereign debt crisis.

"The Japanese government will continue to buy the EFSF bonds that we have been issuing over the last 10 months and we will continue to be in contact about future operations," Regling told reporters after a meeting with Takehiko Nakao, Japan's vice-finance minister for international affairs.

Regling had tried to entice Beijing to invest by saying investors may be protected against a fifth of initial losses and that bonds could eventually be sold in yuan if Beijing desires.

China has powerful reasons to contribute, including supporting the recovery of its single biggest export market and protecting the value of the 600 billion euros of eurozone sovereign debt it already holds, but Regling's pitch drew a cautious response from Beijing.

|

China's careful stance was underscored on Friday by Vice-Finance Minister Zhu Guangyao, who said Beijing was awaiting details on new investment options for the EFSF before deciding its next move.

EFSF chief Regling traveled to Asia after European leaders on Thursday struck a hard-fought accord aimed at tackling the two-year crisis that has already required financial rescues of Greece, Portugal and Ireland.

A key element of the agreement is to leverage the EFSF to 1 trillion euros, though Europe has yet to work out the details and European governments remain wary of pledging more money.

Market economists have been calling for a rescue fund with twice the resources under discussion in Brussels, and the deal failed to ease bond market pressure on major economies Italy and Spain.

One idea for boosting the fund is to offer insurance, or first-loss guarantees, to those buying eurozone debt in the primary market.

Another is to set up a special purpose investment vehicle (SPIV) aimed at attracting investment from cash-rich emerging powerhouses such as China and Brazil.

Japan holds about 2.7 billion euros, or 20 percent, of the total bonds issued by the EFSF after it purchased them in January and June. But it is not clear whether it would be interested in investing some of its $1.2 trillion in currency reserves in the new special vehicle.

Brazil has given a cautious response to buying EFSF bonds in the future, saying it needs more information about the SPIV. The South American country is willing to help the eurozone through a bilateral agreement with the IMF, a senior government source said on Friday.

Russia is also ready to support the bloc, but through bilateral talks with eurozone members or the IMF, the Kremlin's top economic adviser, Arkady Dvorkovich, said on Monday.

Beijing, which holds the world's largest foreign exchange reserves of some $3.2 trillion, has expressed confidence that Europe can overcome the debt crisis, but has made no public offer to buy more European government debt.

Reuters