Spain's deficit woes exacerbated by slow economic growth

Updated: 2011-10-26 07:55

(China Daily)

|

|||||||||

MADRID - Spain will struggle to meet its deficit-reduction target this year as economic growth slows, threatening further debt-crisis contagion as Europe fails to erect a fail-proof firewall.

"They will never make it," said Ludovic Subran, chief economist at credit insurer Euler Hermes SA in Paris.

"Our September forecast sees Spain's deficit at 7 percent" of GDP this year, he said, adding that the prediction was made before the nation's credit rating was cut this month.

European leaders ruled out tapping the European Central Bank's (ECB) balance sheet to boost the region's rescue fund during a summit in Brussels over the weekend.

The government has aimed for a deficit equal to 6 percent of GDP this year, down from 9.2 percent in 2010. Data on the deficit for the first nine months of 2011 will be published sometime this week.

European leaders' failure to end the debt crisis risks "a vicious circle" in which "deficit reduction weighs on growth, rendering targets unachievable and triggering more downgrades, eventually leading" to default, said Angel Laborda, chief economist at savings-bank foundation Funcas in Madrid.

Policymakers must ensure that eurozone nations' debt will be repaid even without growth, he said.

|

At the Brussels summit, Germany defeated French efforts to enable the region's rescue fund, the European Financial Stability Facility (EFSF), to borrow potentially limitless sums from the ECB. Policymakers may use the 440-billion-euro ($610 billion) EFSF to guarantee government-bond sales as a way to extend its reach.

"There is insufficient firepower to meet all the potential liquidity needs," David Mackie, chief European economist at JPMorgan Chase & Co, said of the proposed EFSF enhancements in an Oct 18 note to investors.

With the region's highest jobless rate of 21 percent crimping household spending, Spain's economy slowed in the second quarter, expanding 0.2 percent, compared with 0.4 percent in the first three months of 2011. Quarterly growth will remain at levels similar to the April-June period for the rest of 2011, Prime Minister Jose Luis Rodriguez Zapatero said on Sept 14.

The International Monetary Fund predicts an economic expansion of 0.8 percent this year. The government says it may miss a 1.3 percent target for growth in 2011, when it expects debt will rise to 67 percent of GDP, almost double the 2007 level.

While the European Union said on Monday that Spain is on track to meet its deficit goal for 2011, economists are revising their predictions to reflect dwindling Spanish tax revenue, rising borrowing costs, and fiscal slippage in the semi-autonomous regions and in the social-security system.

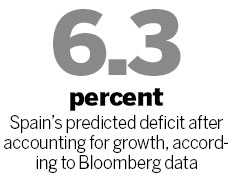

Euler Hermes based its deficit forecast on a growth estimate of 0.7 percent after taking into account Spain's austerity efforts in August. Bank BBVA and Intermoney Valores changed their estimates to 6.5 percent from 6 percent, while Moody's Investors Service expects a gap of 6.5 percent in 2011 and 5.2 percent next year, compared with the government's 4.4 percent goal. Economists surveyed by Bloomberg News predict 6.3 percent, according to the median of 10 predictions.

Spain's region of Castilla-La Mancha was cut five levels to junk on Oct 20 by Moody's, which also downgraded nine other regions on "growing liquidity pressures" and difficulties "reining in their cost base".

Social security, forecast to post a surplus of 0.4 percent of GDP this year, also is coming under pressure with joblessness jumping the most since January in September.

The system "is the main risk for Spain's public deficit", said Luis de Guindos, who served in several roles including as deputy finance minister in former prime minister Jose Maria Aznar's Peoples Party-led government.

"Missing the deficit target would destroy private-sector demand for your bonds," said Harvinder Sian, an interest-rate strategist at Royal Bank of Scotland Group PLC in London. "If you start seeing big figures like 7 percent, then it's very problematic."

Bloomberg News