Economy

S&P cuts Italy's credit rating

Updated: 2011-09-21 07:48

(China Daily)

|

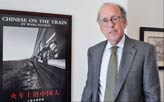

Silvio Berlusconi (left), Italy's prime minister, and Giulio Tremonti (right), the finance minister. The country follows Spain, Ireland, Portugal, Cyprus and Greece as euro-region countries in having its credit rating cut this year. [Alessandra Benedetti / Bloomberg] |

ROME - Italy's credit rating was cut by Standard & Poor's (S&P) on concern that weakening economic growth and a "fragile" government mean the nation won't be able to reduce the euro-region's second-largest debt burden.

The rating was lowered to A from A+, with a negative outlook, S&P said in a statement. The company said Italy's net general government debt is the highest among A-rated sovereigns, and the rating agency now expects it to peak later and at a higher level than it previously anticipated.

S&P also said it lowered its outlook for Italy's annual average growth to 0.7 percent for 2011 to 2014, from a prior projection of 1.3 percent.

"We believe the reduced pace of Italy's economic activity to date will make the government's revised fiscal targets difficult to achieve," it said. "Italy's economic growth prospects are weakening and we expect that Italy's fragile governing coalition and policy differences within the parliament will continue to limit the government's ability to respond decisively to domestic and external macroeconomic challenges," S&P said.

Italy follows Spain, Ireland, Portugal, Cyprus and Greece as euro-region countries in having its credit rating cut this year.

In a bid to calm markets, Prime Minister Silvio Berlusconi's office insisted in a statement on Tuesday it had a solid majority in parliament, which recently passed measures to get a tighter grip on the public finances through a package of tax increases and budget cuts.

It said the government was working on growth measures and had pledged to balance the budget by 2013.

S&P's evaluation, the government said in a statement, "seems dictated more by behind-the-scenes reports in newspapers than reality and seems contaminated by political considerations". It said the fruits of its growth and austerity plans "will be seen in the near-medium term".

Berlusconi passed a 54-billion-euro ($73 billion) austerity package this month that convinced the European Central Bank to buy its bonds after borrowing costs surged to euro-era records in August.

Italy's government debt was 119 percent of GDP last year, more than any euro country after Greece.

Unlike Ireland and Portugal, which followed Greece in seeking bailouts from the European Union and the International Monetary Fund, Italy until July had managed to skirt the worst of the fallout from the debt crisis.

While its budget gap was 4.6 percent of GDP in 2010, lower than France and Germany, debt will reach 120 percent this year.

Italy's economy expanded an average 0.2 percent annually from 2001 to 2010, compared with 1.1 percent in the euro area. GDP rose 0.3 percent in the second quarter from the three months through March, when it grew 0.1 percent, the national statistics institute said on Sept 9.

With austerity in the pipeline, "we now expect the economy to contract in 2012 and 2013", Ben May, an economist at Capital Economics Ltd in London, wrote in a Sept 9 note.

Berlusconi has pushed through two packages of deficit cuts since mid-July totaling about 100 billion euros. Measures included raising the value-added tax (VAT) by one percentage point to 21 percent and a levy on incomes of more than 300,000 euros to balance the budget by 2013.

Borrowing costs began rising again as the government diluted the package. That prompted Berlusconi to revise the plan, introducing the increase in the VAT, raising the levy on high earners and lifting the retirement age for women.

The government's first budget package approved in May wasn't enough to convince S&P that Italy will be able to reduce its debt. The rating company said on July 1 that even with the budget cuts, there's a "one-in-three likelihood that the ratings could be lowered within the next" two years because anemic economic growth would undermine fiscal goals.

Bloomberg News-AP

E-paper

The snuff of dreams

Chinese collectors have discovered the value of beautiful bottles

Perils in relying on building boom

Fast forward to digital age

Bonds that tie China. UK

Specials

Let them eat cake

Cambridge University graduate develops thriving business selling cupcakes

A case is laid to rest

In 1937, a young woman'S body was found in beijing. paul french went searching for her killer

Banking on change

Leading economist says china must transform its growth model soon