Economy

Bond-buying program shores up European markets

Updated: 2011-08-08 17:36

(Agencies)

A pledge from the European Central Bank to support the shaky bonds of Italy and Spain helped calm investor nerves in Europe Monday despite big losses in Asia following the downgrade of US debt by Standard & Poor's.

Though Europe's main markets in London, Paris, and Frankfurt were trading lower, albeit modestly, the exchanges in Milan and Madrid were posting sizable gains as the borrowing costs for both Italy and Spain plunged to more manageable levels after the European Central Bank said it would buy the two countries' bonds in order to help them avoid devastating defaults.

Late Sunday, Europe's central bank said it would "actively implement" its bond-buying program to calm investor concerns that Italy and Spain won't be able to pay their debts. Last week, worries over the two countries' ability to keep tapping bond markets contributed to the turmoil in global markets, which saw around $1.5 trillion wiped off share prices.

Seeking to avert panic spreading across financial markets, the finance ministers and central bankers of the Group of 20 industrial and developing world also issued a joint statement Monday saying they were committed to taking all necessary measures to support financial stability and growth.

"We will remain in close contact throughout the coming weeks and cooperate as appropriate, ready to take action to ensure financial stability and liquidity in financial markets," they said.

For now the proclamations appear to have stemmed the selling tide, which has gripped global markets over the past couple of week. And in the case of Italy and Spain, the pledges of support have sharply reduced the two countries' market borrowing costs and helped their stock markets push ahead. Milan's FTSE MIB was up 2.3 percent, while Spain's rose 2.6 percent.

That relief helped stem the losses elsewhere, especially in comparison to last week when stock markets suffered their worst week since the aftermath of the collapse of US investment bank Lehman Brothers in 2008. Britain's FTSE 100 index of leading British shares was down 0.1 percent at 5,241 while France's CAC-40 fell 0.2 percent to 3,292. Germany's DAX was 0.7 percent lower at 6,193.

"There seems to be a bit of a relief rally but to be honest investors are still cautious," said Neil MacKinnon, global macro strategist at VTB Capital. "This is a short-term band-aid."

The longer term issues that have dogged markets of late remain, MacKinnon said, notably the fear that the global economy is heading towards a double-dip recession and that a number of banks is heavily exposed to potentially bad debt across the eurozone.

Though European stocks have managed to eke out gains Monday, Wall Street is still expected to open lower later in its first session following Standard & Poor's historic decision to downgrade the US's rating for the first time ever.

So far, the downgrade doesn't seem to be having too much of an impact on US government bonds, known as Treasuries. The worry has been that the downgrade would prompt investors to demand more, but the yield on ten-year Treasuries has actually fallen.

"Early market reactions suggest that the treasury market will remain well supported," said Jane Foley, an analyst at Rabobank International. "Even though there may be no sharp sell-off in treasuries this week, S&P's decision should at least provide a signal to the US government that it may be foolhardy to continue to take its creditors for granted indefinitely."

Earlier in Asia, the repercussions of S&P's downgrade weighed on stock markets.

Among the major markets, the Shanghai Composite Index fell 3.8 percent as did South Korea's Kospi. Japan's Nikkei 225 stock average closed down 2.2 percent 9,097.56, while Hong Kong's Hang Seng fell the same rate to 20,490.50.

E-paper

My Chinese Valentine

Local businesses are cashing in on a traditional love story involving a cow herder and a goddess

Outdoor success

Lifting the veil

Allure of mystery

Specials

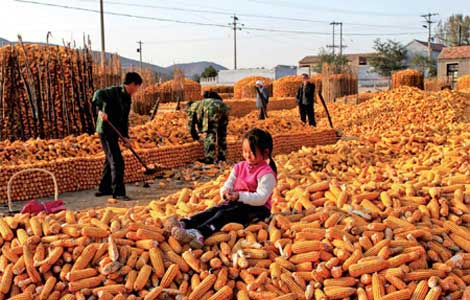

Sowing the seeds of doubt

The presence in China of multinationals such as Monsanto and Pioneer is sparking controversy

Lifting the veil

Beijing's Palace Museum, also known as the Forbidden City, is steeped in history, dreams and tears, which are perfectly reflected in design.

Beer we go

Early numbers not so robust for Beijing's first international beer festival