Politics

ECB to buy eurozone bonds to curb debt crisis

Updated: 2011-08-08 08:44

(Xinhua)

BERLIN - The European Central Bank (ECB) held a conference call late on Sunday ahead of the market opening, pledging the ECB will step in to buy eurozone bonds with efforts to forestall the euro zone's debt crisis from spreading.

The ECB said it will actively implement its plan to buy bonds issued by eurozone governments on the secondary markets in bids to curb the debt crisis.

The ECB welcomed Italian and Spanish announcement on fiscal and structural reforms and commitment of eurozone countries to contribute efforts to alleviate the impact of the debt crisis.

It is fundamental for member states to "activate European Financial Stability Facility (EFSF) in the secondary market" if ECB recognizes the existence of "exceptional financial market circumstances and risks to financial stability," said the ECB in a statement.

The ECB has, after considering the current situations, decided to "actively implement its Securities Markets Program" to "ensure price stability in the euro area," it said.

It is anticipated that the ECB's actual purchase of problematic eurozone bonds would likely prompt a considerable relief on global markets.

The finance ministers and central bankers of the G7 member states -- Britain, Canada, France, Germany, Japan, Italy and the United States -- were expected to talk before the financial markets open in Asia at 0000 GMT on Monday.

Germany's Der Spiegel and other journals has been anticipating a "Black Monday" on the markets, in the wake of world leaders' flurry of meeting of phone calls.

German Chancellor Angela Merkel and French President Nicolas Sarkozy issued a joint statement on Sunday, expressing their "commitment" to the full implementation of the measures agreed on eurozone debt at a summit in July.

"In particular through the following instruments: a precautionary program, finance recapitalization of financial institutions and to intervene in secondary markets on the basis of an ECB analysis," the statement said.

They welcomed budget reform plans in Spain and Italy, saying "complete and speedy implementation of the announced measures is key to restoring market confidence."

However, former British Prime Minister Gordon Brown was sharply critical of the mishandling of the spiralling debt crisis, saying that last month's eurozone summit was "yet another European chance of recovery thrown away."

"No number of phone calls can solve what is a financial, macroeconomic and fiscal crisis rolled into one," Brown said to tell the Independent on Sunday newspaper, that "Europe needs a radical restructuring of both Europe's banks and the euro."

"Every time the big questions are avoided, and every time the outcome is a patchwork compromise, the next crisis gets ever closer and threatens even more danger," the former prime minister and finance minister said.

E-paper

My Chinese Valentine

Local businesses are cashing in on a traditional love story involving a cow herder and a goddess

Outdoor success

Lifting the veil

Allure of mystery

Specials

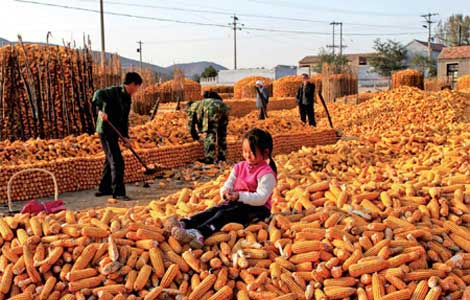

Sowing the seeds of doubt

The presence in China of multinationals such as Monsanto and Pioneer is sparking controversy

Lifting the veil

Beijing's Palace Museum, also known as the Forbidden City, is steeped in history, dreams and tears, which are perfectly reflected in design.

Beer we go

Early numbers not so robust for Beijing's first international beer festival