Economy

Euro zone approves further 12b euros for Greece

Updated: 2011-07-03 07:40

(Agencies)

BRUSSELS - Euro zone finance ministers agreed on Saturday to disburse a further 12 billion euros ($17.4 billion) to Greece and said the details of a second aid package for Athens would now be finalised by mid-September.

After a conference call, the 17 euro zone ministers agreed that the fifth tranche of a 110-billion-euro bailout agreed with Greece in May 2010 would be paid by July 15, as long as the IMF's board signs off when it meets on July 8.

| ||||

Greece's finance minister said he expected it to be ready by mid-September, rather than July 11, as some had foreseen.

Between now and September, the ministers said they would work on the "precise modalities and scale" of the private sector's involvement in the second aid programme, which Germany hopes will eventually total around 30 billion euros.

"The work on a necessary new programme for Greece is continuing at a high pace," German Finance Minister Wolfgang Schaeuble said shortly after the ministers agreed to make the payment.

"That means the inclusion of the private sector, which will be making a voluntary substantial contribution to the next programme for Greece," he said, adding that everything depended on Greece fully implementing the austerity measures promised.

The 12-billion-euro payment will help Athens cover a 5.9-billion-euro bond redemption in August, but the government still has a monumental hill to climb if it is to return to debt sustainability, with its debt-to-GDP ratio above 150 percent.

Athens has repeatedly failed to meet budget targets laid down in the first bailout programme, raising the risk that the crisis will spread across the euro zone if unresolved.

Greece's second financing programme is to run from 2011 to 2014 and will come on top of the existing assistance package. As part of the package, Greece is expected to raise around 30 billion euros from privatisation, while the EU and IMF will provide around 50 billion euros, split two-thirds to one-third.

"Ministers agreed that the main parameters of a multi-year adjustment programme for Greece will revolve around a continued strong commitment to implementing fiscal consolidation measures... and concrete structural reform and privatisation," the finance ministers said in their statement.

EU leaders made a commitment to the second programme at their last summit on June 23-24, which should satisfy the IMF's condition that the euro zone must promise to finance Greece 12 months ahead for the IMF to contribute. The IMF issued a statement welcoming the Eurogroup move on Saturday.

Despite the release of the next tranche payment, which will provide breathing space for Athens, there is growing concern among EU officials that the strictures being imposed on Greece, including 28 billion euros of austerity measures between now and 2015, are too harsh and could cause longer-term damage.

The finance minister for Poland, which has just taken over the six-month presidency of the European Union, suggested on Saturday that too much emphasis had been put on austerity and too little on growth in Greece.

The market still sees an 81 percent chance that Greece will eventually default, and Schaeuble told Der Spiegel in an interview that Berlin was making preparations for such an event although it does not expect it to happen.

How much from the private sector

Private financial institutions held talks with finance ministry and central bank officials in euro zone countries last week to discuss under what conditions the private sector would be willing to help finance Greece and by how much.

Those discussions continue, with the involvement of the private sector in the next package a must for several euro zone countries as voters grow increasingly opposed to shouldering the burden of bailing out Greece on their own.

But private sector involvement must be voluntary to avoid triggering another downgrade of Greek debt to default status by ratings agencies, a development which could put the whole Greek banking sector at risk.

The Institute of International Finance, a global association of financial institutions, said on Friday that the "private financial community is ready to engage in a voluntary, cooperative, transparent and broad-based effort to support Greece given its unique and exceptional circumstances".

Schaeuble has said German banks wanted to roll over 3.2 billion euros' worth of Greek bonds maturing to 2014.

French banks have reached an agreement on how to roll over part of their Greek debt holdings, French President Nicolas Sarkozy said, but did not indicate the total amount.

A further meeting of euro zone finance ministers on July 11 will help to finalise the second financing package for Greece, but some officials said they would not be surprised if the final decision were taken by finance ministers only in September.

E-paper

Shining through

Chinese fireworks overcome cloudy times, pin hopes on burgeoning domestic demand

Pen mightier than the sword

Stroke of luck

Romance by the sea

Specials

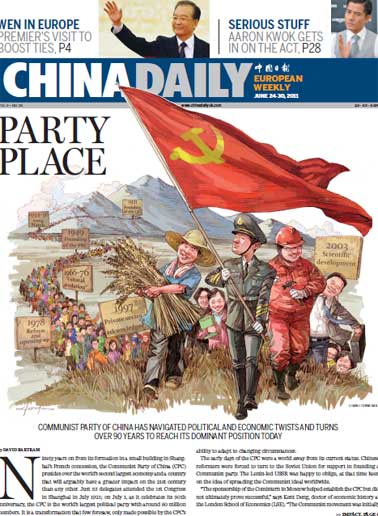

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

My China story

Foreign readers are invited to share your China stories.

Green makeover

Cleanup of Xi'an wasteland pays off for ancient city