Ireland swallows bitter pill

Updated: 2010-11-22 07:49

(Agencies)

DUBLIN - Debt-crippled Ireland formally applied Sunday for a massive EU-IMF loan to stem the flight of capital from its banks, joining Greece in a step unthinkable only a few years ago when Ireland was a booming Celtic Tiger and the economic envy of Europe.

European Union finance ministers quickly agreed in principle to the bailout, saying it "is warranted to safeguard financial stability in the EU and euro area." But all sides said further weeks of negotiations loomed to define the fund's terms, conditions and precise size.

Ireland's crisis, set off by its foundering banks, drove up borrowing costs not only for Ireland but for other weak links in the eurozone such as Spain and Portugal. Ireland's agreement takes some pressure off those countries, but they still may end up needing bailouts of their own.

Irish Finance Minister Brian Lenihan spent much of Sunday talking to other eurozone financial chiefs about conditions they would place on the emergency aid package taking shape.

Lenihan said Ireland needed less than euro100 billion ($140 billion) to use as a credit line for its state-backed banks, which are losing deposits and struggling to borrow funds on open markets. He said the loan facility could last anywhere from three to nine years.

International Monetary Fund director Dominique Strauss-Kahn said his organization "stands ready to join this effort, including through a multiyear loan." He said IMF experts already in Dublin would "hold swift discussions on an economic program with the Irish authoated this year to a European record of 32 percent of GDP _ back to the eurozone's limit of 3 percent by 2014.

The European Central Bank and other eurozone members had been pressing behind the scenes for Ireland _ long struggling to come to grips with the true scale of its banking losses _ to accept a bailout that would reassure investors the country won't, and can't, go bankrupt.

The economically struggling governments of Spain and Portugal, in particular, had criticized Ireland's recent determination to keep going it alone. Ireland's inability to stop its financial bleeding has fueled investor fears of wider eurozone defaults and driven up those countries' borrowing costs on bond markets.

But even with Ireland seeking aid, financial analysts say Spain and Portugal remain on course for potential bailouts of their own. Spain is fighting Europe's highest unemployment rate and Portugal is seen as doing too little to restructure an unusually uncompetitive economy.

Ireland's move comes just six months after the EU and IMF organized a euro110 billion ($150 billion) bailout of Greece and declared a euro750 billion ($1.05 trillion) safety net for any other eurozone members facing the risk of imminent loan defaults. It demonstrates that creating the three-layered fund didn't, by itself, reassure global investors that it would be safe, or smart, to keep lending to the eurozone's weakest members.

Economists question whether the economies of Ireland, Portugal, Spain and Greece will grow sufficiently to build their tax bases and permit them t fate of its overgrown banks, which received access to mountains of cheap money once Ireland joined the eurozone in 1999. The

Dublin banks bet the bulk of their borrowed funds on rampant property markets in Ireland, Britain and the United States, a strategy that paid rich dividends until 2008, when investors began to see the Irish banking system as a house of cards.

When the most reckless speculator, Anglo Irish Bank, faced bankruptcy in September 2008, it and other Irish banks persuaded Lenihan and aides that they faced only short-term cash problems, not a terminal collapse of their loan books.

Lenihan announced that Ireland would insure all deposits _ and, much more critically, the banks' massive borrowing from overseas investors _ against any default, an unprecedented move.

At the time, Lenihan billed his fateful decision as "the cheapest bailout in history" and claimed it wouldn't cost the Irish taxpayer a penny. The presumption was that confidence would return and Ireland's lending would resume its runaway trend.

But in the two years since, Lenihan has nationalized Anglo and two other small banks and taken major stakes in the country's two dominant banks, Allied Irish and Bank of Ireland. The flight of foreign capital began accelerating again in the summer amid renewed doubts that the government understood the full scale of its losses.

Lenihan and the Irish Central Bank responded in September by estimating the final bill at euro45 billion to euro50 billion ($62 billion to $69 billion). Investors, initially relieved to have a figure, quietly resumed their withdrawal from Irish banks and bond markets in mid-October, driving up the borrowing costs for Portugal and Spain, which face their own deficit and debt crises.

Both Cowen and Lenihan have stressed that Ireland's 12.5 percent rate of tax on business profits _ its most powerful lure for attracting and keeping 600 U.S. companies with bases in Ireland _ will not be touched no matter what happens.

France, Germany and other eurozone members have repeatedly criticized the rate as unfair and say it should be raised now given the depth of Ireland's red ink.

However, IMF and EU leaders negotiating the bailout terms with Ireland have said they don't intend to dictate any specific tax reforms to Ireland, only to ensure that targets for cutting spending and raising taxes overall are met. Ireland's right to set its own tax rates also has been enshrined in a series of EU treaties, making any strong-arm tactics now unlikely.

Ireland's 2011 budget, however, could yet be torpedoed by its own divided lawmakers.

The budget faces a difficult passage through parliament when it is unveiled per displayed the photos of Ireland's 15 Cabinet ministers on its front page, expressed hope that the IMF would order the Irish political class to take huge cuts in positions, pay and benefits _ and called for Fianna Fail's destruction at the next election.

"Slaughter them after Christmas," the Sunday Independent's lead editorial urged.

Paper's Digest

China bags Asiad team tennis title after 24 yrs

Wimbledon semifinalist Li Na led host China to capture the team tennis title on Tuesday at the Asian Games, accomplishing her Asiad tour with three consecutive victories.

China rate rises no panacea to curb inflation: PBOC adviser

Specials

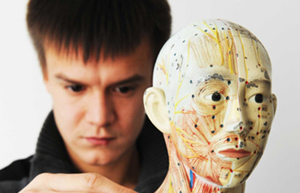

Russian possessed with TCM

Born into a family of doctors, Maxime became interested in Traditional Chinese Medicine (TCM) at the age of 12, after hearing about TCM theories such as health preservation and recuperation.

Acupuncture takes stab at UNESCO list

Acupuncture and Peking Opera have been selected as candidates for UNESCO intangible cultural heritage status.

The wedding coach comes back to life

A groom carries his bride from a wedding coach in Xuchang, Henan province, Nov 11, 2010. Produced a local factory, various original hand-made wedding carriages were displayed on the streets, attracting young people chasing fashion and an environment-friendly lifestyle.