Nuclear to power change in energy mix

Updated: 2016-01-29 07:52

By Lyu Chang(China Daily Europe)

|

|||||||||||

China looks to the atom to grow and export its technology, as well as generating up to 10% of its power from nuclear energy by 2030

Last year's big-ticket developments in China's nuclear power industry signify two key themes: the country's inexorable shift toward clean energy, in line with its commitment to be a responsible, climate-conscious economic giant, and its determination to be a leading global nuclear player in the decades to come.

As many as six nuclear reactors went online in China in 2015. The authorities gave permits for the construction of eight more domestic reactors.

|

The China Guangdong Nuclear Power Group pavilion at a recent nuclear power equipment expo in Shanghai. Provided to China Daily |

As for exports of nuclear technology, in November the country signed a $6 billion deal with Argentina to build a nuclear plant, the South American country's fourth. In the United Kingdom, three nuclear power plants are likely to be built with possible Chinese nuclear technologies.

China recently signed an agreement with Saudi Arabia to develop Chinese fourth-generation nuclear technology in the Middle Eastern country.

But what helps China stand out from the nuclear crowd is its stress on innovation, safety and popularization of its technologies, experts say.

Nuclear power is firmly etched into China's 13th Five-Year Plan (2016-20). According to the National Energy Administration, China's 28 nuclear reactors in operation have an installed capacity of about 25.5 gigawatts. The nuclear plants now under construction and those approved for construction would collectively generate an additional 30 gW.

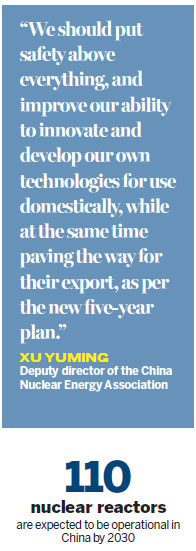

Xu Yuming, deputy director of the China Nuclear Energy Association, says the current program would see the country emerging as the largest market for nuclear power plants. But the priority is safe development of nuclear power and increasing the percentage of its homegrown nuclear technology in the global market.

"Speed (of executing nuclear power projects) is not the goal. We should put safety above everything, and improve our ability to innovate and develop our own technologies for use domestically, while at the same time paving the way for their export, as per the new five-year plan," Xu says.

The safety-first principle became paramount after China suspended approvals for new reactors in 2011 in the wake of the Fukushima nuclear crisis in Japan in order to conduct a review of safety standards at existing nuclear facilities.

In March last year, the government approved construction of units 5 and 6 of Hongyan River nuclear power plant in northeastern Liaoning province, the first such project to receive approvals in four years.

Since then, China started to ramp up electricity generation at its nuclear power plants, which gained currency as clean, abundant sources of energy with potential to fuel a high-growth economy.

Starting in May 2015, the government issued construction permits to units 5 and 6 of Fuqing nuclear power plant in southeastern Fujian province, units 3 and 4 of Fangchenggang nuclear project in Guangxi Zhuang autonomous region, and units 5 and 6 of Tianwan nuclear power plant in eastern Jiangsu province.

Experts say China's pledge to the international community to reduce carbon emissions and generate 20 percent of its electricity from clean energy sources by 2030 will push the country to use more nuclear power in the coming decades.

Xu says China, the world's largest energy consumer, is likely to add five or six nuclear reactors every year from 2016 to 2030, according to estimates in the draft 13th Five-Year Plan.

"By then, nuclear power will account for 8 to 10 percent of the total energy mix," he says. Its current share is about 2 percent.

China is planning to have at least 110 nuclear reactors running by 2030. That would make it one of the largest nuclear energy users in the world.

China also aspires to be a strong nuclear industry. Hence, it is seeking to develop indigenous reactor technologies. Its three nuclear power companies are working to adapt the third-generation nuclear technology to the domestic market.

The first unit of Hualong One nuclear power plant already runs on homegrown third-generation technology developed jointly by China National Nuclear Corp and China General Nuclear Power Group. Some 85 percent of such reactors can be made domestically, with a design life of 60 years.

"It is clear localization will play an increasingly important role. Domestic use of indigenous technology is a prerequisite for its export," says Yu Peigen, deputy general manager of CNNC. "If the design, software and even the fuel cannot be made domestically, how could we export our technology?"

Nestor, a Chinese-built software program for designing nuclear reactors, was tailor-made for Hualong One to increase efficiency and quality of the plant construction and engineering, he says.

Nestor, he says, is analogous to the iOS operating system that powers iPhones, and is key to the third-generation nuclear technology. The software is expected to give a fillip to efforts to export China's nuclear technology.

Both CGN and CNNC have their own supply chains. So their versions of Hualong One will differ but only slightly as the reactor design is standardized, which means 28 technical features remain the same.

CNNC is also developing a fast-neutron reactor, corresponding to fourth-generation technology. This would enable China to depend less on imported supplies of uranium.

The state-backed company was behind China's first fast-neutron reactor, the China Experimental Fast Reactor, in 2011, whose operations reached full capacity in 2014.

The pool-type fast-neutron reactor has a thermal capacity of 65 mW and can produce 20 mW of electricity.

Meanwhile, the Shanghai Nuclear Engineering Research and Design Institute designed CAP1400, another third-generation nuclear reactor technology, based on the AP1000 reactor technology developed by the United States-based Westinghouse Electric Co. China has promoted CAP1400 both domestically and abroad.

Zheng Mingguang, head of the Shanghai institute, has said that construction of the pilot project of the Shidaowan power plant in Shandong province, which will use CAP1400 technology, is likely to start this year. There also is a good chance the technology will be used in South Africa's new-generation nuclear power stations.

"We have an edge over our competitors in terms of cost, reliability and security. Our technology incorporates both imported aspects and latest homegrown advances," he says.

lvchang@chinadaily.com.cn

(China Daily European Weekly 01/29/2016 page26)

Today's Top News

Record number of Chinese tourists visited UK in 2015

Foreigners fill in Spring Festival courier gap

UK adventurer dies on solo journey

Families of expats in China can stay longer

China's growth envy of developed world

Foreigners find hard to buy China's rail tickets

Rags to riches saga underlines China's transformation

Leaders address Iran's thirst for growth

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|