Trading partners

Updated: 2015-01-30 08:38

By Andrew Moody(China Daily Europe)

|

|||||||||||

As Chinese economy increasingly veers toward services, there could be a shuffling of the deck among European countries

Could China's transitioning to a more services and consumption-based economy lead to a change in its trading partners, particularly in Europe?

Germany has had what some have described as an "extraordinary" partnership with China since reform and opening-up in the late 1970s.

Siemens, which has been in the country for more than 140 years, and other German companies have been able to provide the engineering capability that China needed in its first stage of growth.

Yet the next stage of China's development might see countries like the UK with its specialization in financial services, in particular, but also in healthcare, clean tech and life sciences, take more of a front seat.

A new report by law firm King & Wood Mallesons predicts the UK's FDI asset stock in China is set to rise almost fourfold from 6.67 billion pounds ($10.1 billlion; 8.93 billion euros) in 2014 to 25.61 billion pounds by 2020 as China opens up its service sector to foreign investors.

Germany would remain strong, with the growth of its investment in China rising just over three times from 11.67 billion pounds in 2014 to 35.2 billion pounds by 2020.

French investment will rise from 4.33 billion pounds to 10.27 billion pounds over the same period.

Another leading European investor in China, the Netherlands, would see its FDI increase from the same level as the UK's in 2014 at 6.67 billion pounds to 16.64 billion pounds in 2020.

It is clear the government sees a greater emphasis on services as essential to modernize the Chinese economy.

This was emphasized by Chinese Premier Li Keqiang in a speech he made shortly after taking office in May 2013.

"In short, China will use the development of the service sector as a strategic measure to upgrade the economy," he said.

Rob Day, managing partner of King & Wood Mallesons in London, says the next stage of China's development is likely to benefit the UK.

"With China opening up its services sector, this is a fundamental opportunity for the UK.

"If you look in terms of asset stock, Germany is the biggest individual European investor in China. I think the gap, however, may narrow. I think what is implicit is a faster degree of growth from the UK than from Germany."

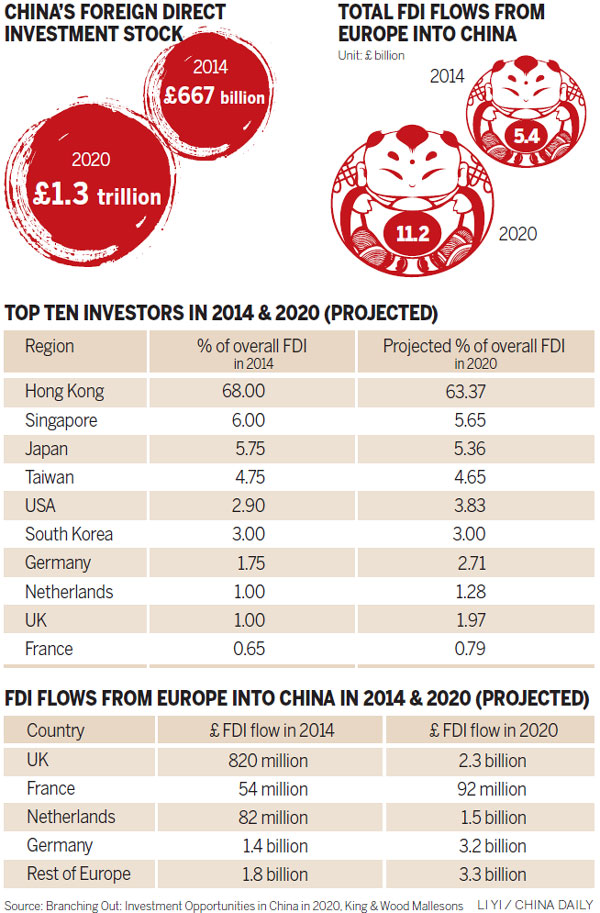

There is certainly a lot to play for. Foreign direct investment in China is set to almost double from a cumulative 667 billion pounds in 2014 to 1.3 trillion pounds in 2020.

Over morning coffee in the impressive reception room of the British embassy in Beijing, Henry Bell, the first secretary at the British Embassy in Beijing, insists the UK is not engaged in some new battle with the Germans.

"I don't think it is a zero sum game. The cake is getting bigger and so everyone stands to benefit from a larger cake but you would expect to see the UK's share of the cake grow faster."

UK Prime Minister David Cameron on his December 2013 visit bringing along with him the leaders of some 100 British companies - talked of a new "growth partnership" between Britain and the world's second-largest economy.

"It is based on the premise that the UK and China have very complementary strengths. Their (relationship's) comparative advantage is that they don't compete with each other. They complement each other," adds Bell.

"You are seeing that the UK is benefiting from a rise in middle class China and the associated consumer demand with that. So, for example, our biggest exporter to China is Jaguar Land Rover which is seeing a fantastic year on year growth in sales of Range Rovers and Jaguar F types."

But Thomas Luedi, managing partner Greater China at AT Kearney, who is based in Shanghai, believes the Sino-German link is more than just a strong trade partnership and that it will take more than a transitioning economy to break it.

"There is something that is very culturally close between the Germans and the Chinese. If you look at China's state-owned enterprises, they are essentially run by engineers. Much of the government itself is made up of engineers," he says.

"I think they appreciate the sharp engineering capability the Germans bring, the structure, quality and detail of their analytical approach. I don't think it is any coincidence that some of the first multinationals to come to China were, in fact, German."

Luedi also believes there is a lot of road left in the relationship because China will still need the skills of German engineering companies to complete its urbanization.

"China is still only just over 50 percent urbanized so the urbanization journey hasn't quite ended. So the German companies, as well as the Japanese engineering companies, will still have a lot of opportunities."

At the office of the European Chamber of Commerce in China at the Lufthansa Center in Beijing, the organization's president, Joerg Wuttke, says the existing EU trade relationship with China is not as German-dominated as many assume.

"You might not see many British cars here, apart from Minis and Jaguars, or the big physical presence that companies like Siemens and others have. But you have huge investment coming out of Britain into China. A lot of this is portfolio investment that comes via Hong Kong. It is often invested in Chinese companies or joint ventures," he says.

Some of the UK investment from Hong Kong might actually be reflected in the FDI figures. Some 68 percent of China's FDI came from the Special Administrative Region in 2014, according to King & Wood Mallesons. This compares with just 1 percent directly from the UK, 1.75 percent from Germany and 0.65 percent from France. The top four investors were all from Asia, and not Europe, with Japan contributing 5.75 percent, Taiwan 4.75 percent and South Korea 3 percent.

Kerry Brown, director of the China Studies Centre at Sydney University, insists any new UK involvement with China should not be overplayed.

Like Bell, he was first secretary at the British embassy in Beijing, between 2000 and 2003.

He was once given the task of finding out how much UK investment there actually was in China. In Xinjiang Uygur autonomous region, all he could find was a coffee shop run by a British expat, in Kashgar.

"It was very difficult working out what the stock of British investment was. A lot of it was offshore from places like the British Virgin Islands so it was difficult to be that precise."

He says the current upturn in UK-China trade should not come as a surprise but the relevance of it should not be overstated.

"China is a big and a growing economy and the UK has had trade relations with it for so long that there would be something fundamentally wrong if it weren't increasing. It should really only go upwards."

Brown, who has a book to be published in March on UK-China relations, What's Wrong With Diplomacy?, believes UK trade efforts have often been hampered by its often heavy-handed diplomacy.

"The UK has this mindset that is schizophrenic. On the one hand they are yelling at China over certain value issues and also not doing it in a particularly sophisticated way. On the other hand they just want Chinese money.

"The Germans, however, have tended just to go and do business and not get too complicated about it."

At his offices in the Dongwai Diplomatic Office Building in Beijing, Russell Brown, managing partner of accountants Lehman Brown, believes the attitude toward China among UK companies has changed dramatically over the past two years.

"I think the UK attitude even a couple of years ago was that China was one of many markets. They sometimes were influenced by all the supposed horror stories rather than the good news stories."

Brown, also honorary chairman of the British Chamber of Commerce in China as well as vice-chairman of the China British Business Council, says there has been a recent influx of many UK service businesses, particularly in architectural and interior design as well as product and brand design.

"The thing with services is that they can be performed anywhere in the world. The design companies that have come into the market place may be working for Chinese companies but the work they are doing is often done in the UK. Some may set up an office here but their core work will be done in the UK."

One of the opportunities for service sector businesses, particularly in financial services, is the Shanghai Free Trade Zone, which was officially opened in September 2013.

Others will now be established in Guangdong, Fujian and in Tianjin. Many European companies have set up operations in Shanghai and others are seeking to do so.

Although some argue there is still a lack of clarity about the rules framework, the zones offer the potential for service businesses, particularly in the financial and healthcare sector, to operate with fewer restrictions and also greater ease of moving money in and out of the country.

The King & Wood Mallesons report argues they could be a test for more liberal rules nationwide that could encourage further foreign direct investment.

Managing Partner Day adds the zones offer the opportunity for service sector businesses to use the Shanghai Free Trade Zone as a platform to build their businesses in China.

"They represent an economic experiment for companies who want to gain access to some of these sectors and actually start to build a business. It is a great way to get in early and against a backdrop of more liberal rules," he says.

Bell at the British embassy is excited by the opportunity of the SFTZ and other zones playing to the UK's strengths, in particular.

"The UK is already doing pretty well in China's financial services industry relative to other foreign participants, and you would expect us to stay strong."

Chi Fulin, president of the China Institute of Reform and Development, a think tank based in Haikou in Hainan province, believes the opening up of China's services sector and the transitioning of its economy will be a major boost to Europe.

"We can see that China's transition to a more service-sector economy will create huge markets for Sino-Europe trade cooperation," he says.

"I think this transition will be one of the most important aspects of Sino-Europe cooperation over the next five to 10 years."

In Shanghai, Xu Bin, professor of economics at CEIBS, thinks it is easy to exaggerate the impact China's transitioning will have on the size of its trade with Europe.

"China's transitioning from a manufacturing to a service-sector economy is not such a dramatic change. The change has been happening gradually and is part of the natural process of an economy moving from a manufacturing to service-sector economy."

He also does not believe that it will have such a major impact on China's trading partners.

"I think it is misleading to separate industry and services as if they are competing against each other. I don't think they can be regarded as substitutes. Many manufacturing companies like IBM actually moved from manufacturing to services and many other companies have this mix. So there is unlikely to be this big change in trading partners."

Luedi at AT Kearney also believes it is also wrong to frame the debate about a transitioning economy resulting in a change in European trading partners.

The competition the Germans might fear most is that from emerging Chinese companies.

Four of the top 10 infrastructure companies in the world now are Chinese Cheung Kong Infrastructure Holdings, China Communications Construction, China National Building Material Company and China Railway Engineering Corporation according to Ranker, the listings website.

"I think the bigger challenge for the Germans and, indeed, the Japanese engineering companies in China will be from the Chinese themselves. The Chinese companies are getting stronger and leveraging their engineering capabilities," he says.

But Day at King & Wood Mallesons believes there is a feeling in the UK that it wants to grasp any new opportunity and catch up in its relationship with China.

"I think there is a sense within the UK that we could have done more to build and promote a trade relationship and I think that is what is happening at the moment. I think there is a much greater push," he says.

Ren Qi contributed to this story.

andrewmoody@chinadaily.com.cn

|

From left: Rob Day at King & Wood Mallesons, and Henry Bell, first secretary at the British Embassy in Beijing. |

|

From left: Russell Brown, managing partner of Lehman Brown, and Xu Bin, professor of economics and finance at the China Europe International Business School. |

|

Joerg Wuttke, president of the European Chamber of Commerce in China and chief representative of BASF. Zhu Xingxin / China Daily |

( China Daily European Weekly 01/30/2015 page1)

Today's Top News

President Xi meets Russian Foreign Minister

US taking 'fresh look' at weapons for Ukraine

New regional system set up

EU Parliament evacuated as police check suspicious car

Indian PM expected to visit President Xi's hometown

Dalai Lama-Obama meet risks Sino-US trust

Nearly 90% of cities in China don't meet air quality standard

Chinese money flows into UK

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|