Experts' take

Updated: 2014-03-21 08:16

(China Daily Europe)

|

|||||||||||

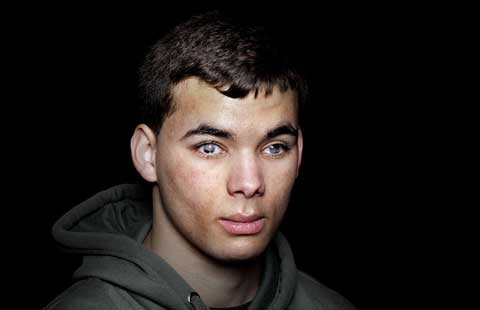

Martin Wolf,

chief economics commentator at the Financial Times

How long does China's current economic model have left?

It will have to adjust by the end of this decade or early the next one.

What are the reform challenges?

The choice is whether to make the transition smoothly or quickly and sharply and face economic turbulence.

Is having investment at 50 percent of GDP a problem in itself?

The dependence on investment is so extreme, it is unprecedented. There can't be any doubt the rate of return on investment must be falling.

Louis Kuijs,

chief economist, Greater China Markets, Royal Bank of Scotland

How long does China's current economic model have left?

There is a risk that China's growth could slump within 3 years but it is not the central case. The model remains sustainable because China's debt is funded domestically.

What are the reform challenges?

The challenge is avoid growth falling to 4 or 5 percent in the process but the government has a lot of levers left to prevent that.

Is having investment at 50 percent of GDP a problem in itself?

If you can keep consumption per GDP low without having a social crisis then it could continue with this pattern of growth.

Liu Zhiqin,

senior fellow at the Chongyang Institute for Financial Services at Renmin University of China

How long does China's current economic model have left?

The model is not wrong and the economy is in no danger of collapsing. Western economic theory fails to understand the nature of the economy.

What are the reform challenges?

I am skeptical whether financial measures such as interest rate liberalization will bring cheaper finance to the private sector.

Is having investment at 50 percent of GDP a problem in itself?

It is not a problem because China is still a developing country. The global problem is more related to the over-consumption of Western companies.

Marie Owens Thomsen,

senior economist and strategist at Credit Agricole Suisse Private Banking

How long does China's current economic model have left?

I have no fear of an investment bust in China, although one has to remain humble with forecasts.

What are the reform challenges?

Structural reform such as liberalizing the capital account might be harder after the global financial crisis than before. I think the yuan will be fully convertible by 2020.

Is having investment at 50 percent of GDP a problem in itself?

Difficult to change the model while China has one of the lowest per capita incomes in the world. Reform of the hukou system and better pensions is the key to boosting consumption.

Goolam Ballin,

chief economist and head of research for the Standard Bank Group, in Johannesburg

How long does China's current economic model have left?

I don't see any risk of collapse to 2 percent or negative growth, which would be disastrous to African commodity-producing countries.

What are the reform challenges?

The challenge will be to reform the economy as smoothly as possible. We have already been guided that future growth is going to be lower.

Is having investment at 50 percent of GDP a problem in itself?

There was a time when this level of investment was appropriate but it is now creating stresses and crowding out household consumption.

Gary Liu,

deputy director Lujiazui International Finance Research Center

How long does China's current economic model have left?

Even the Chinese government recognizes the model is flawed but it is hard to predict how long it has left.

What are the reform challenges?

The main problem is reining in local governments. If they sell some of their assets in market reforms, they might go on another infrastructure spending spree.

Is having investment at 50 percent of GDP a problem in itself?

Investment has to remain relatively high before consumption kicks in as a new driver of growth.

George Magnus,

senior independent economic adviser for UBS London

How long does China's current economic model have left?

Without reform growth will fall within three years. The danger for the government is blinking and stimulating the economy only to have a bigger economic crisis in two to three years.

What are the reform challenges?

Financial reform such as widening the yuan-trading band and interest rate liberalization are easier than dealing with local government finance and state-owned enterprises, where there is more resistance.

Is having investment at 50 percent of GDP a problem in itself?

The issue is not so much the rate, although it is unprecedented, but the speed of capital accumulation since 2000 and the reliance on debt financing.

(China Daily European Weekly 03/21/2014 page16)

Today's Top News

China, the Netherlands seek closer co-op

Crimea is part of Russia

Images may help solve jet mystery

Obamas wowed by China

Xi leaves Beijing for first trip to Europe

Beijing beefs up hunt for missing jet

Putin signs law on Crimea accession

Australia to resume ocean search for missing jet

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|