Magnetic attraction

Updated: 2013-08-02 08:51

By He Wei (China Daily)

|

|||||||||||

|

David Preston, chairman of Boehringer Ingelheim China, dots the eyes of a lion head during the ground breaking ceremony of the expansion of its Zhangjiang Plant in Shanghai in this 2011 file photo. The company has invested 35 million euros in its joint venture in Shanghai. Provided to China Daily |

Opportunities abound for smaller European firms to invest in China as innovation comes to fore

With the growth of total foreign direct investment in China tailing off, the biggest waves of capital inflow may have passed. But the waves still come. Only now, they tend to be smaller or medium-sized, and from Europe.

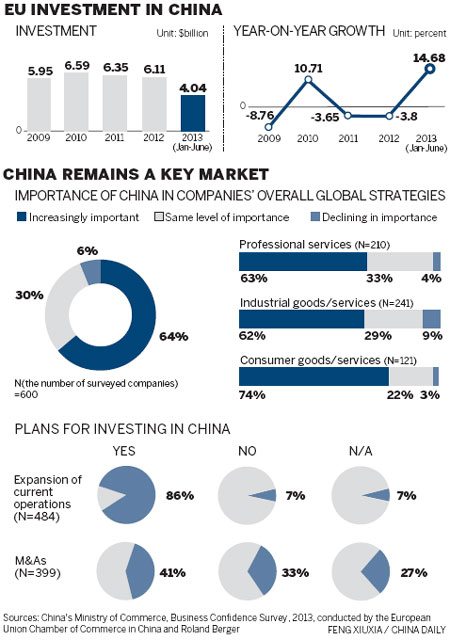

Many expected FDI in China to continue to fall this year, after dropping 3.7 percent year-on-year to $111.72 billion (84.19 billion euros) in 2012, but investment from the European Union climbed 30 percent to $2.47 billion in the first four months.

In the first half of this year, foreign investors established 10,630 companies in China, down 9.18 percent year-on-year, while total FDI inflow rose 4.9 percent year-on-year to $61.98 billion, according to the Ministry of Commerce.

The investment surge from the EU is being called the new wave of capital migration, and is being ridden largely by small and medium-sized enterprises that have positioned themselves at the head of niche businesses.

"It marks Europe's third wave of overseas investment," Piter de Jong, vice-chairman of the European Union Chamber of Commerce in China told South China Morning Post. "The first two waves were made some 20, 30 years ago from, first, the state-owned enterprises and later big private corporations. Now it is the turn of SMEs."

SMEs recently looking to enter China include small auto-parts suppliers, green technology firms and consumer goods distributors, and de Jong expects more to come.

Why they come varies from company to company, but it is now less to do with labor and operating costs and more to do with technological innovation and improvement.

Not so long ago, Thomas Pester, owner of Pester Pac Automation GmbH, a German packaging machine maker, would never consider expanding his 125-year-old family business to China, especially during difficult economic times.

Now he is building a new plant in Shanghai's Songjiang district, the only one outside his home market, to serve the pharmaceutical and cosmetics industry in China and neighboring countries.

"Every company must find out for itself when and why to invest," Pester says. "For us, a family-run business, it's quick and easy to make decisions."

It was made easier when Pester realized China was home to 5,000 pharmaceutical companies, and the market remained one of the few bright spots for growth during the global economic downturn.

"Nowadays, European markets are largely saturated and have stagnated, which propelled us to look for new areas of growth. The BRICS nations are definitely where new businesses would be set up," he says.

"I would say the market access in China is much easier today compared with 15 years ago when everything was a bit unknown and unexpected. You find yourselves better located, the number of English speakers has picked up dramatically, and you find flights to China are more frequent than before."

Pester Pac has supplied more than 7,000 film-wrapping, case-packing and palletizing machines to companies around the world, including Colgate-Palmolive and Johnson & Johnson.

Pester believes that the tide of investment has now turned in favor of smaller established European companies who, inspired by the success stories in China of their bigger peers, have been awaiting their turn.

Another German company, Boehringer Ingelheim, has spent around 35 million euros setting up a joint venture in Shanghai and establishing itself as the first biopharmaceuticals manufacturer in China to use mammalian-cell culture technology.

"The gloomy outlook for the world economy makes China the single most important emerging market for European small and middle-sized enterprises," says Christian Boehringer, chairman of the shareholders' committee.

The partnership with ZJ Base Co in Shanghai is an important step in Boehringer Ingelheim's strategy to meet the growing demand for high-quality biopharmaceuticals in China, Boehringer says.

"There are some small and middle-sized companies that have developed new medicines but have not come up with a set of matching manufacturing processes," he says. "We help them to design ways of mass production, boost efficacy and achieve commercialization so that their products will be licensed and find ways to market."

As markets become global, an increasing number of European SMEs are turning to exporting their ideas and efforts to other countries, says Chang Xinjie, public relations director of Haldor Topsoe (Beijing) Co Ltd, a Chinese subsidiary of the Danish catalysts producer.

In June, the company announced plans for a new plant in Tianjin, North China, which it expects to help double its annual turnover.

Chang says the move is in line with Haldor Topsoe's strategy of strengthening and expanding cooperation between Denmark and China, with energy efficiency and environmental protection priorities on the Chinese government's agenda.

"In continuously driving toward greener economic growth, the Chinese government needs more and more advanced technology and solutions in agriculture, infrastructure, manufacturing, energy, environment and service sectors," Chang says. "In these areas, EU SMEs do have something to offer and will be naturally attracted to the Chinese market."

Swiss electronic components manufacturer Huber+Suhner has made the single biggest investment in its history - 60 million Swiss francs ($65 million, 49 million euros) - to establish a plant in Changzhou, Jiangsu province, producing low-frequency wire and cable products.

The products will be widely used in railway vehicles, solar technology and electric and hybrid vehicles.

Urs Kaufmann, company CEO, believes that China now possesses enough skilled engineers and researchers that it has not only become the biggest growth market, but also powerhouse for the company.

"We believe in the growth of the Chinese market, and more importantly, customer proximity is key to our success," he says.

Confidence in China's continued rise has also attracted the manufacturing group Halma Plc, a former rubber trader with headquarters in Britain.

"I think the track record of China's strong and sustainable growth has proved China's ability and that it can and will make further progress in a more balanced way," says Martin Zhang, director and chief representative of Halma Plc in China.

The company, with expertise in electronic, health and safety, and environmental technologies, acquired the Hebei-based Baoding Longer Precision Pump Co to consolidate its growth in China.

Longer Precision Pump makes syringe and gear pumps used in laboratory, medical and industrial applications.

Zhang says acceleration of the European SMEs' investment in China shows the country has created a better business environment by simplifying investment procedures and improving transparency.

They also believe the competitive edge EU companies provide matches the country's economic development plan to move up the value chain and pursue high-tech industries.

"We focus our resources in the industry safety, medical and environmental sectors, and these markets will grow strongly in China over many years to come," Zhang says. "China needs the help from other countries for their most advanced technologies and services."

This comes at a time when a string of European conglomerates have signaled a retreat from their Chinese manufacturing operations, citing soaring labor and operational costs among major concerns. Sportswear maker Adidas AG, for instance, opted to relocate to cheaper ASEAN nations for cost control.

But such costs do not worry SMEs so much.

SMEs account for more than 98 percent of companies in Europe and account for 70 percent of EU jobs and gross domestic product. More importantly, they are considered the chief source of creative ideas and technological innovation.

Pester Pac Automation identifies high-caliber skills as the most valuable resource for innovation and long-lasting business ideas.

"Unlike those bigger firms, we are not big producers in volume," says Thomas Pester. "Rather, we need a small number of highly-educated people as input in our business. We don't really need quantity of people but quality, and we have that in China, and in Shanghai."

Similarly, Haldor Topsoe, with its new catalysts plant in Tianjin, aims to localize production as much as possible, seeking qualified industry specialists and hiring local operations teams.

However, in a recent survey, consultancy Roland Berger found that 30 percent of 526 European firms in China mentioned high competition from privately owned Chinese companies as a key impediment to local business.

Haldor Topsoe's PR director Chang says it will be a challenge to recruit and retain local specialists as Chinese industry is continuing to improve, and competition for top talent is fierce.

But the investment has been made viable, he says, thanks to a much more transparent business environment in China, where the EU has opened many contact points to give its SMEs easier access and make it more beneficial for smaller firms.

While rising labor and operational costs may still be a concern, Kaufmann of Huber+Suhner is optimistic that the value of their products increase accordingly.

Boehringer says Shanghai was chosen to launch its joint venture with ZJ Base because of advantages in the investment environment, service system and talent resources, as well as positive feedback and support from government and regulators.

On the exit moves of some of the bigger Western companies, Dan Steinbock, research director of International Business at the India, China and America Institute, an independent think tank in the US, believes that while these companies can enjoy greater cost efficiencies by moving to emerging neighboring countries, they cannot achieve comparable scale and scope. Nor would they benefit from comparable infrastructure and logistics.

"As the Chinese economy is moving from a tangible, asset-based economy to an intangible and value-added one, the size of FDI means much less today than its composition," he says.

Robert Theleen, chairman of the American Chamber of Commerce in Shanghai, points out that before China's rise, the successful Asian countries were either an island (Japan), peninsula (South Korea) or city state (Singapore). But China is the first nation to industrialize rapidly that is similar in size to a continent. That requires it to think "horizontally", he says.

Unlike many smaller markets that have only one scale of competitiveness and develop vertically, China has plenty of scope for sustainable growth from its coastlines to inland, and may well leverage comparative advantages across different regions and cities.

According to Tim Lyons, general manager of Manage China, an Australian-invested business process outsourcing firm, China's edge is through clear government direction, outlining key industries to ensure people continue investing.

"It is no longer a black-and-white situation where foreign companies prefer the market access or the cost advantage," he says. "It is more of an overlap of labor, high technology as well as owning brands."

China's supply chain has grown sophisticated, and even if some firms move out, they choose to maintain a relationship that may prove valuable and useful in the future, he says.

But experts say the Chinese government still has a way to go to convince companies that they can move inland in China rather than leaving the country.

"It is still problematic because many inland cities are not perceived as pro-business, due to lack of regulation and higher logistic costs," says Pedro Videla, professor of economics at IESE, the graduate business school of the University of Navarra in Barcelona.

Another thing the government can do is to clear investment hurdles by lowering thresholds in industries such as telecoms and finance, which are held by domestic monopolies, experts say.

hewei@chinadaily.com.cn

( China Daily European Weekly 08/02/2013 page1)

Today's Top News

Overseas investors welcome to bid in Beijing

US extends closure of embassies

New Zealand milk stokes fears

EU solar deal hailed as blueprint

Riding the clean energy boom today

Magnetic attraction for EU SMEs

Bespoke shoes, Italian-style, made in China

Mugabe wins Zimbabwe presidential election

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|