Foreign investors target China's domestic market

Updated: 2011-12-09 08:38

By Lan Lan (China Daily)

|

|||||||||

China remains a magnet for foreign investors seeking its huge internal market, especially after the country's economic boom over the past decade.

After China joined the World Trade Organization (WTO) in 2001, its reform and opening-up became a passive move under the WTO rules, said Li Xiaogang, director of the Foreign Investment Research Center at the Shanghai Academy of Social Sciences.

Since then, China has made perfecting its regulatory mechanism a top priority, with foreign investors benefiting from the country's globalization. Over the next decade, foreign investors will be affected by China's economic structural reform, he said.

China, the world's second-largest economy, is in the transition to rebalance its export-reliant, investment-led economy toward a consumption-driven one.

For foreign investors, China is gradually losing its cost advantages in terms of favorable taxes, cheap land and low costs for damaging the environment, compared with 10 years ago.

"China has the strength to make its internal market more appealing and it will remain a magnet for foreign investment," Li said.

Today, the majority of foreign companies in China are here for the local market, compared with the labor-intensive and export-oriented foreign direct investment a decade ago.

The companies also see significant increases in revenue and profit in China. A survey by the European Union Chamber of Commerce in China showed 78 percent of responding European companies reported a marked revenue increase in 2010, compared with 50 percent in 2009.

About 59 percent said they were planning major new investments in the country in the next two years, up 11 percent from last year.

The companies' optimism comes partly from their confidence in China's 12th Five-Year Plan (2011-2015) which will stimulate the business environment, opening opportunities for high-tech and green products and technologies, and in the service industries, said Davide Cucino, the chamber's president.

Analysts also say the development of emerging industries will spark a new round of foreign investment, be a new engine for economic growth and attract more capital inflows.

China has designated industries such as energy conservation and environmental protection, new information technology, advanced equipment and new energy as the keys to sustainable growth.

Meanwhile, the nation is committed to further opening up the service sector, also indicating business opportunities will abound in the coming years.

Over the next five years, China will guide foreign companies toward investing more in sectors including agriculture, high-end manufacturing and services, the 12th Five-Year Plan says.

Commerce Minister Chen Deming said China has plans to further loosen the restrictions on the service sector.

He said China was determined to continue opening up because competition is the best force to push reform and improve people's livelihoods.

Analysts said the government is studying the feasibility of opening more areas in the service sector, but they warned it would take time.

Huo Jianguo, president of the Chinese Academy of International Trade and Economic Cooperation, a think tank with the Ministry of Commerce, said China has opened up more than it had committed to when it entered the World Trade Organization 10 years ago.

"Most areas of the service sector have already opened up, just in different degrees and layers," Huo said.

"But the pace could be a bit faster. That would be a double-edged sword, posing more challenges to domestic companies while letting them grow faster in a competitive environment."

He said the government is studying the feasibility of opening further areas, such as transportation and some other public services.

Timothy Bond, chief economist for Asia Pacific at Bank of America Merrill Lynch, said the Chinese economy has not yet balanced its development of manufacturing and services.

"Developing the service sector is important for the Chinese economy and important for keeping consumers spending, but at the same time, service sector reform will take time," Bond said.

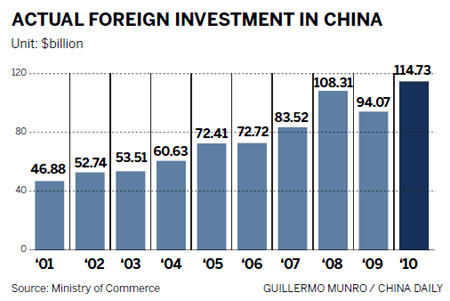

FDI jumped 18.6 percent year-on-year in the first nine months of this year to $86.6 billion. Foreign investors set up about 20,400 companies during the period, up 6.24 percent.

In the first nine months, US investments in China contracted 9.88 percent year-on-year and the European countries' investments decreased by 1.8 percent.

Many US and European firms are facing financial difficulties due to the turbulent financial market and that has affected their investment in overseas markets, including China, said Li Zhongmin, an investment researcher with the Chinese Academy of Social Sciences.

But the discouraging prospects for economic recovery in the US and Europe will make the growing Chinese market more appealing to investors from those areas, he said.