Sowing the seeds of doubt

Updated: 2011-08-05 11:13

By Zhou Siyu (China Daily European Weekly)

"Multinational players such as Pioneer have great technological advantages and seed resources, and they invest heavily in research and development every year," says Ma Wenfeng, a senior analyst at Beijing Orient Agribusiness Consultant Ltd, one the largest consultancies in the industry.

"By comparison, most Chinese companies are small- or medium-sized. They cannot compete with them (the multinationals) in either respect," he adds.

And Pioneer's business will continue to expand. The company will boost its presence in northwestern and southwestern China through further investment over the next few years, Niebur says.

In addition to continual investment, the company will also "launch a new pipeline of corn seeds into China's market", says James Borel, executive vice-president of DuPont de Nemours, which bought Pioneer in 1997.

Ma says that the presence of foreign seed companies in China has had a positive influence.

"The international industry giants can bring advanced technologies, management and service expertise into China. They will help improve the professional standards of Chinese seed companies," he says.

However, given the sensitive nature of the seed industry, Ma suggests that the government should "keep an eye on the movements of the foreign companies" to avoid a worst-case scenario where overseas companies control the domestic industry.

Whoever controls the seeds controls the whole nation, he says.

Chinese regulations mean that foreign outfits specializing in field-crop seeds, such as soybeans and rice, are not allowed to hold more than 49 percent of joint ventures, according to the Ministry of Commerce.

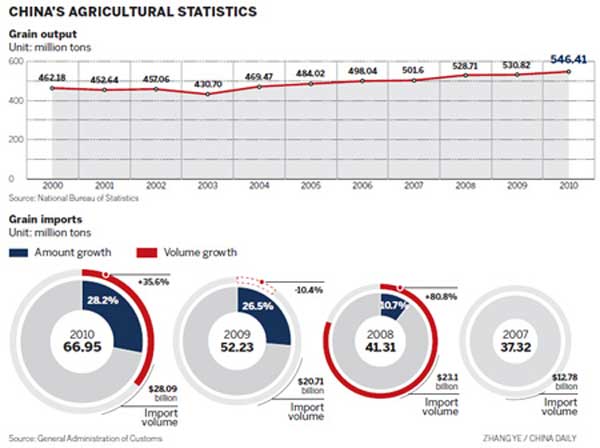

But in the eyes of the global players, China's current low rate of food production is far more threatening than their growing market share. China has to feed more than 22 percent of the global population, with 7 percent of world's arable land and 8 percent of its water resources. This is a country where the multinationals' advanced technologies can be employed to benefit both farmers and consumers.

|

"China's problem in terms of agriculture is nothing short of profound. We need to increase agricultural production and we need to do it over a predetermined time period. This requires collaboration (between government and the private sector)," says John Ramsay, chief financial officer of Syngenta AG.

The Swiss company is the world's largest producer of crop-protection chemicals, the third-largest vendor of seeds by sales, and one of the companies making inroads in China's agriculture sector.

"We would like to work with the new policy to accelerate the development of the industry, particularly in the conversion of farmers from low-quality seeds to high-quality," Ramsay says.

Syngenta is the leader in China's vegetable-seed market, especially in varieties such as tomatoes and sweet peppers. In 2010, its sales in China saw "a high single-digit increase for vegetable seeds", according to the company.

"There has been very strong growth in China for a number of years. And we see no disruption to that trend in the near future," Ramsay says.

"But our market share is very small (because the market is highly segmented), and sales in China contribute only a very limited amount to our global sales," he adds.

Kevin Eblen, regional leader of Monsanto North Asia (a division of Monsanto Co), says his company has the same problem in terms of market share and sales. The company is the world's largest producer of genetically modified (GM) seeds and globally holds "a major market-share advantage" in GM soybeans, corn, cotton and canola, the company says. However Chinese regulations prevent foreign companies from producing and developing GM seeds.

This policy has had a significant impact on Monsanto's business in China, Eblen says.

Even with the regulations, there are still plenty of reasons for the Chinese government to be cautious, says Jing Fei, a seed expert at Bohai University.

If the government were to give the green light to allow foreign companies to produce GM seeds, the global giants such as Monsanto and Pioneer would dominate the Chinese market with their world-class technologies and seed resources, according to Jing.

"Chinese companies are at an elementary stage in GM technology research," he says. "They will be vulnerable in the face of giants such as Monsanto and Pioneer."

Monsanto has set up three joint ventures and also owns three companies in China (bought before the shareholder regulations were applied) and its seed business focuses on hybrid corn, GM cotton and conventional vegetable seeds. Its hybrid corn seeds, sold under the name of Dekalb, are mainly grown in provinces in the southwest of the country.

In 2010, Monsanto's global sales declined 10.4 percent year-on-year to $10.5 billion, according to the company's figures. The Chinese market contributed less than 1 percent to the global total, according to Eblen.

"We currently have a very limited market share in China," he says, "but our business is growing steadily and we obviously see great prospects for the future here."

On the shoulders of giants

Despite the heated debate about the influx of foreign companies and the country's food security, farmers in Shanxi province have experienced the benefits brought by advanced technologies and services. Wei, the local seed officer, said yields of Pioneer 335 are 10 to 15 percent higher than common domestically produced corn seeds.

This means additional income of 7,500 yuan ($1,162) for every hectare annually, Wei says.

Better yields can now be gained with less labor. Traditionally, farmers put half a dozen seeds in each drill hole to ensure at least one of them would sprout. But Pioneer's technology enables farmers to sow a single seed in each hole, with a germination rate of more than 95 percent, according to the company.

Single-seed planting technology can save farmers the time and effort required to remove competing seedlings from the same hole, a labor-intensive task which is usually performed under the scorching summer sun.

"These technologies improve efficiency and make the work of planting easier," Wei says. "To the farmers, they are revolutionary."

More appealing to the farmers are the services the company has brought to their fields: the single-planting technology has facilitated the use of mechanized seed drills. Every spring, Pioneer instructs local distributors to organize a team of farmers to help sow seeds mechanically. The team charges 300 yuan to sow a hectare with corn. In good years, each hectare can yield crops worth 30,000 yuan.

"The work is exhausting, but I can earn 10,000 yuan for just one week of ploughing every spring," says Hao Quanxiang, a member of the crop-sowing team.

Hao and his machine will work for any farmer in Shitie county that requires their services. During the spring ploughing period, his working day begins at 3 am and ends late at night.

The mechanized drills are owned and shared by Pioneer's seed distributors. The company provides a subsidy of 1,000 yuan for each machine, says Zhang, the Shitie county distributor. Shitie currently shares 100 machines with neighboring counties, and the number is growing every year.

"The machines make our lives much easier," says Meng Chunying, a 51-year-old farmer. Meng has two children, but they have both left home to earn more money working in the city. China's fast pace of urbanization has seen young people move away from villages, leaving behind just the elderly and children.

"With the machines and Pioneer's seeds, my children do not need to come back for spring ploughing every year," Meng adds. Spring ploughing is one of the busiest periods in the annual timetable of the rural areas.

Pioneer's seeds have become so popular with China's farmers that some domestic companies have also launched single-seed planting products. Moreover, some disreputable operators have simply copied Pioneer's packaging and sold the seeds at half price.

Vendors of fake and counterfeit seeds often sell them directly to the farmers, claiming that they are the genuine article, a villager says.

Sometimes those who have been duped and suffer poor yields blame the genuine seeds and those who provide them, says Zhang, the seed dealer.

Last year, a frustrated farmer spent an entire day standing at the door of Zhang's shop, swearing and insulting the couple inside. He had bought fake seeds and had a bad harvest as a result, Zhang says.

"I will always remember the feeling of frustration and humiliation of that moment. I intended to help people by selling better seeds. I do not deserve this," he commented ruefully.

For Zhao, the distributor in Dongzhao county, the experience has been much more positive.

He and his wife sold their restaurant in a nearby city two years ago and moved back to their village to start a seed business.

"I was a chef and knew almost nothing about farming," Zhao says, recalling his first year in the business.

"This is a quiet business. It takes time to gain the villagers' trust," he says. "So far, everything has been going well and the future will be better," he says.

Sun Ruisheng contributed to this story.

E-paper

Going with the flow

White-collar workers find a traditional exercise helps them with the frustrations of city life

The light touch

Long way to go

Outdoor success

Specials

Star journalist remembered

Friends, colleagues attended a memorial service to pay tribute to veteran reporter Li Xing in US.

Robots seen as employer-friendly

Robots are not new to industrial manufacturing. They have been in use since the 1960s.

A prosperous future

Wedding website hopes to lure chinese couples