Bubble worries

Updated: 2011-07-08 11:02

By Andrew Moody (China Daily European Weekly)

|

|

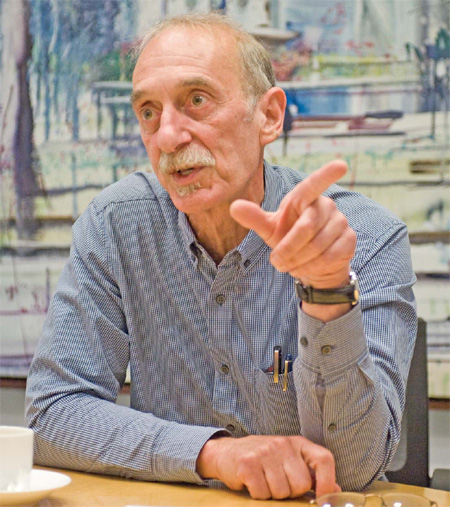

Unlike many others, Economist George Magnus is not optimistic about China's outlook

George Magnus has the distinction - unlike many economic commentators - of being right, at least once.

Like Nouriel Roubini of "Dr Doom" fame, the 62-year-old senior economic adviser at Swiss bank UBS predicted the financial crisis.

The worrying thing for China is that he is now very bearish about the country's immediate economic outlook.

In his latest book, Uprising: Will Emerging Markets Shape or Shake the World Economy?, which is about to be translated into Chinese, he argues China's supposed property bubble may burst and its economy could experience the same sort of slowdown that has afflicted Japan for the past two decades.

"It is the most obvious place where there is obviously asset-price inflation," he says.

He believes the Chinese government's 4 trillion yuan (4.5 billion euros) stimulus package since the economic crisis could end in some form of bust.

"Whether the tools of monetary policy are being applied adequately to put this genie (asset-price inflation) back in the bottle is where my concern is in a nutshell," he says.

Magnus has a certain slightly old-fashioned genteel academic manner that is slightly at odds with the modern steel and concrete offices of UBS' London headquarters right next to Liverpool Street Station.

He was in the news the morning of our interview with an article in the Financial Times warning that China might be reaching its credit-fueled "Minsky moment", named after the US economist Hyman Minski who warned of the dangers of economies becoming over-leveraged.

Magnus says China's political leaders are currently grappling with the same sort of economic issues that faced American politicians in the 1920s before the Wall Street crash and, indeed, the Japanese in the 1980s.

The comparison with the United States nearly 90 years ago relates to the actions of the then fledgling Federal Reserve Bank. It, too, was worried about the external value of its currency, like China is today.

E-paper

Shining through

Chinese fireworks overcome cloudy times, pin hopes on burgeoning domestic demand

Pen mightier than the sword

Stroke of luck

Romance by the sea

Specials

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

My China story

Foreign readers are invited to share your China stories.

Green makeover

Cleanup of Xi'an wasteland pays off for ancient city