Leveraging history

Updated: 2011-03-11 10:39

By Andrew Moody (China Daily European Weekly)

|

Jonathan Chajet, executive director for Interbrand in Asia, says low price is a perfectly reasonable strategy to building brands. Yong Kai / For China Daily

|

Brand consultant says Chinese companies have huge scope to tap into ancient civilization in a wide range of products

Leading brand strategist Jonathan Chajet believes China's emerging brands should focus on their home market, India and Africa rather than striving for success in Europe.

The executive director for international brand consultancy Interbrand in Asia says there are at least 10 times as many consumers in these markets and they actually like China brands.

"I often get on my soap box on this but why focus on the 300 million middle-class consumers in Europe and the United States who are skeptical about Chinese brands when you have 3 billion consumers in China, India and Africa already predisposed to the value proposition that Chinese companies offer?" he asks.

Chajet says these developing markets are wide open for Chinese goods and services.

"There is often an absence of brands in these markets and so in a lot of these countries they are not competing against established brands. And so they have an opportunity to establish their own brands more easily."

Chajet advises both international companies and Chinese companies from Interbrand's Shanghai office. The company also has bases in Beijing and Guangzhou.

The 44-year-old American from New York City says Chinese companies have yet to capitalize on the brand potential that China has.

Chinese goods are often seen as cheap and low tech in international markets but there are a lot of positive qualities associated with China's long 5,000-year history that are not fully exploited.

"This seems to me totally untapped. When you think of a 5,000-year history, you think about techniques, knowledge, all the things associated with craftsmanship passed down from generation to generation," he says.

"These are the sort of things you could associate with soap making, wood making, ceramics and so on. There are loads of categories with which you could leverage this 5,000-year story and there is huge scope for this."

Chajet, a political science graduate from Grinnell College in Iowa and who has an MBA from Stern Business School at New York University, began his career as an account executive with media group Rapp Collins in Chicago.

He went on to work for advertising agency J. Walter Thompson in New York, later gaining his first major experience of Asia with Mercer Management Consulting in Jakarta.

After there he went back to New York to manage the global advertising account of the South Korean giant Samsung Electronics.

He came to China in 2006 to join Interbrand after being executive director of brand strategy for Siegel & Gale in New York.

Chajet says one of the interesting aspects of working in China is seeing how European and international businesses bring their brands to the market.

"Right now what we are seeing is incredibly exciting. There are so many interesting examples of companies trying to get their business model just right. Sometimes they do well and in other cases not so well," he says.

Chajet says the classic example of a company succeeding in China has been Kentucky Fried Chicken, or KFC, owned by Yum! Brands.

It opened its first branch near Tian'anmen Square in 1987 and now has more than 3,200 restaurants in more than 700 cities. KFC is twice as big as McDonald's in the country whereas elsewhere in the world the Big Mac chain is bigger.

Part of its success has been down to localizing its menu offering Chinese-style porridge and spicy diced chicken.

"KFC is the gold standard. It has been here for 20 years and has completely adapted its menu," says Chajet.

Other companies have not been so successful, such as Best Buy, the US consumer electronics retailer, which earlier this year announced it was closing all of its branded China stores.

"It was just a typical example of hubris. Their attitude was: 'We have our business model and a great brand' but they didn't adapt it sufficiently for the local market. It was just an example of a company taking itself too seriously," he says.

Chajet says one of the problems foreign and also Chinese companies face is that most of the brands in China are regional rather than national.

Some companies such as China Resources Snow Breweries, China's leading beer producer which is partly owned by London-based SABMiller, the world's second largest beer conglomerate, is trying to change that by acquiring regional breweries.

"A number of large companies are acquiring regional brands and then are slowly migrating them to be national brands. A lot of the automotive brands, which are also regional, are beginning to follow Snow's example."

A delicate issue within the Chinese market is whether consumers prefer Chinese or foreign made products.

The baby milk scandal more than two years ago led to an exodus toward what were seen as safer Western products.

Currently, Chinese condom maker Jissbon is being sued for allegedly posing as a foreign and, therefore, it is assumed, better brand.

"This just illustrates a point. I think Chinese consumers are prepared to pay a premium for foreign brands. There is research also to show how intensely nationalistic Chinese consumers can be. The younger they are the more nationalistic they tend to be also," adds Chajet.

Chajet believes Chinese companies have a greater opportunity to exploit this nationalism in third- and fourth-tier cities.

"The Procter & Gambles and Unilevers do extremely well in the top-tier cities. They come up against more competition in third- and fourth-tier cities where local Chinese companies have over decades built up strong distribution channels," he says.

Chajet argues that it is difficult for Chinese companies to simply follow in the path of Japanese and South Korean companies who began producing products for their home markets and then started to conquer export markets with their brands.

They rapidly satiated their smaller domestic markets but for Chinese companies it is almost impossible to do this because the potential of their home market is so vast.

"If the Koreans and the Japanese wanted to keep going they had to go overseas. That is not the case with Chinese companies because of the huge potential growth in China," he says.

Although companies such as Haier, the washing machine and other consumer goods manufacturer, Huawei (the telecommunications solutions provider) and Li Ning, the sportswear company, are beginning to make an impact on global markets, Chajet believes the Chinese brand which makes a big breakthrough could still be a low cost item.

"China will soon be able to bring a $5,000 car to the market and that is going to be something to take notice of. I am not sure who will do it. I am a big fan of Chery but maybe it will be Geely, with or without Volvo," he says.

Chajet says there is nothing wrong with a low-price approach to building brands.

"Low price is a perfectly reasonable strategy. There is nothing wrong if one of the components of your strategy is low price. There are a number of world-class brands built on low price such as Walmart, Dell and Toyota," he says.

He believes, however, it won't be long before they will have strong brands which can compete on terms other than price.

"The approach of Li Ning is very interesting. They have opened a research and development center in Portland (Oregon) just like adidas has," he says.

"This is the learning approach that Chinese companies are taking more often than not in Europe and America now. We will see the results of this in the next five to 10 years. It is a learning game right now."

E-paper

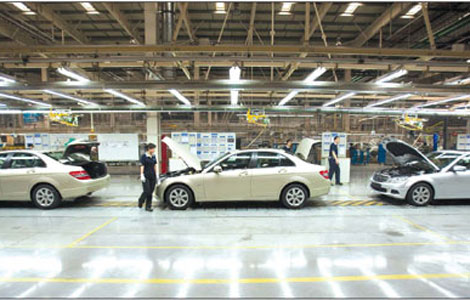

Factory fever

Despite auto manufacturing bubble scare, car giants gear up expansion of factories.

Dressed for success

Fabric of change

High spirits

Specials

Earthquake Hits Japan

A massive 8.8 magnitude quake hit the northeast coast of Japan on March 11,2011.

NPC & CPPCC sessions

Lawmakers and political advisers gather in Beijing to discuss major issues.

Slide: Japan quake

Devastating earthquake and tsunami left millions without water, electricity, homes or heat.