Inflation is the next big thing in Europe?

Updated: 2011-02-11 10:51

By Qian Yanfeng (China Daily European Weekly)

A girl arrives at the railway station in Hefei, capital of Anhui province, on Jan 19. Photos Provided to China Daily

|

"Part of the cost increases from China might as well be shared between the Chinese exporters and European dealers without passing on to end consumers, as European wholesalers are aware of the declining purchasing power of local consumers."

Zhao also believes the overall impact of Chinese inflation on the European economy would be under control, as Chinese exports to the region are mostly consumer necessities, the demand for which is comparatively stable even during difficult times and therefore would not cause job losses in the local retail sector.

|

A migrant worker heads for the train station in Hangzhou on Jan 19, as snow hits the capital of Zhejiang province. Photos Provided to China Daily

|

Furthermore, he says, excluding food and energy price hikes, underlying inflationary pressure in Europe remains subdued instead of across-the-board, and that fiscal austerity measures are expected to help keep price pressure in check.

While it may take some time for European consumers to feel the chill of rising Chinese labor costs, European companies in China have already started to feel the pinch.

Zeng Xiwen, vice-president of Unilever Greater China, says the company is mulling plans to set up new production bases in inland provinces such as Hunan and Sichuan where labor supply is ample and stable thanks to the return of large numbers of migrant workers.

He says the London- and Rotterdam-based maker of Dove soap, Lipton tea and Wall's ice cream is also relying more on automatic packaging lines to substitute cheap manual labor so as to reduce labor pressure during its business expansion.

"Labor shortages are visible not only among production-line blue collars, but also in the engineering and corporate management levels due to increasingly fierce competition between foreign and large State-owned Chinese companies," says Annabelle Yang, a human resources manager at a European automobile company.

|

A job-seeker checks out offerings at a career fair in Lianyungang, Jiangsu province, on Jan 8. Photos Provided to China Daily |

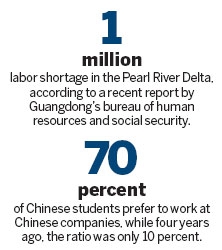

She says that according to a recent survey, conducted by Universum, an employer branding company, Chinese companies were preferred employers for seven of the top 10 Chinese students, while four years ago, it was only one. Chinese students also have increasingly higher expectations on salaries, she says.

She also says that cost increases in labor and other raw materials at her company will not, at least for the moment, be passed on to Europe through the global procurement system, as the company enjoys high profit margins and therefore has significant leeway for margin cuts.

For those not immediately hit by the labor crunch, the stability of the upper-stream supply chain has come under question.

Andy Cao, head of procurement in the Asia-Pacific for a European manufacturer of carton packaging and filling machines for beverages and food, says he has growing concern over supply stability for some Chinese suppliers, which have been hit hard by the shortage of cheap labor.

"Although we have been able to leverage our bargaining power to keep price increase from suppliers in check, it may also become a real challenge to ensure a secure supply if the suppliers are not in a firm position to keep a stable workforce for production," he says.

Although moving to other developing countries for more stable and cost-effective labor supply remains an option, Cao says China - as the world's largest production base - still has major advantages given its overall overheads, which is still way lower than that in Europe.

Ashley Davies, senior economist and strategist at Commerzbank, says it is unlikely that a significant proportion of production in China will be shifted to other countries. However, given the size of China, even a small shift of production out of China in search of lower costs could have large implications for smaller nations.

"Also, keep in mind that rising wages in China imply a rapidly growing domestic market. Producers like to be close to market. If necessary, companies can move west within China in search of lower wages. Hence, the likelihood is that we will have more sophisticated higher margin products produced in the east and lower margin higher volume products increasingly done in some of the less developed parts of China," says Davies.

Rowley from Cass says China's demographic distribution is metamorphosing with greater numbers not being replaced by younger generations. One result will be "competition for declining numbers of young workers and rising labor costs".

To tackle the challenge, he says, "China needs to develop other ways of competing and also thinking, such as increasing productivity while developing more value-added and quality-based companies, products and reputations, and move away from the 'cheapest is best' mentality."

|

|

In fact, money-losing Chinese exporters have already begun investing on quality and value of their products as rising costs keep eroding their profit margins, according to Li Hongqiang, a manager at Zhejiang China Commodities City Group which publishes the Yiwu Index, a gauge of the world's largest wholesale market for small commodities in Yiwu, East China's Zhejiang province.

Although the monthly index has not shown clear signs of price increases for exports, Li says the upward trend for price levels will definitely show up in March and April, when exporters get rid of low-margin stockpiles and come up with the new season's fashions and products which leave greater room for price hikes.

"In the end more and more exporters will work on product design and improve along the value chain in order to stay competitive amid the sluggish world economic environment, which will also pave the way for industrial restructuring in China," he says.

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Carrefour finds the going tough in China

Maid to Order

Striking the right balance

Specials

Spring Festival

The Spring Festival is the most important traditional festival for family reunions.

Top 10

A summary of the major events both inside and outside China.

China Daily in Europe

China Daily launched its European weekly on December 3, 2010.