Specter of 1970s stagflation rises in Europe

Updated: 2011-02-11 10:37

By Horst Loechel (China Daily European Weekly)

In December last year, the inflation rate in the euro area rose to 2.2 percent, well above the 2 percent inflation target set by the European Central Bank. For the entire year, inflation is expected to be 1.5 percent, a pretty significant increase from the 0.3 percent in 2009. With an expected increase of 4.7 percent, Greece is the front-runner in Europe but the UK's rate also rose to 3.7 percent in December.

Given the data, it is no surprise that inflation expectations have risen sharply. For instance, Germany's long-term treasury bonds, which are the benchmark for the euro area, have risen more than 100 basis points in recent months, reflecting inflation concerns in the market.

Rising inflation is not an exclusive European phenomenon. Indeed, particularly in emerging economies, including China, inflation rates have climbed to unsustainable levels in recent months. But unlike Europe, growth remains high in emerging economies. It is not yet stagflation in Europe but the specter of the 1970s with sluggish growth and high inflation is raising its head.

Inflation rates have generally been low in the West over the last two centuries or so with a few exceptions. This was mostly because of low prices in goods imported from emerging economies that reflected the comparative cost advantages in these countries. In fact, the West imported price stability from the East. Eventually this led to a consumption boom in Western countries, particularly in the United States, combined with low interests rates that in turn triggered the debt crisis.

The interesting question is what will happen if labor costs and, therefore, the prices of exported goods, rise in emerging economies in future. The answer, of course, is imported inflation in Europe and the West in general.

Take the case of China. Millions of migrant workers were just returning from eastern coastal cities to their rural homes. It was expected that a significant number of them would not go back but choose to stay home after the New Year holiday celebrations. The trend has already been seen in recent years due to rising living costs in the big eastern cities and stagnating payrolls. Furthermore, China's urbanization policy is paying off. There are more job opportunities in the poorer western region of China as well. As a result wage bills will rise due to labor shortages.

Europe is one of China's biggest export destinations and rising export prices due to higher labor costs will drive up the inflation rate in Europe. To what extent and how fast has yet to be seen. In any case, rising import prices will immediately enter into inflation expectations and thereby put an upward pressure not only on interest rates but also on wages. The latter could finally result in an inflationary spiral in which wages push up inflation.

The effect of rising inflation in Europe due to higher import prices will be accelerated by the gradual appreciation of the yuan in the years to come. Indeed, a rising yuan is a double-edged sword for Europe. Whereas it increases the international competitiveness of Europe vis--vis China because of lower export prices from Europe and higher import prices from China, it increases inflation within Europe and will affect growth and employment.

Rising inflation is indeed anything but good news for Europe in the face of the still tumescent sovereign debt crisis. It paves the way to higher interest rates that in turn will damage growth, employment and income that is needed to overcome the fiscal crisis.

Europe could try to compensate for higher production costs due to higher interest rates with rising labor productivity and therefore take its international competitiveness to a higher level - the way Germany has masterfully demonstrated in recent years. But the price of this policy, at least in the short-run, is higher unemployment, unless overall demand increases.

It seems to be in the European interest that labor costs in China as well as the value of the yuan increase gradually and smoothly. The good news is that this is in the interest of China as well.

The author is director of the German Centre of Banking and Finance at China Europe International Business School (CEIBS) and professor of economics at Frankfurt School of Finance and Management.

E-paper

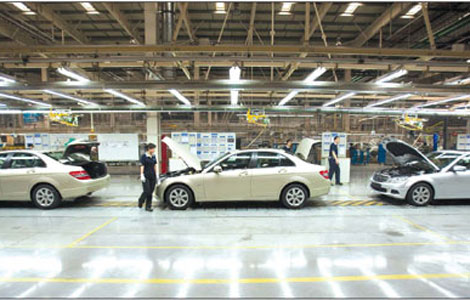

Factory fever

Despite auto manufacturing bubble scare, car giants gear up expansion of factories.

Dressed for success

Fabric of change

High spirits

Specials

Earthquake Hits Japan

A massive 8.8 magnitude quake hit the northeast coast of Japan on March 11,2011.

NPC & CPPCC sessions

Lawmakers and political advisers gather in Beijing to discuss major issues.

Slide: Japan quake

Devastating earthquake and tsunami left millions without water, electricity, homes or heat.