Data processors eye China

Updated: 2012-08-27 08:04

By Gao Yuan (China Daily)

|

|||||||||||

|

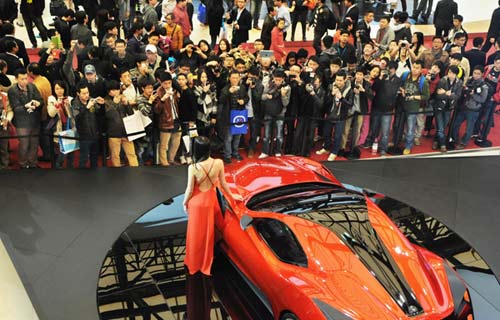

Overseas companies are major players in China's data management market. World-famous brands, including Teradata, Netapp Inc and Oracle Corp, have been operating in China for more than 10 years. Heckler Pierre / For China Daily |

But many firms prove reluctant to install new systems despite being overloaded

Chinese companies are set to deeply embrace data management software to process increasing amounts of unstructured data as more tangled bytes pour into enterprises' data warehouses. But it will take years for the market to mature, said industry insiders.

Currently, the major customers for virtualization software are still confined to the financial and telecommunications industries. Industries such as retailing, e-commerce and social networking, which have a need to manage and analyze huge amounts of data, have yet to fully realize the importance of big data management, said David Sung, president of VMware Greater China.

The company provides virtualization software for customers to manage business data.

Other industry players have made steps to find fresh customers. German enterprise software maker SAP AG announced late last year it will invest more to lure small and medium-sized Chinese enterprises to implement their data analysis kits.

"SMEs will have an urgent desire to install advanced software to process company data, especially when the economy is facing another downturn," said Hera Siu, president of SAP China. The company also pledged to double its workforce in China by the end of next year.

"Generally speaking, Chinese companies find it easier to adopt the cutting-edge technologies from overseas to arm themselves," said Sung. But only a few companies are willing to install new data management platforms when the current system still works tolerably well.

Sung said data companies have to patiently wait and spend more time cultivating the market in the country before enjoying a boost in demand.

"Chinese companies lack the drive to adopt new analysis software. It is a major problem for the development of data companies," Sung added.

However, their attitude does not mean upgrading virtualization software is a matter of little value. The big data solutions will save and create far more value than the actual investment in implementing next-generation software, said Sung.

"Banks, insurance agencies, hospitals and shipping companies must process a huge amount of data every single day and have an enormous need for faster analyzing software," he said.

The problem is that not a single individual data center is capable of handling the overwhelming data stream in the era of big data. As a result, cloud computing was introduced to leverage the performance of big data analyzing platforms.

In addition, the cost will be incredibly high for all the companies to establish their own data centers. "Purchasing a cloud-based virtual machine has become an economic alternative for companies whose everyday data stream is low but which shoots up to an extremely high level once a month or even once a year," said Sung.

Overseas companies are the predominant players in China's data management market. World-famous brands such as IBM, Netapp Inc and Oracle Corp have been operating in China for more than 10 years.

Localization was thought to be the most essential move for international brands to survive in China. Almost all the overseas data companies running in China have set up innovation plants in the country to accelerate localization.

"Overseas companies have to think of themselves as an indigenous Chinese data solutions provider in order to compete against others," said Sung. "We were thinking ahead of our competitors on how to make VMware a Chinese company."

gaoyuan@chinadaily.com.cn

(China Daily 08/27/2012 page17)

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|