Economy cools in 3rd quarter

Updated: 2011-10-19 07:51

By Chen Jia (China Daily)

|

|||||||||

Hard landing ruled out due to robust consumption

BEIJING - Economic growth cooled in the third quarter to its slowest pace in more than two years amid tightening measures, debt fears in the euro zone and a sluggish US economy.

| ||||

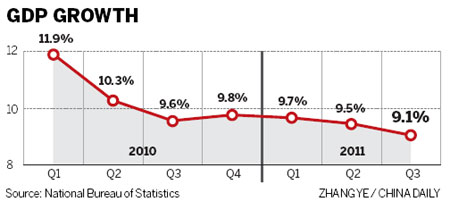

Year-on-year GDP growth slipped to 9.1 percent in the July-to-September period from 9.5 percent in the second quarter and 9.7 percent in the first, indicating a moderate expansion, the National Bureau of Statistics (NBS) said on Tuesday.

The sluggish global economy, slumping financial markets and tightening monetary policies have combined to weigh down domestic output, Louis Kuijs, Hong Kong-based chief Asia economist at MF Global Holdings, said.

However, Kuijs does not believe that the country will experience a double-dip recession and is confident that China can be an engine for global growth thanks to its manufacturing industry.

Fan Jianping, head of the economic forecast department at the State Information Center, also dismissed concerns of a steep correction.

"Fears of a hard landing (in China) are unfounded," he said, citing still robust domestic consumption.

Domestic demand remained resilient last month. Year-on-year growth for retail sales was 17.7 percent, up from 17 percent in August.

Industrial output in September rose to 13.8 percent from a year earlier and 13.5 percent in August. The figure for the January-to-September period increased by 14.2 percent year-on-year, according to the NBS.

"China's economic development is likely to maintain a relatively fast pace in the fourth quarter although both external and internal conditions are turning more complicated with increasing uncertainties," NBS spokesman Sheng Laiyun said at a news conference on Tuesday.

Many economists predicted that the nation could see GDP growth of above 9 percent for the whole of this year, compared with 10.4 percent in 2010.

"The September Purchasing Managers' Index (a key manufacturing indicator) also signaled a production rebound," Sheng said.

The index climbed to 51.2 year-on-year in September, up from 50.9 in August and July's 29-month low of 50.7. Above 50 indicates growth, anything below 50 indicates contraction.

Fixed-asset investment, a key driver behind economic growth, showed robust growth of 24.9 percent in the first nine months. Investment in real estate increased 32 percent from a year earlier.

Despite strong growth in domestic investment, analysts said that the nation should make renewed efforts to boost domestic demand as global economic prospects continue to dim.

Exports may contribute less to GDP growth in 2012, so domestic demand takes on greater urgency, Fan Jianping of the State Information Center said.

Domestic consumption could be boosted next year by a recovery in car sales, said Wendy Liu, a Hong Kong-based economist with the Royal Bank of Scotland (RBS). "Car sales are predicted to grow by up to 20 percent next year, a sharp rebound from 5 percent this year," Liu said.

The economic slowdown may prove to be a useful antidote to China's inflation headache. The consumer price index, a main gauge of inflation, fell for two consecutive months to 6.1 percent in September, from July's 37-month high of 6.5 percent.

Inflationary pressure is likely to continue to drop in the last quarter of this year, because of tightening policies and falling commodity prices caused by weak global demand, said NBS spokesman Sheng.

The central bank raised interest rates five times since October 2010 and increased the reserve requirements for commercial banks six times this year. The tightening measures have hit small companies as they don't have easy access to bank lending.

The State Council unveiled a series of supportive financial and fiscal measures on Oct 12 to bail out cash-strapped small businesses and create more investment opportunities for them.

"Macro-policy objectives may shift slightly from fighting inflation to ensuring growth after inflation comes down as the environment for small exporters may become tougher in 2012," said Liu with the RBS.

China Daily

(China Daily 10/19/2011 page1)