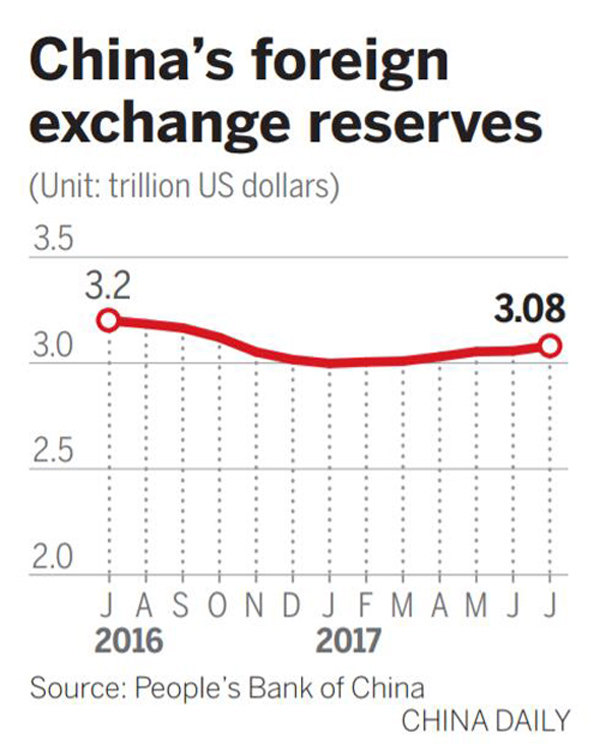

Forex reserves increase for the sixth consecutive month

|

|

A teller counts and arranges dollar notes at an Agricultural Bank of China branch in Qionghai, Hainan province. [Photo/China Daily] |

China's foreign exchange reserves grew for a sixth consecutive month in July, as a stronger yuan and strengthened oversight over outbound investment helped curb capital outflows.

The forex reserves rose by $3.2 billion over June to $3.08 trillion in July.

Analysts said a recent weak dollar is one major reason for the continued gain of China's forex reserves.

The dollar index, which measures the value of the dollar against a basket of major currencies, has tumbled since late June to hit 92.57 early this month, as concern over US President Donald Trump's plans for a large fiscal stimulus persist.

The index is down by 10 percent compared with early this year. The recent weakening of the dollar has helped push up the value of nondollar currencies in China's forex holdings, according to Zhao Xueqing, an analyst with Bank of China.

Apart from the valuation effect, easing capital outflow pressure since the beginning of the year has helped bolster forex reserves, where the government's strengthening of oversight over irrational investment in other countries has played a role, she said.

China has enhanced efforts in regulation of overseas investment since late last year, which has led to more rational outbound investment activities, according to an official with National Development and Reform Commission, who declined to be named.

The official said that if capital outflow pressure is expected to continue easing, the government will loosen some of its grip over outbound investment, while continuing to keep an eye on investments in some fields.

Looking ahead, China's forex reserves are expected to see a moderate increase, according to Guan Tao, a former Administration of Foreign Exchange official, because the market has become more upbeat about the yuan.

The yuan rose by more than 3 percent against the dollar from January to July, compared with depreciation of around 6.5 percent last year. The State Administration of Foreign Exchange said on Monday that it expected cross-border flows to remain stable due to the country's strong economic performance.

The economy expanded by 6.9 percent in the first six months, beating market expectations and leading major international organizations to raise their forecasts for China's growth this year.

The central bank, supported by sound economic fundamentals, will have less need to stabilize the currency through use of reserves, according to Liang Hong, chief economist with China International Capital Corp.

She said China will work to open up the domestic financial markets, and more capital inflows will help stabilize the cross-border capital flow balance, further stabilizing forex reserves.

Efforts such as the bond connect program between the mainland and Hong Kong, which allows qualified overseas investors to trade bonds on the mainland's interbank bond market, is expected to attract 3 trillion to 5 trillion yuan ($446 billion to $744 billion) in the next a couple of years, ICBC International estimates.