Bigger families mean bigger market for MPVs

Updated: 2016-05-27 08:17

By Du Xiaoying(China Daily Europe)

|

|||||||||

Krupinski says the second-child policy will have an impact on the population structure, family structure and economic development in the decades to come, and he believes that a bigger family size will create a need for bigger cars.

Hiroji Onishi, head of Toyota's China operations, told Reuters that MPVs have good prospects in China: "Given the changing life-stage needs, we think what's going to be popular are smaller, more affordable MPVs like the (Toyota) Noah Voxy, a compact minivan that we market in Japan."

He was quoted as saying that young Chinese couples tend to live near their parents, so the second-child policy is expected to make family units larger.

According to Reuters, Toyota officials and dealers think the Voxy's interior comfort offers a more subtle way for China's rich to signal their wealth in a climate where overt excess is frowned upon. And in China, trends that catch on at the premium end traditionally spread quickly through the rest of the market.

China's MPV segment is divided into several niche markets. Low-end models priced below 100,000 yuan ($15,200; 13,600 euros) currently account for the majority of sales.

For example, the top best-selling models last year were the Wuling Hongguang microvan and the Baojun 730 minivan, both produced by SAIC-GM-Wuling, a joint venture between General Motors, SAIC Motor Corp and Guangxi Automobile.

Popular models priced from 200,000 to 400,000 yuan are the Buick GL8 and the Honda Odyssey. For the high-end niche, the typical model is the Mercedes-Benz V-Class, a replacement for the Viano, which ranges in price from 500,000 to 600,000 yuan.

Zeng Zhiling, managing director of LMC Automotive Consulting, says the most important reason behind the rise in MPV sales is the China Association of Automobile Manufacturers' rejig of vehicle categories in 2013, which saw MPVs classified as minivans.

The rising demand for logistics and commuting in the lower tier cities and towns, as well as the expected rise in use of MPVs by high-end families in the wake of the second-child policy, are also key reasons, he says.

"But the market for high-end MPVs is small, about tens of thousands of units a year," Zeng says, adding that he predicts the growth rate of the segment will slow down and that low-end MPVs will continue to contribute most sales.

Zhang Yu, managing director of Automotive Foresight Co, forecasts that the segment will grow at a rate of more than 10 percent year-on-year for the next five to six years. He agrees that low-end models will largely drive the sector.

"Many people say an MPV is the next breakthrough point, but I'm not sure," he says, adding that MPVs lack good models that can compete with SUVs in off-road functions and in terms of reflecting the car owner's taste and social status, which is vital in China.

Zeng says most MPV buyers are from semi-urban areas and have budgets of 50,000 to 70,000 yuan. "The customers decide the products, not the producer," he says.

duxiaoying@chinadaily.com.cn

|

After the introduction of China's second-child policy, families are expected to get larger, which auto industry insiders say will likely lead to a surge in demand for multipurpose vehicles. [Photo by Li Wenming / China Daily] |

|

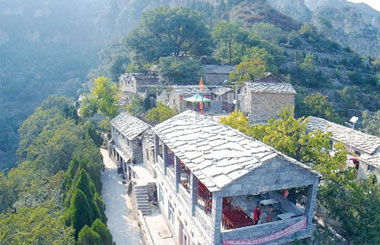

Workers monitor an MPV production line. [Photo by Hu Weiguo / China Daily] |

Today's Top News

Rescue vessel eyed for the Nansha Islands

Steeled for change

EU has to cope with outcome of British referendum

Four Chinese banks among world's 10 largest

Kiev swaps Russian detainees for Ukraine's Savchenko

Refugees relocated during major police operation

China calls for concerted anti-terror efforts

London's financial centre warns of dangers of Brexit

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|