Bears focus on Alibaba as investors fret over China's economy

Updated: 2016-01-26 07:46

(Bloomberg)

|

|||||||||||

|

|

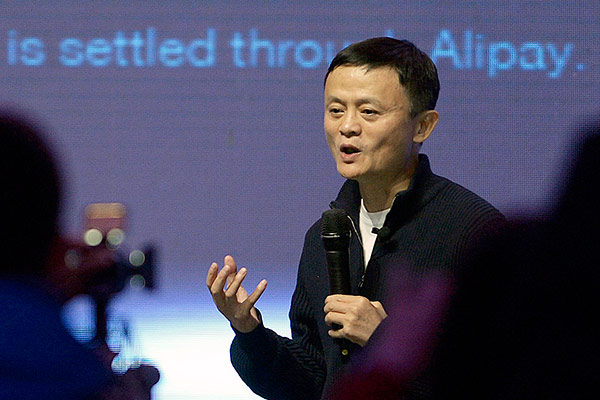

Jack Ma, chairman of Alibaba Group Holding Ltd, answers reporters' questions during the Tmall Singles Day online shopping festival. [Photo/China Daily] |

Short sellers in the United States have pushed bets against Alibaba Group Holding Ltd to the highest in more than 14 months on concern that China's deepest economic slowdown since 1990 will only get worse.

Short interest in China's biggest online retailer surged to 7.5 percent of shares outstanding on Jan 21, the highest since November 2014, according to data compiled by Markit and Bloomberg. That is more than double from a Dec 1 low.

Bearish bets on rival JD.com Inc have hovered around 2 percent since last month.

Pessimists are once again taking aim at Alibaba-a bellwether for US investor sentiment on China-as mainland stocks entered a bear market last week.

Those wagers are already starting to pay off as a selloff since the start of the year sent the American depositary receipts of Alibaba down more than 13 percent.

Investors see Alibaba as a stock that reflects the state of the Chinese economy, said Henry Guo, a San Francisco-based analyst at Summit Research Partners LLC, who has a buy rating on the stock.

"With China's economic outlook worsening, that's just an easy way for people to have short China exposure."

China's top leadership has signaled it may accommodate more economic slackness as officials tackle delicate tasks such as reducing excess capacity.

The world's second-largest economy will slow to 6.5 percent this year and 6.3 percent next year, according to the median of economist estimates.

At a corporate level, counterfeit products and accounting frauds at Alibaba are also on the mind of investors since the company's record 2014 debut on the New York Stock Exchange.

Kynikos Associates LP founder Jim Chanos warned against the stock in November, according to a CNBC report. In December, Russian billionaire Alisher Usmanov said he has started to sell his stake in the e-commerce giant.

Alibaba declined to comment on market speculation in an e-mailed statement.

The company is scheduled to report third-quarter earnings Jan 28. Revenue is expected to hit 33 billion yuan ($5 billion), according to the average estimates of 26 analysts surveyed by Bloomberg.

Related Stories

Alibaba payment company forms alliance with Russia's VTB bank 2016-01-22 19:16

Alibaba's Aliyun releases big data service platform 2016-01-20 14:02

Alibaba goes offline with brick-and-mortar store in Tianjin 2016-01-12 10:24

Alibaba's Ant Financial joins red envelope frenzy 2016-01-08 08:21

Alibaba to step up competition in globalization, rural areas and top-tier cities 2016-01-06 16:26

Today's Top News

China's growth envy of developed world

Foreigners find hard to but China's rail tickets

Rags to riches saga underlines China's transformation

Leaders address Iran's thirst for growth

UK's interest in China boosted by BBC TV series

Global push

AIIB chief vows to run clean, lean, green institution

'More Europe' to deal with 'triple crisis'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|