Parallel universe

Updated: 2015-07-31 08:26

By Andrew Moody(China Daily Europe)

|

|||||||||||

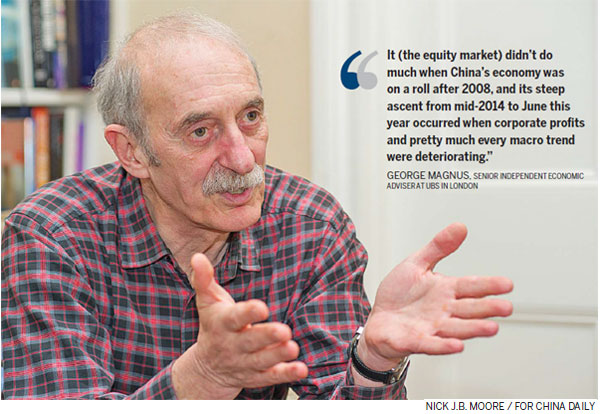

"I think attempts to sway the market set a very bad example. What investors learn from this is that the government is going to bail them out. They are going to take even more irresponsible risks in the future."

One pressure on the economy from the recent stock market falls could be the damage done to the country's financial services sector.

Somewhat under the radar, it has become a significant driver of China's GDP, particularly over the past few months.

In the first half of this year, when the Shanghai Composite Index was roaring ahead, the financial services sector grew at 19 percent year-on-year.

This was almost three times the growth of the overall economy and a marked increase on the 11 percent the sector grew in the first half of 2014.

Kowalczyk at Credit Agricole CIB, says that if financial services had not grown so fast then the government would have missed its 7 percent growth target.

"If the sector had grown at the same rate of the first half of last year at 11 percent, the overall economy would have grown by 6.3 percent and not 7 percent. It is therefore fair to assume that in the second half of this year, financial services won't be making this outsize contribution to growth."

Zhu at the Shanghai Advanced Institute of Finance insists also that it is wrong to dismiss out of hand the importance of the stock market to the rest of the economy just because its traded shares represent a relatively small proportion of GDP.

He says this understates the role the share market is now playing in funding companies right from recent IPO listings, of which there have recently been record numbers, right up to the major state-owned enterprises.

"Other sources of funding such as shadow banking vehicles have largely dried up over the past two to three years. China does not have any sort of developed bond market either, so the stock market has become very much a primary source of revenue for many companies. This is very different from the West, where there is an array of sophisticated financing sources," he says.

Today's Top News

Realty firms in Europe brace for influx of Chinese buyers

Malaysia seeks help to widen search for MH370

Beijing to ban vehicles for V-Day parade

China's Bohai bids $2.6 billion for aircraft leasing firm Avolon

Rule covers HIV as work hazard

Probable MH 370 debris to be studied in Toulouse

Beijing makes it, again!

Graft probe into Guo Boxiong to win army, public's support

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|