New challenges for firms going global

Updated: 2015-03-13 10:36

By Zhang Fei(China Daily)

|

|||||||||||

The global competition for markets and resources is intensifying with many advanced Western economies implementing "re-industrialization" policies for the re-flow of capital and retracting investments in developing countries such as India and Vietnam.

Amid this global scenario, Premier Li Keqiang said last week that China's GDP growth target for 2015 has been lowered to 7 percent in accordance with the "new normal" rate of expansion, indicating that a series of changes is about to take place for domestic enterprises that intend to "go global".

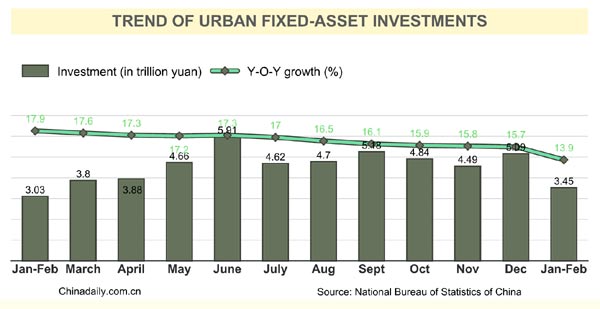

The "go global" wave among Chinese enterprises is strong. The country's "go global" strategy, proposed in 2000, has yielded results as overseas investments have widened and increased in scale. According to the Ministry of Commence data, foreign investments over the past five years have enjoyed high growth rate, ranging from 15 percent to 20 percent a year. In 2014 alone, industry-wide direct foreign investment amounted to $116 billion making China the world's third-largest investor for three years in row. Last year also saw China almost striking a balance between inward and outward investment.

Besides, investors from the Chinese mainland directly invested in more than 6,000 overseas enterprises in about 156 countries and regions in 2014, covering 15 different industries including leasing and commercial services, mining, manufacturing and real estate. And unlike in the past when major State-owned enterprises took the lead, more and more non-SOEs and small and medium-sized enterprises have ventured into overseas investments.

Another noteworthy fact of the "go global" strategy is that domestic brands and capital, rather than products and factories, have made inroads into foreign markets. By establishing local sales networks, purchasing patents, building research centers and industrial parks in foreign countries, more and more Chinese investors are conducting cross-border mergers and acquisitions to further their overseas expansion.

These achievements have not only eased the pressure stemming from excessive capacity and trade surplus in the domestic market, but also are in line with China's economic "new normal". But Chinese investors still have a long way to go when it comes to overseas business management. For instance, the lack of long-term planning, funding, technologies and talents has dealt a blow to many enterprises' foreign investments. Needless to say they are also short of information on situations and conditions, including market-related policies and business partners, in their investment destinations.

Related Stories

Private investment hits $35b in Qingdao last year 2015-03-13 09:50

Stronger trade ties, rising investment 2015-03-13 08:56

New Guangdong FTZ set to boost investment 2015-03-13 08:52

China reports lower-than-expected output, investment data 2015-03-11 16:43

Today's Top News

China likely to ease again if inflation falls: insider

Reproach for wrongful convictions

China's two universities make top 50

Astronauts return from space station

Italian court upholds Berlusconi's acquittal

UK companies seek new opportunities in China

CNR, CSR merger passes overseas antitrust scrutiny

Official urges Dalai Lama to forsake evil ways

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|