Affordable luxury comes to the fore in China

Updated: 2015-03-09 07:50

By Shi Jing(China Daily)

|

|||||||||||

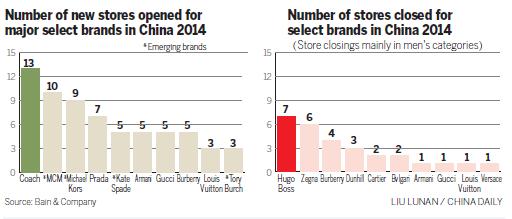

It is also interesting to notice the shifts in magnitude and dominance among the top five brands in the monitored sectors. Brands which offer less expensive products were easily found in sectors such as cosmetics, watches and leather goods. As a result, Kiehl's Tissot and Coach were rated among the top five in their respective industry.

The reason for the change is quite simple. In 2013, the buzzwords defining the luxury industry used to be outlet, quality, traditional brands, etc. However, the keywords for 2014 were fashion, style, value for money, exclusivity, etc.

More importantly, the rise of the Chinese middle class has also contributed to the success of more affordable luxury products. According to Zhou Ting, director of the Fortune Character Institute, which studies the luxury industry, China already has a middle class, which means that the market has to be more sophisticated in order to cater to their needs.

According to market consultancy company McKinsey& Company, around 76 percent of Chinese households will reach the middle-income level in 2022, while the figure was only 4 percent in 2000. By 2022, the annual disposable income of each of these families will be between 60,000 yuan and 229,000 yuan, which is equal to the level in Brazil and Italy.

As McKinsey has found out, the Chinese middle class is willing to spend more time and money on recreational activities and tourism. Products or services which stress emotional and social aspects will gain more preference. Meanwhile, the Chinese middle class is becoming more inclined to overseas brands.

The continued growth of the Chinese middle class, especially the upper-middle class, will lead to a "more mature and attractive" market for businesses, according to the consulting firm.

As a result, overseas brands, especially those in the fast fashion industry, are seeking rapid development in China.

Japan's Uniqlo is undoubtedly the most aggressively expanding fast fashion brand in China. As of the 2014 fiscal year which ended on Aug 31, the company had a total of 374 stores in China, among which more than 80 had opened last year. Last year, during the Chinese online shopping carnival Singles' Day-which falls on Nov 11 every year-Uniqlo came out on top among garment companies, notching up online sales revenue of 260 million yuan.

Swedish fashion giant H&M also saw its net profits rise 17 percent to 19.98 billion kronor ($2.44 billion) in 2014 while sales increased 18 percent to 176.62 billion kronor.

Related Stories

Luxury labels embrace "new normal" as Chinese market shrinks 2015-02-25 17:34

Chinese consumers buy more luxuries overseas 2015-02-02 08:14

Super rich continue to cut back on gifting 2015-01-30 05:34

Six trends in China's luxury market in 2014 2015-01-26 15:19

Appetite for luxury wanes in China 2015-01-21 07:31

Today's Top News

China to strictly regulate e-commerce industry

Chinese apps storm into expats' lives

Solar Impulse is go from Abu Dhabi

Merkel reminds Japan to face wartime past

Juncker calls for creation of EU army

Two charged over Nemtsov killing

China likely to maintain 7% growth for 20 years

Moscow releases last Chinese detained for alleged drug trafficking

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|